Stellantis faces challenges and has lost ground in the U.S. CEO Carlos Tavares acknowledged during Thursday’s “Investors Day” conference, putting some of the blame on his own shoulders. But the carmaker’s flexible strategy and new products offer hope for the future and protect the company’s profitability, he promised analysts and shareholders.

“Arrogance” caught Stellantis by surprise during the first quarter of the year, acknowledged CEO Carlos Tavares.

Faced with declining market share in North America, Stellantis CEO Carlos Tavares says he ordered a shakeup in the company’s marketing effort as it attempts to regain momentum with new products from Jeep and Ram.

The Euro-American automaker reported an assortment of problems during the first quarter that included problems at two key factories, as well as a build-up of inventory forcing Stellantis brands such as Jeep and Ram to flood the U.S. market with incentives.

The shake-up – which has resulted in the departure of several key executives – was the result of “arrogance,” said Tavares who added that “When I’m talking about arrogance I am talking about myself. Nobody else.”

Shake-up takes out key executives

In response to a question during the “Investors Day,” Tavares admitted the automotive marketing operations in the U.S. were not “rigorous and professional” enough. They didn’t cope with the dynamic challenges as the automotive market environment shifted away from the permissive pricing created by the post-COVID supply shock. With manufacturing constrained by a shortage of semiconductors, customers were forced to pay sticker price – and frequently more.

Stellantis CFO Natalie Knight told investors the company is back on the financial track it previously announced, including revenues and margins.

With chip supplies back to normal, and manufacturers flooding the market with vehicles, the situation has reversed. Buyers again are demanding discounts, and with dealer inventories rising, manufacturers like Stellantis have had to comply.

“Our management was sub-optimal,” added Tavares, who has directed an overhaul including a shake-up in management. Among the senior executive who’ve departed in recent weeks are former Dodge and Ram boss Tim Kuniskis and Jeep chief Jim Morrison. Antonio Filosa was named CEO of the Jeep brand. Chris Feuell was recruited to serve as Ram CEO, even while continuing to oversee the struggling Chrysler brand.

Mark Stewart, formerly chief operating officer of Stellantis’ North American operations, was replaced by Carlos Zarlenga. The new COO is now responsible for restoring market share, improving inventory dynamics, and capitalizing on specific low-emission vehicle growth opportunities in the medium-term.

Manufacturing issues

Tavares also observed operations of Stellantis assembly plants in the United States, which are critical to the company’s overall profitability, do not yet measure up to the company’s internal benchmarks and needed fixing.

Tavares, however, stopped short of blaming conflict with the United Auto Workers and the higher labor costs resulting from the new union contracts signed last autumn for the problems. He noted 85% of the costs of a new vehicle is tied up in the materials purchased from outside suppliers and vendors and another 5% is tied up in inbound and outbound logistics.

Stellantis is confident it can fix the problems and is preparing to add new products to the Jeep and Ram product lines in the second half of 2024 and in 2025 that will help them regain market share they have lost, Tavares said.

More Stellantis News

- $25,000 Jeep EV Coming “Very Soon,” Says Stellantis CEO

- Stellantis “In the Black” on EV, Says CEO, But Tavares Warns Other Automakers Could Be Forced Out by Losses

- Shake-Up at Stellantis Claims Once-Rising Star Tim Kuniskis

Flexible strategy key to EV transition

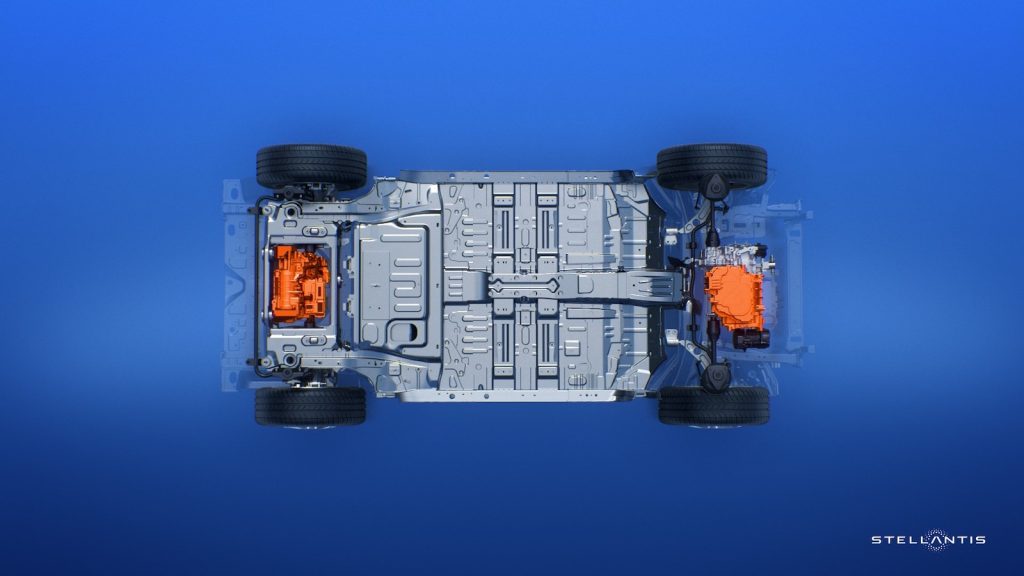

Wagoneer S will be based on the new STLA Large electric vehicle platform Stellantis is developing for some of its biggest models.

Tavares emphasized Stellantis’ strategy is “flexible” and depends on offering a broad array of powertrain technologies. These include traditional gas and diesel engines, as well as a mix of conventional and plug-in hybrids, range-extenders, and battery electric vehicles. Jeep is already the top seller of PHEVs – with the Wranger 4xe among four of the top five in North America.

During the Investors’ Day summit, Tavares and a handful of other executives outlined the automaker’s near to mid-term product strategy. The CEO said the company is now reaping the benefits of its decision to go with multi-energy platforms capable of using a variety of different powertrain options.

Dodge, for example, recently debuted the new version of its Charger muscle car which will be offered both in conventional gas and all-electric forms. Jeep, in particular, will make use of six different technologies over the next several years.

The Jeep brand was the centerpiece of the Thursday event, new brand boss Filosa noting plans to add new mid-sized and small utility vehicles to the lineup in 2025. And he and Tavares confirmed plans to introduce a $25,000 Jeep a few years later.

The Chinese are coming

The full transition to electric vehicles is inevitable, said Tavares, describing it as an “ethical and moral” responsibility. But the shift has been — and will continue to be — uneven, which is why Stellantis paused construction of two “gigafactories” in Europe.

The charging infrastructure required to support battery electric vehicles is inadequate and improvements are slow, he said.

At the same time, the industry faces competition from the makers of electric vehicles from China, who have a major cost advantage since they can produce EVs for about 30% less than Western and Japanese manufacturers.

Tavares downplays tariffs

Higher tariffs are a reality, he said. “But you are naïve if you think protection is the answer,” he added. “Only performance is protection,” he said.

“The only way to move is go racing. “We’re not the best, which means we have a world of opportunity in front of us,” Tavares said.

One way Stellantis is fighting back is with its new partnership with Leapmotorss, one of China’s fastest-growing EV brands. It has taken a 51% stake in Leapmotors’ international operations and plans to use its products to gain a leg up in a number of markets, including Europe.

New opportunities lie ahead.

As it competes by bringing in new suppliers, developing software and engineering new platforms, Stellantis is making progress, Tavares said. EVs built on Stellantis’ new “small” platform will rival those built from Tesla in cost and efficiency, he claimed.

The new battery electric vehicles will be sold in Europe and in places such as growing markets in North Africa, like Algeria and Morocco. That is meant to help Stellantis maintain its dominant market share – which is facing challenges from new Chinese companies.

However, Stellantis also has other powerful weapons in its arsenal. It plans to use the Jeep and Ram brands to help bolster its position in markets in the Middle East, South Africa, and the Latin America, which serve as the “third engine” of the company’s profitability, Tavares said.

“Deglobalization”

Stellantis will continue to respond to what Tavares called “globalization” by adjusting its portfolio of brands and products to reflect the needs of individual markets.

Stellantis currently operates fourteen of its own brands – 15 with Leapmotors — which is has maintained despite critics who think it should pare back. They protect the company in a fragmenting world where “deglobalization” has picked up momentum, the CEO said. Peugeot is a “local hero” brand in France, while Fiat serves that role in Italy. The exception is Jeep, he noted, which is a hero brand all over the world.

“Today we are a unique company by nature and a powerful carmaker by performance, well-equipped to deliver through tough times and win the long game. Our global presence, powerful technology, and brand portfolio span across diverse products – ranging from quadricycles to luxury cars – giving us an enviable customer reach,” Tavares told attendees.

“What consumers around the world are looking for is clean, safe, and affordable mobility. This is the reason we exist,” he said.

Better return for shareholders

Stellantis CFO Natalie Knight helped wrap things up with what investors came to Michigan to hear Thursday: a financial review of the company’s performance in 2024 and beyond. “Despite the related short-term headwinds, we remain confident in our ability to deliver double-digit profitability, among the best OEMs in the world, while continuing to deliver exceptional capital returns to shareholders,” said Knight.

The guidance she offered included double-digit adjusted operating income, or AOI, margins and positive industrial free cash flows during the remainder of 2024. Knight noted Stellantis had a 10% to 11% AOI margin in the first half of 2024, though the industrial free cash flow was below the prior year period.

The company will target the upper range of its 25-30% dividend payout policy, versus 25% in recent years, Knight added. Positive cash flow will sustain 7.7 billion euros or about $7.16 in dividends and buybacks in 2024. The company will continue to use share buybacks and ordinary dividends to return excess cash to shareholders,m she promised adding that Stellantis is setting target liquidity levels of 25-30% of revenues for the mid-term, as it shifts focus to capital efficiency and supporting strong shareholder returns.

In his own wrap-up, Tavares added, “Together with the activation of our uniquely aligned partnership with Leapmotors, an innovative Chinese new energy vehicle maker, we’re confident we can deliver what customers want while providing strong shareholder returns this year, and beyond.”

Paul A. Eisenstein contributed to this report.

0 Comments