EV leader Tesla is cutting prices again. The sales leader in the segment is looking to offset some economic uncertainties in order to set another full-year sales record. Get details below.

Here we go again.

Tesla cut prices on versions of its Model 3 and Model Y models. The reductions come in the wake of third quarter deliveries that fell short of analysts’ expectations. The company said it delivered 435,059 battery-electric vehicles around the world during the third quarter, whereas industry observers thought the number would be more than 455,000.

The final tally for Q3 was down from 466,000 vehicles between April and the end of June. The automaker previously posted record numbers, driven by both growing consumer interest in EVs and the sharp price cuts it had taken earlier in the year, according to various industry observers.

Tesla noted the decline in its release.

“A sequential decline in volumes was caused by planned downtimes for factory upgrades, as discussed on the most recent earnings call. Our 2023 volume target of around 1.8 million vehicles remains unchanged,” the company noted.

Why and how much lower

The latest cuts come as the company strives hard to deliver a record 476,000 vehicles in the last three months of 2023 to meet the annual target of handing over 1.8 million vehicles.

The company’s steadily cut prices throughout 2023 as it looks to remain comfortably ahead of competitors in markets around the world. The current reductions amount to about 2.7% to 4.2%.

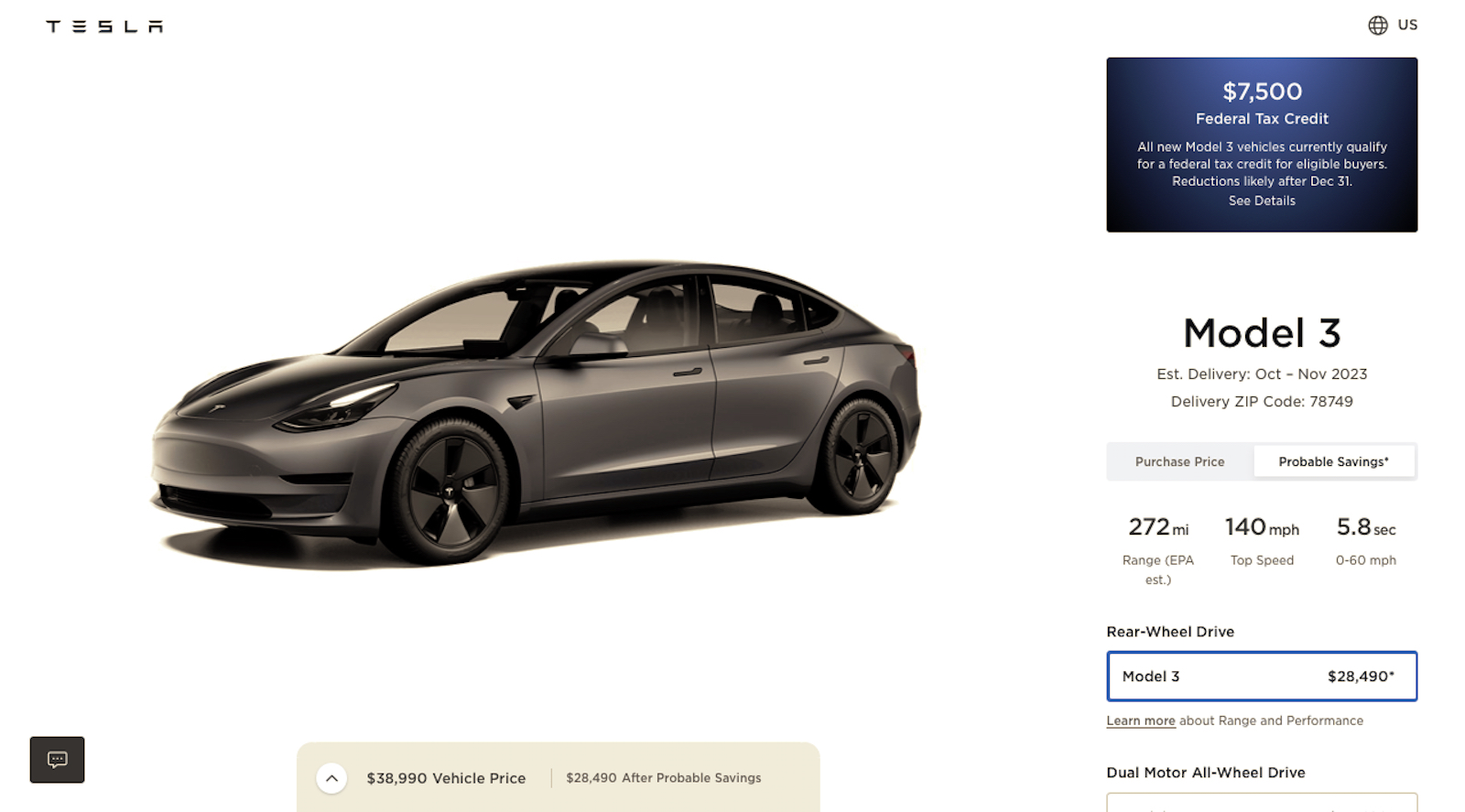

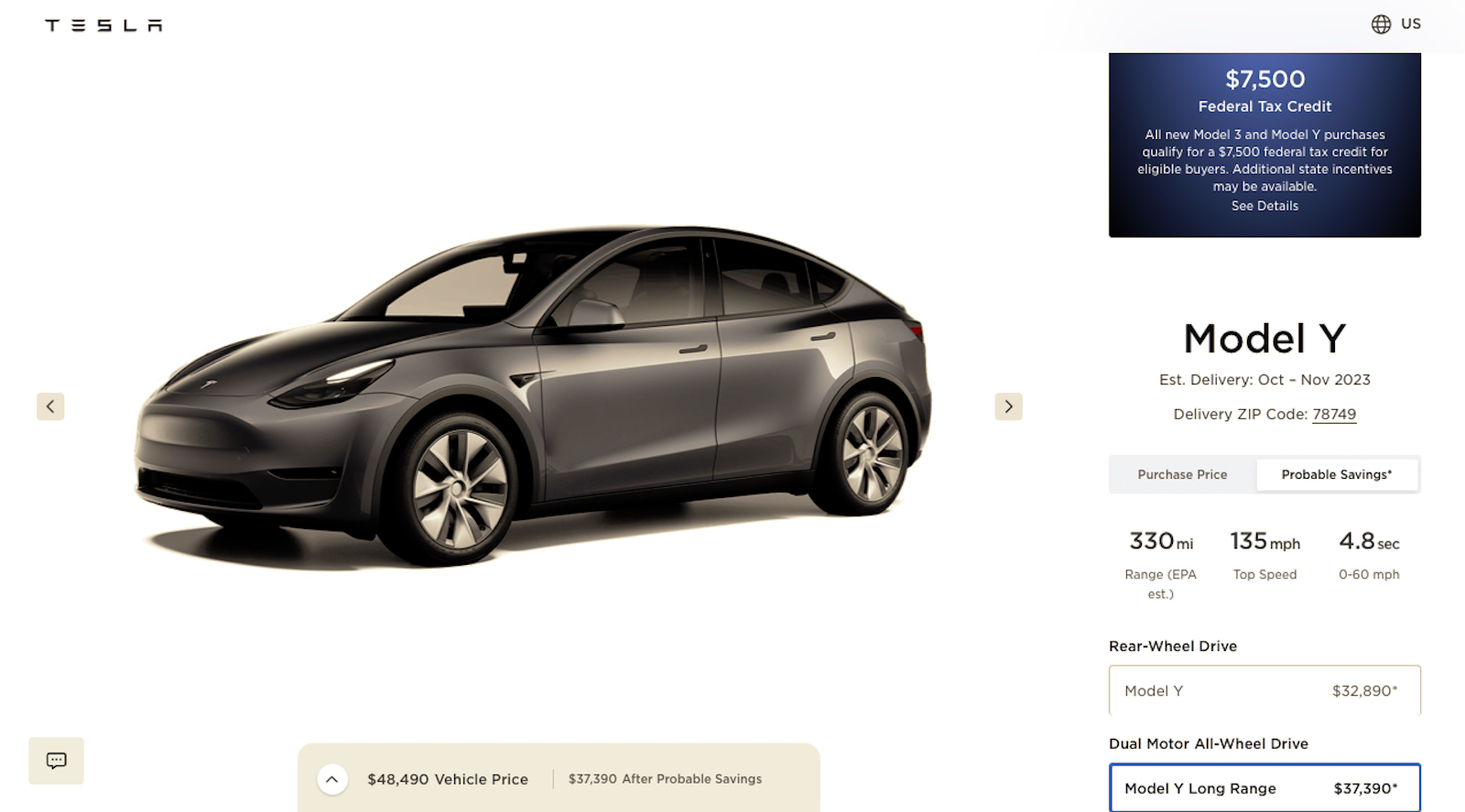

The standard Model 3 sedan got a $1,250 cut down to $38,990, while the Model Y long-range version was reduced $2,000 $48,490, according to the company’s website. Tesla also instituted reductions for its higher-priced variants of both vehicles.

Overall, the standard Model 3’s prices have come down by about 17% since the start of the year, while the Model Y long-range variant has seen a drop of over 26%, Reuters reported.

Impact on others

The company’s previous cuts “inspired” price cuts by Ford and other automakers. The most recent reduction in concert with the ongoing strikes by the UAW are expected to pressure Tesla’s competitors to make cuts to move metal as well.

Additionally, a new contract with the union is expected to drive up costs, benefiting non-unionized automakers such as Tesla and others, reported Reuters. Tesla is set to report third-quarter earnings on Oct. 18.

0 Comments