Ford turned around its Q3 earnings this year, finishing in the black compared to year-ago results; however, the newly minted tentative agreement with the UAW is tempering the any enthusiasm about the results.

Ford CFO John Lawler said the new UAW contract will add between $850 and $900 to the cost of new vehicles going forward.

Ford posted its third-quarter results this week, announcing revenue of $44 billion, up 11% year-over-year. Net income of $1.2 billion reversed last year’s Q3 net loss of $827 million. Adjusted earnings before interest and taxes, or EBIT, in Q3 of this year increased to $2.2 billion.

Despite the positive numbers and year-over-year improvements, Ford missed Wall Street expectations of $11 billion in adjusted earnings and free cash flow of $6.5 billion for the quarter. As a result, the company’s stock fell 4% in after-hours trading.

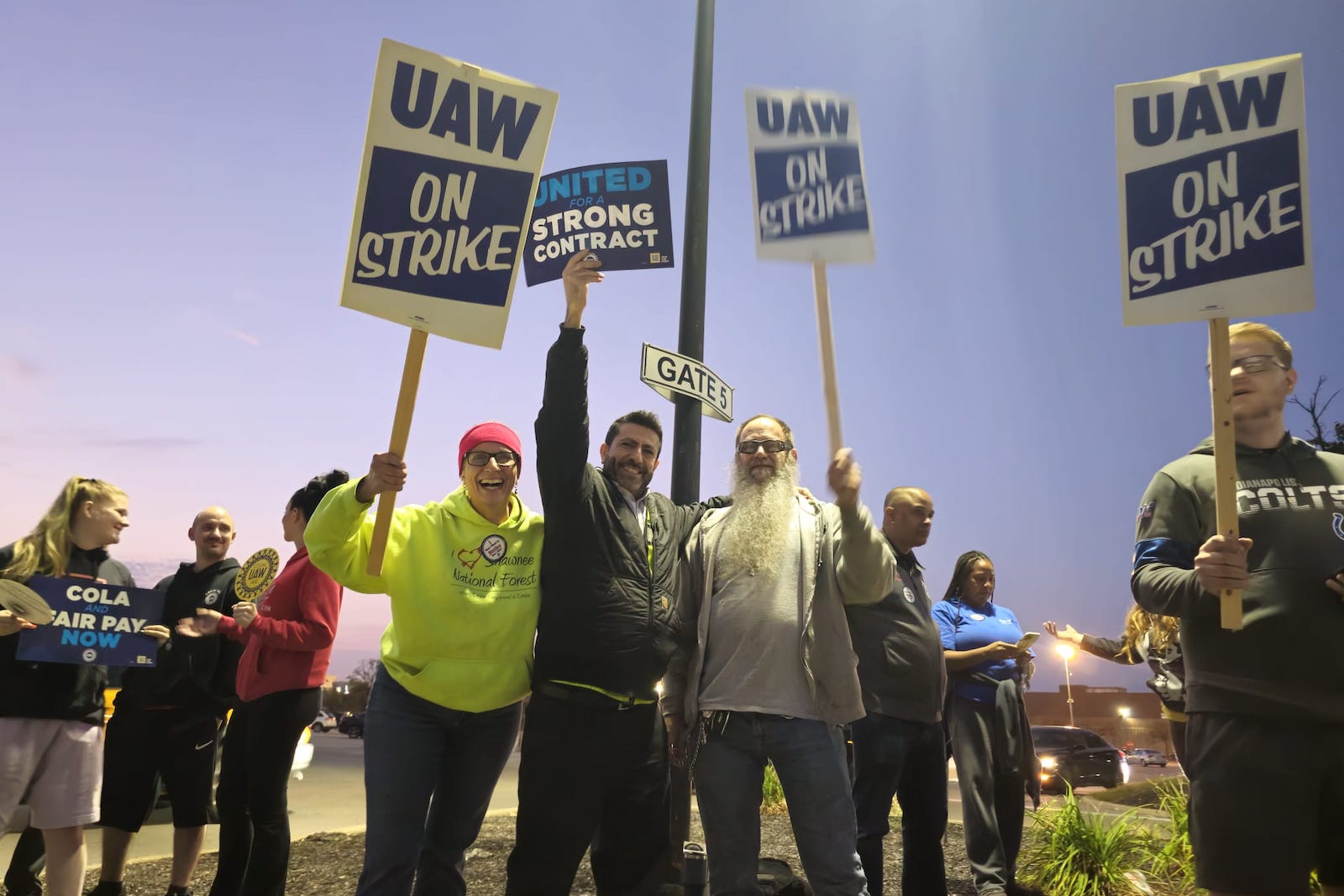

Part of the reason for the missed expectations was the United Auto Workers strike, which Ford estimates has cost the company about $1.3 billion this quarter. Before the strike, Ford expected to hit its targets, Ford CFO John Lawler noted during the company’s quarterly earnings call Thursday evening.

During the earnings call, Lawler revealed the 25% raise the hourly workers will get if they ratify the new deal, will add $850 to $900 to the cost of manufacturing each vehicle. Lawler said, “We’re going to have to find efficiencies and productivity throughout the company to help mitigate the impacts of the higher labor costs.”

EV delays

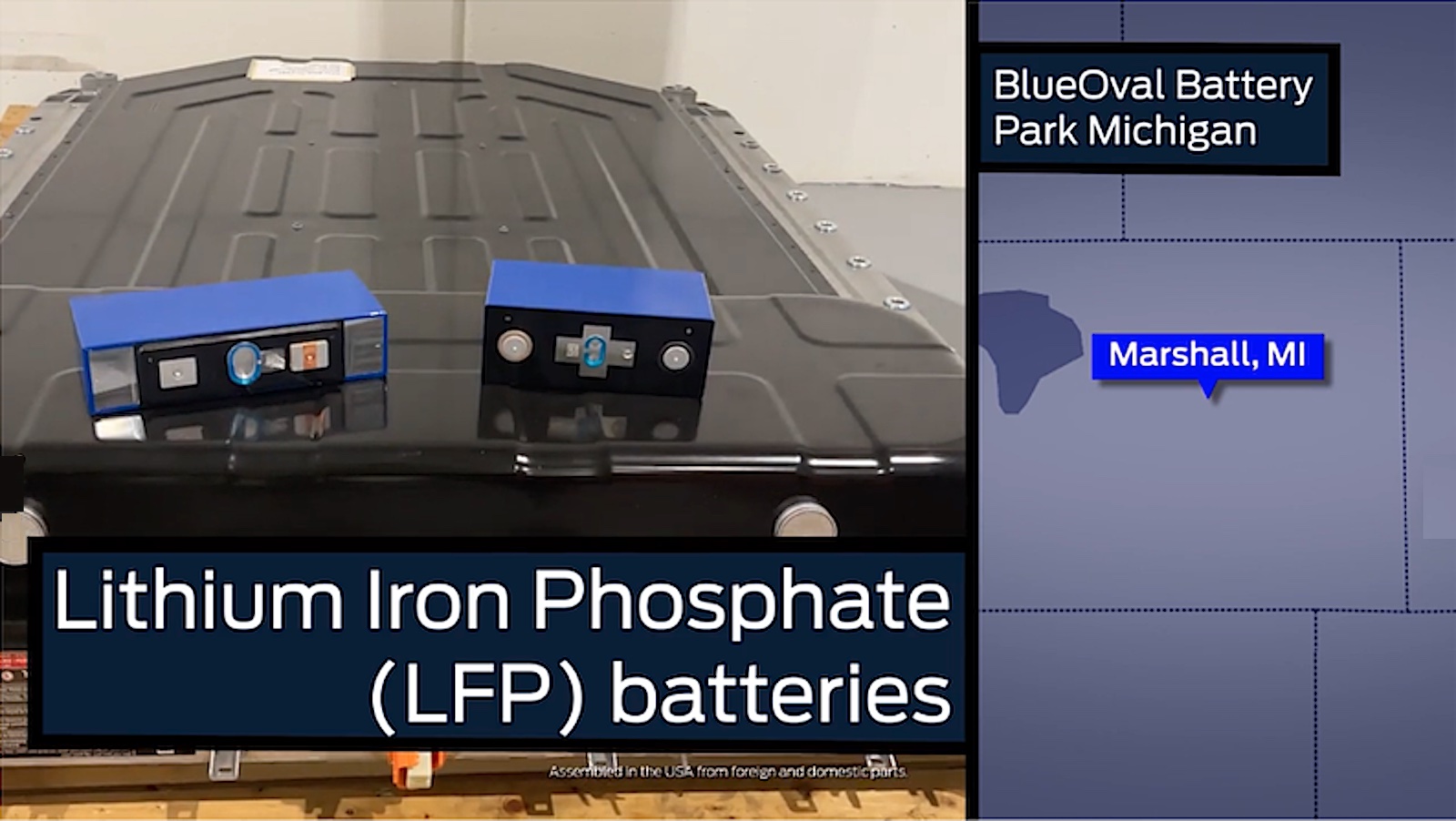

During the talks, Ford suggested the new EV battery plant planned for western Michigan may be delayed as the company reassesses how quickly it wants to spend those billions of dollars — or $3.5 billion in the case of the Marshall, Michigan site being developed to produce new chemistry batteries.

Demand for Ford’s F-150 has plunged, and the company lost more than $36,000 on each EV delivered to dealers in Q3.

Lawler said the delays are a result of “tremendous downward pressure” on the price of electric vehicles. The average price for a new EV is about $49,000 — beyond most of the buyers in the market. Further, Ford is struggling to find a way to make its EVs green … not environmentally, but profitably.

Ford lost an estimated $36,000 on each of the 36,000 electric vehicles it delivered to dealers during the third quarter. That’s a bigger loss than the estimated $32,350 loss per EV in the second quarter, Reuters reported.

The automaker is quickly confirming that new EV customers are unwilling to pay a substantial premium for battery-electric models.

Ford said its EV unit posted a loss in earnings before interest and taxes of $1.3 billion, bringing its nine-month EBIT loss to $3.1 billion. The company had forecast a full-year pretax loss of $4.5 billion for the Ford Model e unit.

Ford’s balance sheet remains strong, with more than $29 billion in cash and $51 billion in liquidity at the end of Q3, providing important financial flexibility. That included a $4 billion contingent liquidity facility that the company secured in August in anticipation of business uncertainties, including the strike, which was resolved for Ford on Wednesday.

Michael Strong contributed to this report.

0 Comments