Apparently the strike against General Motors by the UAW didn’t hit the company’s bottom line too badly. The Detroit-based automaker reinstated the full-year guidance it offer before the union’s walkout. Not only that, the company’s implementing a $10 billion accelerated share repurchase program.

The strike by the UAW cost GM $1.1 billion, which was not enough to derail the company’s profitability for 2023.

GM revealed early Wednesday morning it is reinstating its full-year 2023 earnings guidance. In addition, the company announced a $10 billion accelerated share repurchase (ASR) program and its intention to increase its common stock dividend by 33% beginning with the January 2024 declaration.

The company’s stock jumped more than 6% in pre-market trading. It closed Tuesday at $28.89 a share. It’s trading at $30.75 before the market opens.

“GM will deliver very strong profits in 2023 thanks to an exceptional portfolio of vehicles that customers love and our operating discipline,” said GM Chair and CEO Mary Barra in a statement. She also noted the company’s adjusting its 2024 budget to ensure it remains in the black.

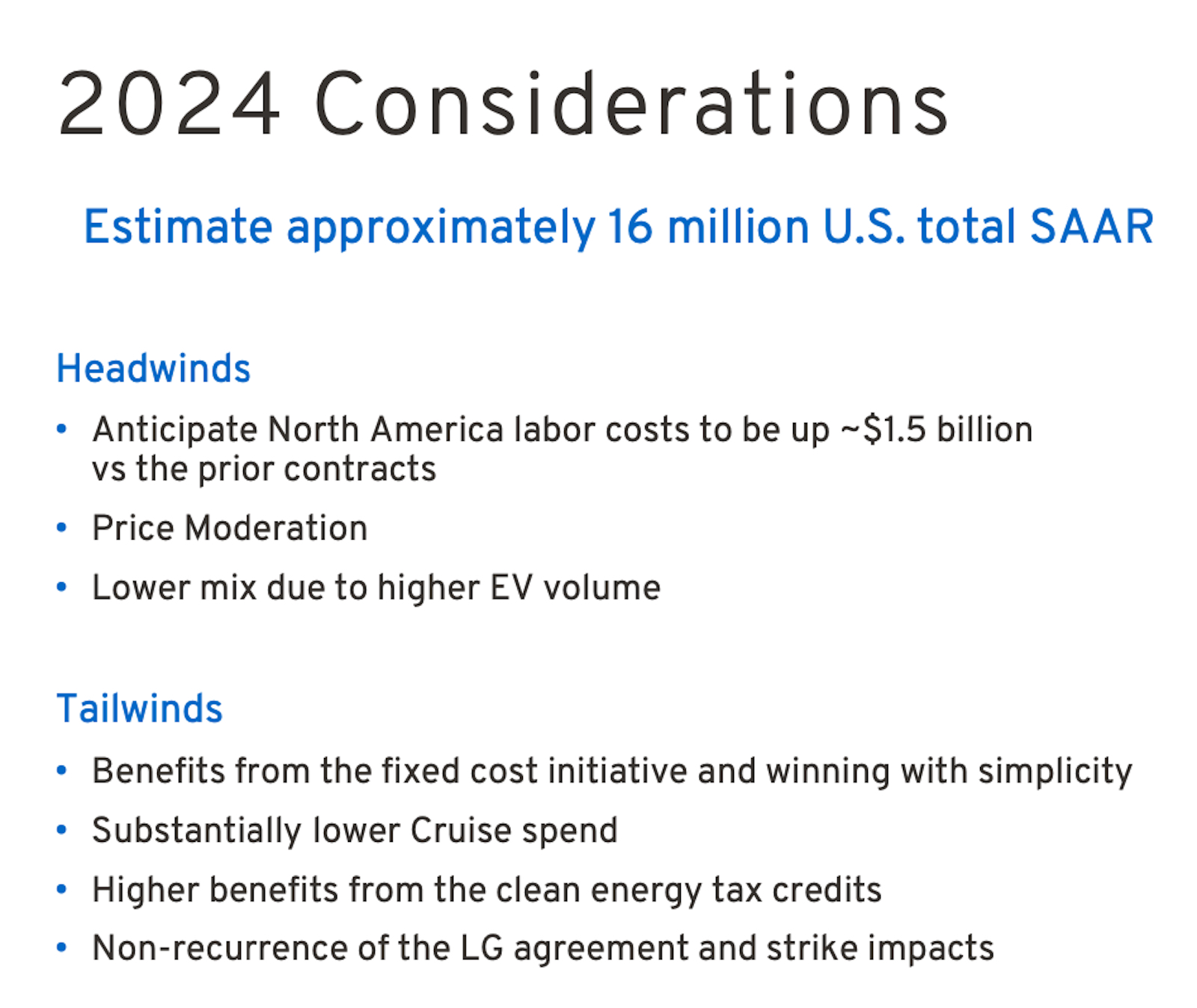

“We are finalizing a 2024 budget that will fully offset the incremental costs of our new labor agreements and the long-term plan we are executing includes reducing the capital intensity of the business, developing products even more efficiently, and further reducing our fixed and variable costs,” she added. “With this clear path forward, and our strong balance sheet, we will return significant capital to shareholders.”

UAW impact

There was no detail on what adjustments were made, but the company did reveal the new deal will add $500 to the cost of new vehicles in 2024. Over the life of the 4.5-year deal, it will have an average impact of $575 per vehicle. The total cost of the new deal is $9.3 billion. Ford estimated the new deal could add as much as $900 per vehicle.

What to expect

This year had been going great guns for the largest of the three Detroit-area automakers, GM twice raising its full-year earnings guidance prior to the union walkout in late September.

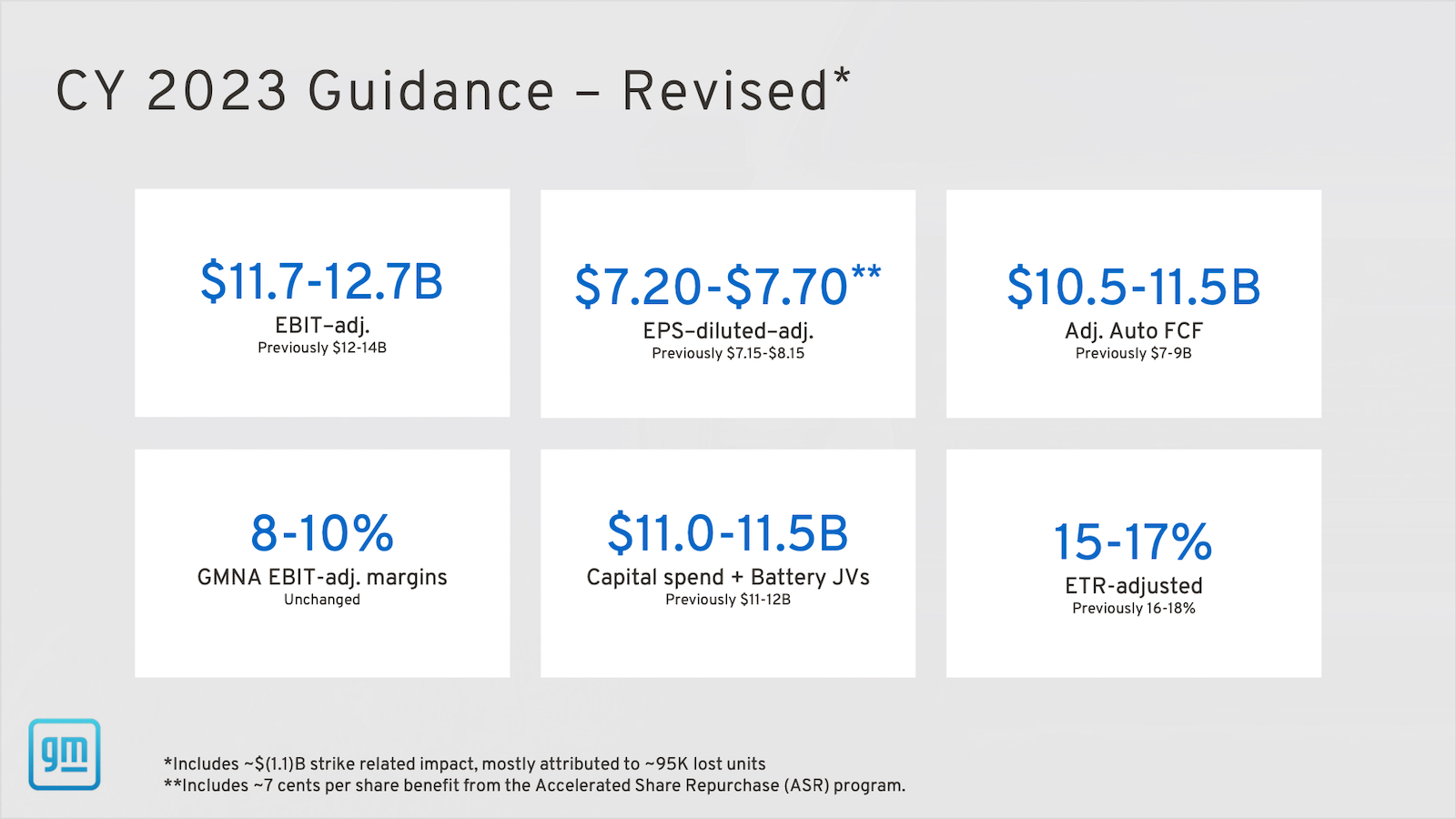

GM’s full-year guidance includes:

- Net income attributable to stockholders of $9.1 billion-$9.7 billion, compared to the previous outlook of $9.3 billion-$10.7 billion;

- EBIT-adjusted of $11.7 billion-$12.7 billion, compared to the previous outlook of $12 billion-$14 billion;

- EPS-diluted in the $6.52-$7.02 range, including the estimated impact of the ASR, compared to the previous outlook of $6.54-$7.54;

- EPS-diluted-adjusted in the $7.20-$7.70 range including the ASR, compared to the previous outlook of $7.15-$8.15;

- Net automotive cash provided by operating activities of $19.5 billion-$21 billion, compared to the previous outlook of $17.4 billion-$20.4 billion; and

- Adjusted automotive free cash flow of $10.5 billion to $11.5 billion, compared to the previous outlook of $7 billion-$9 billion.

GM now anticipates full-year 2023 capital spending to be $11.0 billion-$11.5 billion, which is at the low end of its prior guidance range of $11 billion-$12 billion, driven by the previously announced retiming of certain product programs and more capital-efficient investment.

Buying what?

The company also announced plans to implement a $10 billion accelerated share repurchase program. The plan is to retire $6.8 billion of common stock. Some is likely available for purchase as the automaker has 1.37 billion shares outstanding.

Bank of America, N.A., Goldman Sachs & Co. LLC, Barclays Bank PLC and Citibank, N.A. will implement the plan. Additionally, GM will have $1.4 billion of capacity remaining under its share repurchase authorization — separate from the ASR — for additional, opportunistic share repurchases.

The company also canceled a $6 billion revolving credit facility it entered in October. It plans to enter into a new 364-day $3 billion committed credit facility put together by the banks executing the ASR acting.

GM also expects to increase its common stock dividend by 3 cents per quarter to 12 cents beginning in 2024.

0 Comments