After a bit of dip in January, automakers are expected to report strong numbers for new vehicle sales in February. The first two months of the year are typically slower, so February’s expected returns are a pleasant surprise.

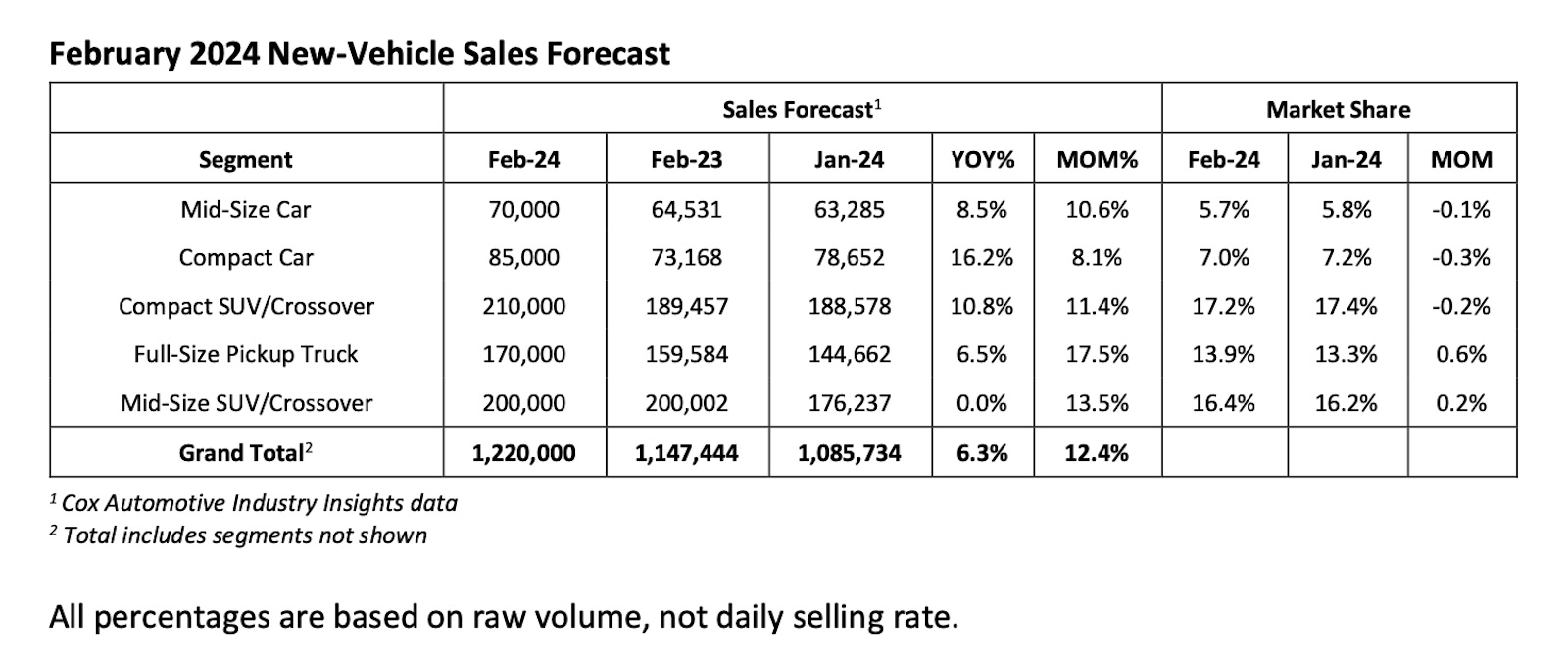

New vehicle sales are expected to rise 6.3% in February, or about 1.22 million vehicles, according to Cox Automotive. Analysts at J.D. Power agree, predicting sales to be up 5.6% for the month. Much of the rise is being attributed to severe product shortages in the market at this time last year. Also bolstering sales is an increase in incentives from automakers as inventory levels have basically returned to normal levels and they want to move metal.

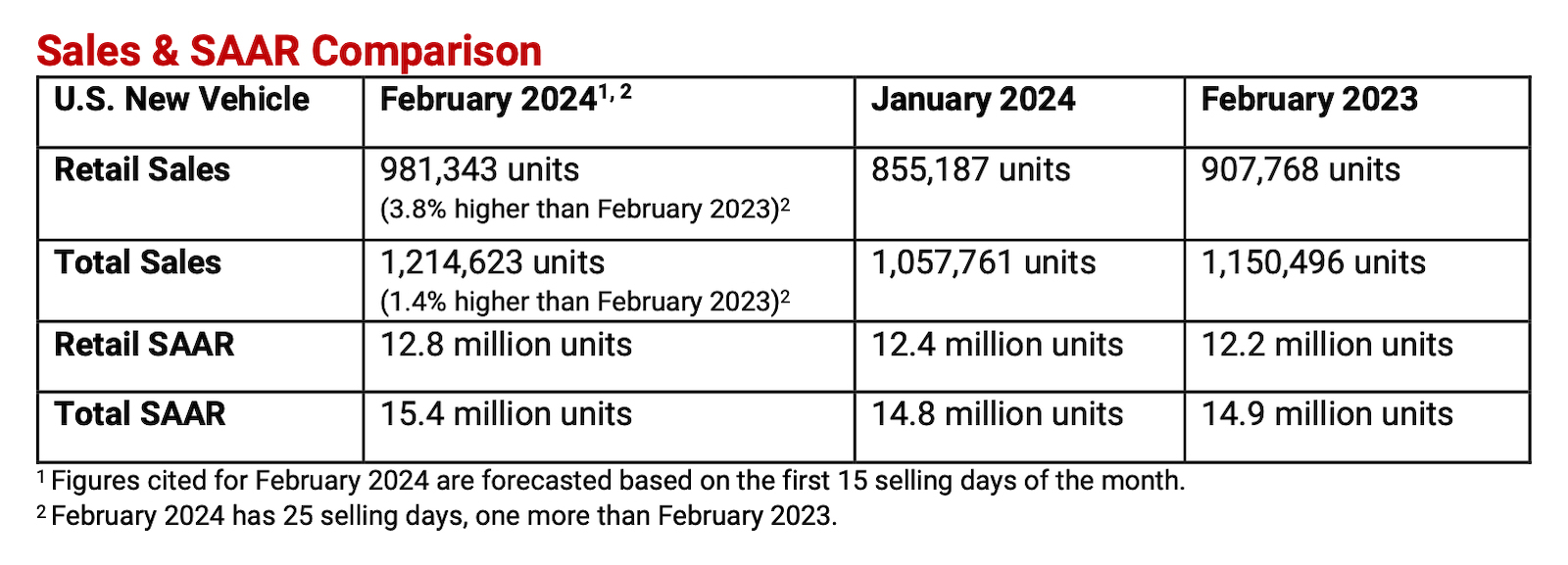

The seasonally adjusted annual rate (SAAR), or selling pace, is expected to finish near 15.4 million, up 0.5 million over last year’s pace and an improvement over January’s surprisingly low 15.0 million level.

“January and February are slow months for vehicle sales, but the new-vehicle sales pace this past January saw a surprising decline from December,” said Charlie Chesbrough, senior economist, Cox Automotive.

“Bad weather was a likely contributor and kept shoppers away from dealership lots. However, the weather this February was particularly mild across much of the country, so a bit of a rebound is expected this month. We are also seeing solid inventory levels and growing incentives and discounts, which should help sales volume.”

Prices are falling

Sales are on the rise, but the prices people are paying for these cars, trucks and utility vehicles continue to decline.

“The average new-vehicle retail transaction price is declining due to rising manufacturer incentives, falling retailer profit margins and increased availability of lower-priced vehicles,” said Thomas King, president of the data and analytics division at J.D. Power.

“Transaction prices in February are trending towards $44,045, down $1,919 or 4.2% — from February 2023. However, despite the significant decline in average transaction prices, higher sales volumes mean consumers are on track to spend nearly $40.8 billion on new vehicles this month — the highest on record for the month of February, and 4.1% higher than February 2023.

Again helping drive prices down are discounts from automakers, which are expected to come in at $2,565 in February — $66 higher than January. Expressed as a percentage of MSRP, incentive spending is currently at 5.3%, an increase of 2.3 percentage points from a year ago.

“One of the drivers of higher incentive spending is the increased availability of lease deals, and leasing is growing accordingly. This month, leasing is expected to account for 23.2% of retail sales, up 4.5 percentage points from 18.7% in February 2023.”

After rising consistently during the past few years, average monthly loan payments are stabilizing. The average monthly finance payment in February is on pace to be $722, flat from February 2023. The average interest rate for new-vehicle loans is expected to be 6.9%, an increase of 17 basis points from a year ago.

More sales stories

- Healthy January Sales Get Car Business Off to Good Start in 2024

- Key Carmakers Post Strong Q4, Full-Year Sales Despite Challenges

- Sales of German Brands Climb But Market Share Dips

What’s selling

According to Cox, compact cars are seeing the biggest increase, rising 16.2 percent compared to last February. Compact crossovers and SUVs are up 10.8% while midsize versions of those same vehicles remain flat.

The monthslong stagnation of EV sales is expected to carry over into February. Consumer concerns about the range of battery-electrics and capability of the public charging networks have chilled sales of new EVs. But Power analysts are expressing some optimism about the near-term future.

“But 2024 has started with slowing EV sales. In January, battery electric vehicle sales fell 1.6 percentage points from 9.2% in December 2023. Further, upper-funnel EV shopper interest declined for a fourth consecutive month,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power.

“New-vehicle shoppers who are ‘very likely’ to consider purchasing an EV for their next vehicle dropped to 25.6%, a full percentage point lower than in December. Shoppers cite a lack of charging station availability as the main reason for rejecting EVs.

“That said, some good news is on the way. Infrastructure scores have improved 5 percentage points, marking the most significant increase in the three years of EV history tracked by J.D. Power. The improvement is driven largely by non-Tesla charging installations at higher power levels and upgrades to the existing networks.

“Infrastructure scores are expected to continue increasing this year as the Tesla Supercharger network is opened to non-Tesla EVs. But this alone is not enough to move the needle. Improvement is needed in terms of the availability of affordable EVs for mainstream customers.”

0 Comments