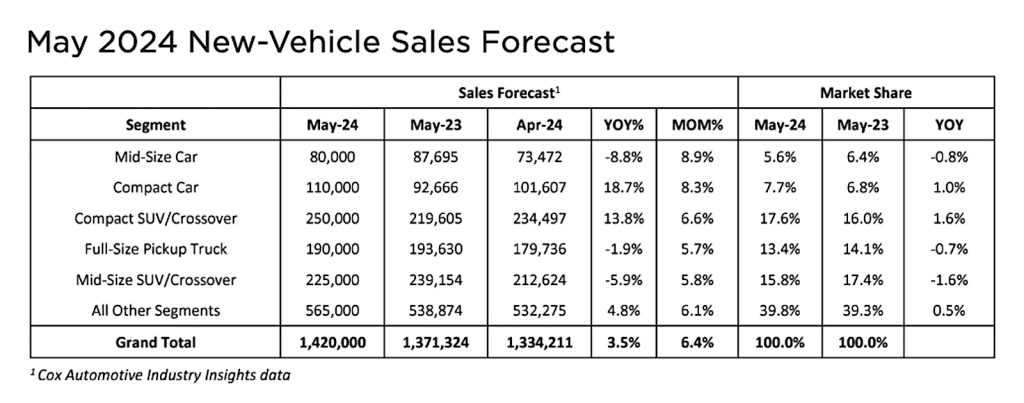

After a stumble in April, U.S. new vehicle sales are expected to rise as much as 3.5% courtesy of increased inventory levels and the rise in incentives that comes along with it. The numbers might have been higher if not for vehicle affordability issues.

Analysts at J.D. Power & Associates believe new vehicle sales will rise 2.9% in May while Cox Automotive expert predictors are more optimistic predicting 3.5%. A strong inventory — about 2.84 million vehicles — hasn’t driven prices down as expected.

“Rising inventory means fewer vehicles are being pre-sold by retailers, with more shoppers able to buy directly off dealer lots,” said Thomas King, president of the data and analytics division at J.D. Power.

“This month, J.D. Power forecasts that 33.3% of vehicles will sell within 10 days of arriving at the dealership, down from a peak of 58% in March 2022. The average time a new vehicle remains in the dealer’s possession before sale is expected to be 40 days, up from 29 days a year ago.”

More on the hood

The price for a new vehicle hasn’t dropped much in the past year, but the rising inventory levels means rising incentives should help consumers. That’s only going increase with the long holiday weekend.

“Sales in May generally improve over April as nicer weather brings more shoppers out to dealer lots,” said Cox Automotive Senior Economist Charlie Chesbrough.

“Memorial Day weekend often sees many low-price promotions from manufacturers as they try to build strong sales momentum for the summer season. With high inventory levels for several brands, we expect shoppers to see many aggressive offers this year.”

Incentives are already running at twice the level of this time last year. Manufacturer discounts are expected up only slightly from April — up just $33 per unit — but it’s a significant jump from year ago.

The average incentive spend per vehicle has grown 48.1% from May 2023 and is currently on track to reach $2,640, according to Power analyst King. Expressed as a percentage of MSRP, incentive spending is currently at 5.3%, an increase of 1.7 percentage points from a year ago. Increased spending of current model year is nearly offset by lower volumes of prior model year vehicles with higher spending.

The average new-vehicle retail transaction price in May is expected to reach $45,033, down $1,045 from May 2023.

The numbers

The average new-vehicle retail transaction price in May is expected to reach $45,033, down $1,045 from May 2023. The previous high for any month — $47,329 — was set in December 2022. Trucks and SUVs will account for 80.6% of sales in May, Power experts note.

They also expect interest rates for new vehicles to rise to 7.1%, despite the jump, the average new vehicle payment is going to drop.

“After rising consistently during the past few years, average monthly loan payments are stabilizing. The average monthly finance payment this month is on pace to be $727, down $3 from May 2023,” King added.

Cox Automotive has the monthly new vehicle payment even higher, at “above $750.”

More Sales Stories

- Japanese Automakers Post Strong April Sales Numbers, Korean Makers Sales Dip

- March Auto Sales Look Strong – But Affordability Remains an Issue

- Healthy January Sales Get Car Business Off to Good Start in 2024

EVs charging in wrong direction

Sales of electric vehicles have slowed in recent months, with EV market share peaking in April at 8.8%. That’s expected to fall gently, just 0.4%, in May. Hybrid sales have exploded during the same period, rising 50% during the first quarter of 2024.

Sales of electric vehicles have slowed in recent months, with EV market share peaking in April at 8.8%. That’s expected to fall gently, just 0.4%, in May. Hybrid sales have exploded during the same period, rising 50% during the first quarter of 2024.

Results from the J.D. Power 2024 Electric Vehicle Consideration Study show that, for the first time since the study’s inception in 2021, EV shopper consideration has dropped from the previous year, noted Elizabeth Krear, vice president, electric vehicle practice at J.D. Power.

“This year, 24% of shoppers say they are ‘very likely’ to consider purchasing an EV, which is down from 26% a year ago. Shoppers who are rejecting EVs point to lack of charging station availability, purchase price, limited driving distance per charge, time required to charge and inability to charge at home or work.”

0 Comments