Analysts predict sales of new cars, trucks and SUVs in July won’t set the world on fire — just like last month. This means the industry will need to wait another month to recover the sales lost due to the cyberattack against the nation’s auto dealers.

New vehicle sales in July aren’t expected to be earth shattering as dealers continue to dig out from the cyberattack mess.

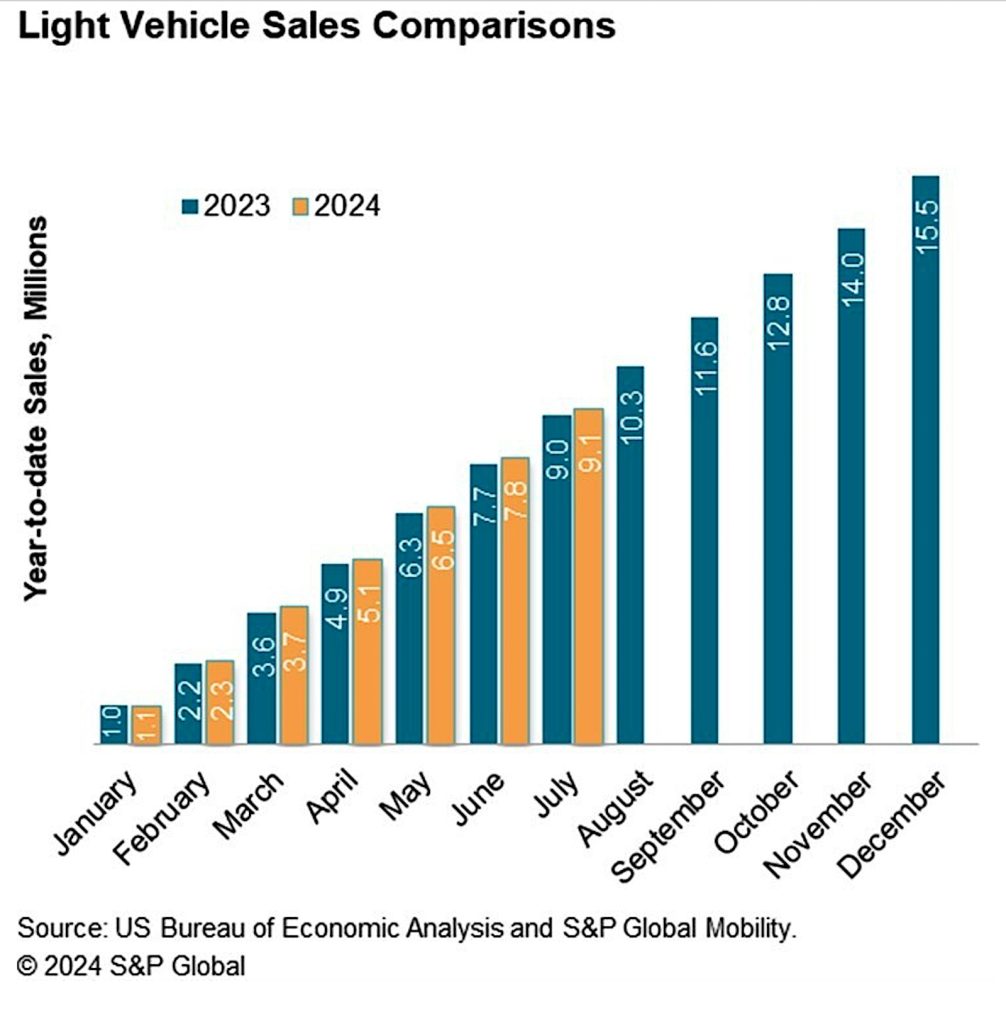

Two sets of industry experts — S&P Global Mobility and Cox Automotive — predict sales will rise less than 1.5% year-over-year. July is normally a slow month anyway, but June sales were down due to the cyberattack, and many were hoping the rebound would be in full swing this month.

S&P predicts a 1% rise while Cox analysts are more optimistic, suggesting a 1.3% decline.

However, that’s not been the case.

“As a result of delayed transactions from the June auto dealer cyberattacks, even with one less selling day than June 2024, auto sales volume in July is expected to essentially match the month-prior result,” said Chris Hopson, principal analyst at S&P Global Mobility.

Ongoing trend

Courtesy of the cyberattack the industry’s been in a bit of a lull since April, with sales being basically flat during that time.

“When averaged together, the two-month SAAR level of June and July would be very similar to the respective readings of April (15.8M) and May (15.9M), which were progressing mildly as rising inventory and incentive levels continue to help alleviate some new vehicle affordability pinch points.

“When averaged together, the two-month SAAR level of June and July would be very similar to the respective readings of April (15.8M) and May (15.9M), which were progressing mildly as rising inventory and incentive levels continue to help alleviate some new vehicle affordability pinch points.

“Mixed signals regarding the outlook for the second half of the year remain entrenched though, as new vehicle affordability concerns remain prevalent, and inventories are not expected to advance as strongly as they have done over the past 12 months.”

That said, the average would essentially be weighed down by June’s unexpectedly low number — about 15.3-million-unit pace — but July sales will be close to a 16-million-unit pace.

“July sales will likely include some sales that were delayed from June, which should push the market toward the upper end of the sales range,” said Charlie Chesbrough, senior economist at Cox Automotive. “How much is unknown, but tens of thousands of vehicles may have been affected.”

More Dealer Cyberattack Stories

- CDK Cyberattack Cost Dealers $1 Billion

- Cyberattack Cripples Car Dealers Across U.S.

- Hackers Hijack June Sales

Path to recovery

Now that the dealer situation’s been resolved, inventory levels are starting to level out as well. Many dealers weren’t certain exactly what vehicles they had in their inventory due to the cyberattack on the Dealer Management System. Now that they know what they have, they know what they can sell.

Now that the dealer situation’s been resolved, inventory levels are starting to level out as well. Many dealers weren’t certain exactly what vehicles they had in their inventory due to the cyberattack on the Dealer Management System. Now that they know what they have, they know what they can sell.

According to Matt Trommer, associate director, S&P Global Mobility, “Analysis of June retail advertised inventory data in the US finds that inventory continues to rise. Available retail advertised inventory at the end of June continued to grow, up 1.8% compared to May and 57% over last June.”

Expect the unexpected

On the supply side of the equation, with pockets of automakers reaching inventory saturation points given the current pace of sales, there are expected to be some interesting dynamics in the short-term production outlook.

“Some automakers are struggling to balance their sales, production, inventory and incentive targets as the market returns to more normal dynamics than what occurred from 2020-2023,” said Joe Langley, associate director at S&P Global Mobility.

“Our North American light vehicle production outlook for the remainder of this year has been scaled back as automakers attempt to manage these factors.”

0 Comments