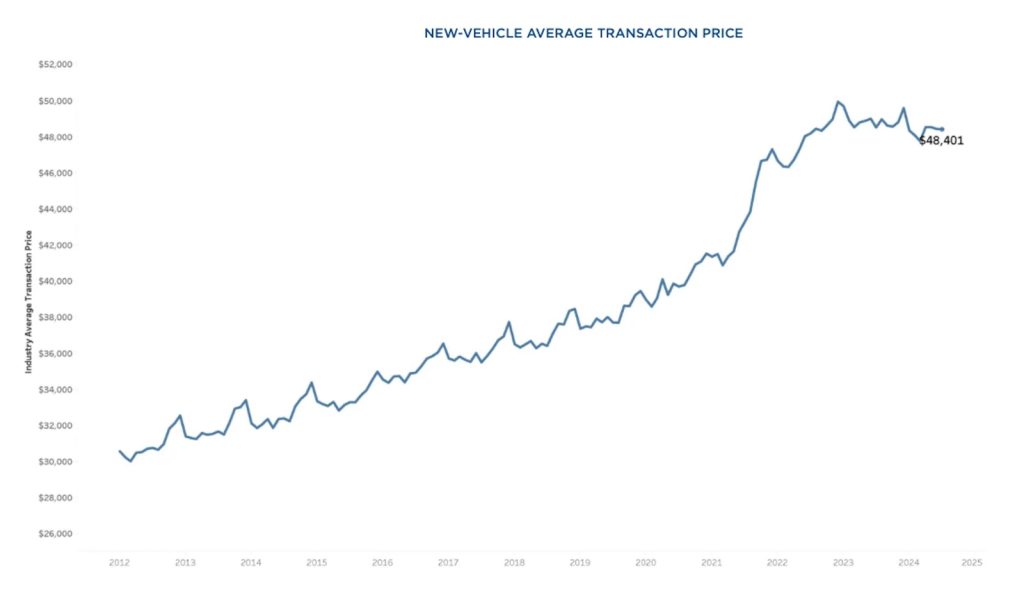

The average transaction price for a new vehicle fell last month — the 10th straight month of declines as the push by automakers to rebuild inventories exerts pressure on prices. As more and more vehicles sit longer and longer on lots, automakers offer higher incentives to move new metal.

Conditions continue to favor new vehicle buyers as new vehicle inventory levels have basically returned to pre-COVID norms. This is forcing automakers to pony up, and dropping the price buyers are paying.

Kelley Blue Book noted the average transaction price (ATP) for a new vehicle in the U.S. was $48,401. New-vehicle prices in July were mostly unchanged from the revised-lower June ATP of $48,424, a drop of just $23 and last year ($106). According to Kelley Blue Book, new-vehicle ATPs were lower in July by 3.1% from the peak in December 2022 at $49,929.

The huge factor in the pricing efforts is the fact that interest rates are still higher than most new vehicle buyers would like, so they’re staying home, keeping they’re money on ice until interest rates drop far enough to make monthly payments more palatable.

A little on the hood

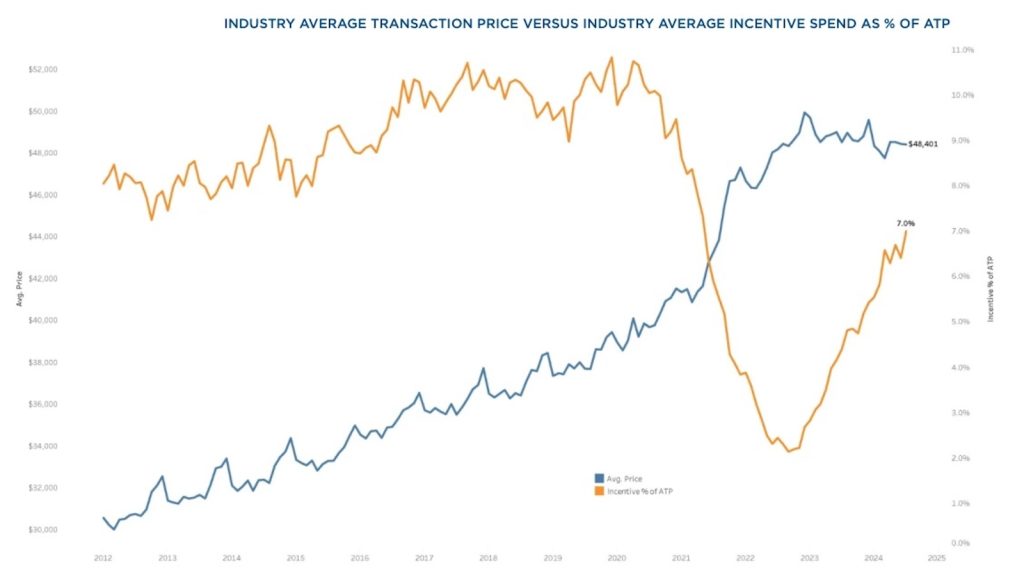

Technically not cash on the hood, but automaker incentives rose to 7% of the ATP last month to an average of $3,383. They’re not only up on a year-over-year basis, but month-over-month by 6.4%. They now stand at their highest level of the calendar year, KBB says.

Technically not cash on the hood, but automaker incentives rose to 7% of the ATP last month to an average of $3,383. They’re not only up on a year-over-year basis, but month-over-month by 6.4%. They now stand at their highest level of the calendar year, KBB says.

Incentives are now higher by 59.1% compared last July when the average incentive package was 4.4% of ATP. New-vehicle incentives in July were at the highest point in more than three years. Dealers are working with consumers to find a way to get a deal done.

“The thing about the U.S. is its diversity, and that goes for the U.S. auto market as well,” said Erin Keating, executive analyst at Cox Automotive. “There are many expensive, high-profile vehicles out there, but consumers have many good options priced well below industry average.

“We hear this from the large dealers all the time: No matter the budget, chances are we can make something work. This is particularly true where inventory is higher, and incentives are following.”

More across the board — nearly

Basically every brand pushed incentive levels higher on a year-over-year basis in July. The biggest spenders included Infiniti, Volkswagen, Audi and Nissan. Surprisingly, despite industry-leading inventory levels, incentive spending at the core Stellantis brands — Chrysler, Dodge, Jeep and Ram — remain below the industry average.

“Not every brand is seeing sky-high days’ supply, but, in most cases, where there is excess, incentives are climbing,” added Keating.

“The higher incentives are helping consumers, but stubbornly high interest rates and tighter credit conditions continue to make affordability challenging. If we are going to see the market live up to its potential, we will need to see rates lower, and credit loosen.”

More Sales Stories

- Sales of New Vehicles Increase in July Amid High Interest Rates and Computer Problems

- Hackers Hijack June Sales, Automakers Report Mixed Sales Picture

- Japanese Automakers Post Strong April Sales Numbers, Korean Automakers See Sales Dip

EV prices high, but dropping

While new EV buyers are still spending more than their gas- and diesel-power counterparts, the ATP is dropping. The ATP in July was $56,520, which was higher than June, but lower than the year-ago number by 1.5%.

Average transaction prices at Tesla continue to move higher after dropping to near the industry average in December 2023. In July, Tesla ATPs were $59,593, up 11% from one year ago and at the highest point since February 2023.

Success of the popular new Cybertruck is likely pulling Tesla prices higher, although the volume products, the Model 3 and Model Y, have seen prices rise consistently through the year.

0 Comments