For the first time in several years, the number of people buying a new vehicle remained loyal to the brand of car, truck or SUV they were getting out of. According to S&P Global Mobility, the first half registration data showed 52.5% of buyers remained loyal — a 1.9% increase on a year-over-year basis.

Tesla enjoys the most loyalty of any automotive brand among U.S. buyers, with Model 3 buyers being the most loyal.

Consumers electing to “stand pat” as it were through the first six months of the year, rose for the first time since 2020. The reversal reflects well on automakers, according to S&P analysts, in the wake of inventory shortages and the pandemic.

“Last year we saw a big jump in the number of households returning to market for a new vehicle, but the inventory was lacking,” said Vince Palomarez, associate director, loyalty product management at S&P Global Mobility. “This year, return-to-market volume remains consistent; however, inventory levels are up more than 40%, so households have more opportunity to remain loyal to their previous brand.”

Why and what does it mean?

The increase came across the board as more than half of brands enjoyed an increase of 1 point or better. Perhaps just as importantly, loyalty improved not just for mainstream brands but also luxury nameplates, which tend to see more movement.

Growing inventory levels and a strong pipeline of return-to-market households were the primary factors in loyalty gains for the first half of 2024. Although the increase bodes well for automakers, the loyalty rate is still below what it was even just three years ago: 52.5% versus 52.7%.

Growing inventory levels and a strong pipeline of return-to-market households were the primary factors in loyalty gains for the first half of 2024. Although the increase bodes well for automakers, the loyalty rate is still below what it was even just three years ago: 52.5% versus 52.7%.

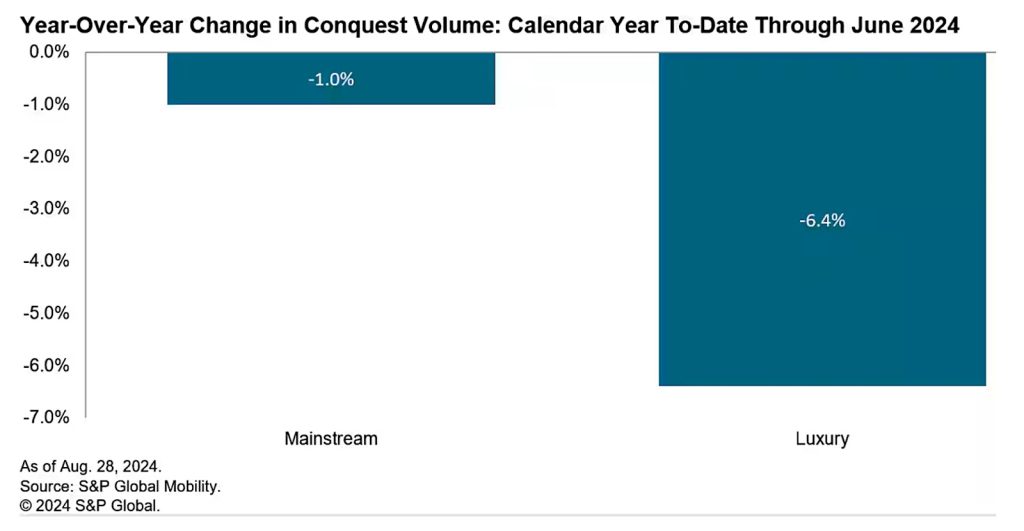

In what may seem like common sense on the surface, S&P analysts noted that this renewed loyalty to brand negatively impacted conquest volume in the mainstream and luxury segments.

Luxury brands saw an 18% year-over-year increase in conquests — where a brand lures a buyer from different brand, i.e. moving to Lincoln from Cadillac — for the first half of 2023. However, that changed dramatically this year, dropping 6.4% in the first half of 2024. Meanwhile, mainstream brands, while still declining year over year, saw conquest levels fall 1% vs. the first half of 2023.

“The positive jump in loyalty came at the expense of conquests,” said Tom Libby, associate director for loyalty solutions and industry analysis at S&P Global Mobility.

“Past years have shown that increases in both loyalty and conquests are possible if the pool of return-to-market rises as well. The first half of 2024 showed little-to-no change in return to market, so either loyalty or conquest were going to be affected.”

More Sales Stories

- Hackers Hijack June Sales, Automakers Report Mixed Sales Picture

- Japanese Automakers Post Strong April Sales Numbers, Korean Automakers See Sales Dip

- March Auto Sales Look Strong – But Affordability Remains an Issue

The winners

Keeping buyers suggests several companies are doing something right. General Motors appears to be doing the most right. The Detroit-based automaker leads all multi-brand manufacturers in manufacturer loyalty for the first half of 2024, at 67.7%.

Jaguar, Land Rover, and Lincoln are among the highest year-over-year gainers in brand loyalty, each improving rates by more than 6 percentage points. The Lincoln Nautilus is the current leader in model loyalty at 46.7%.

Jaguar, Land Rover, and Lincoln are among the highest year-over-year gainers in brand loyalty, each improving rates by more than 6 percentage points. The Lincoln Nautilus is the current leader in model loyalty at 46.7%.

Among individual brands, Tesla remains atop the leaderboard. The world’s biggest seller of electric vehicles remains the automotive brand with the most loyal owners. The company retained 67.8% of its owners through the first six months of the year. The leader among its five vehicles, the Model 3 with a 72.1% loyalty rate.

Retaining such a large percentage is impressive given the influx of new electric vehicles into the North American market during the past 18 months.

“Tesla has historically been a brand with strong loyal ties among their consumer base, despite a limited product portfolio,” said Palomarez. “Changes in BEV prioritization among other OEMs, along with Tesla’s directive to cut pricing when needed, has kept households from defecting.”

0 Comments