Despite dealing with a variety of difficult issues during the past year, a new study shows customer satisfaction with the automotive industry inched upward. The American Customer Satisfaction Index Automobile Study showed small brands made the difference in a 1% year-over-year improvement.

Tesla scored an 83 in the recent ACSI study in the luxury category, tying Mercedes-Benz for the top spot.

Overall, the industry scored an 80 out of 100 with the mass market segment receiving 79 and the luxury group tallying an 81. However, the small brands, such as Jaguar, Land Rover, etc. enjoyed a 7% jump, moving from 76 to 81. While higher scores are a good thing, officials warn that it’s important to keep pushing forward.

“Despite automotive sales showing strong growth in 2023, many consumers remain cautious about making major purchases like new vehicles,” said Forrest Morgeson, Associate Professor of Marketing at Michigan State University and Director of Research Emeritus at the ACSI.

“Inflation poses challenges and there are real concerns over new vehicles becoming outdated quicker because of how fast technology evolves. Plus, factors like economic uncertainty and range anxiety around electric vehicles contribute to this hesitation.”

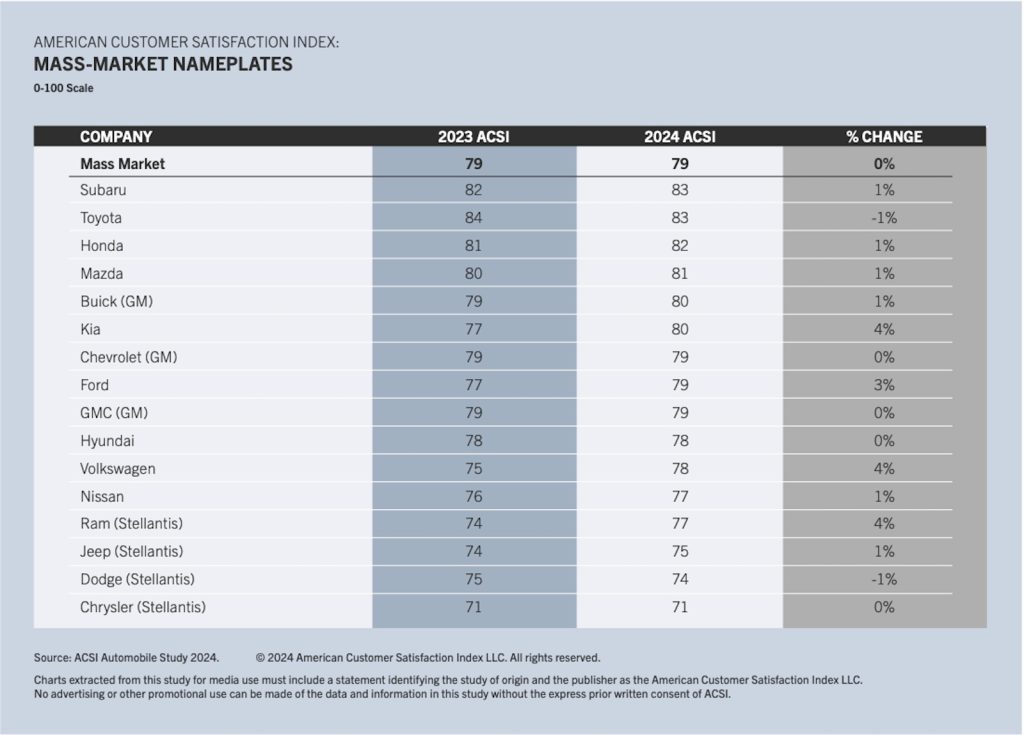

Mass market companies

Subaru and Toyota topped the mass market segment, each getting an 83. Subaru’s score rose 1% from last year while Toyota fell 1%. ACSI suggested the recent sales success each has enjoyed is indicative of how customers feel about each. Subaru’s posted 22 consecutive months of month-over-month sales increases while Toyota’s sales have grown 14.3% during the first half of this year.

Subaru and Toyota topped the mass market segment, each getting an 83. Subaru’s score rose 1% from last year while Toyota fell 1%. ACSI suggested the recent sales success each has enjoyed is indicative of how customers feel about each. Subaru’s posted 22 consecutive months of month-over-month sales increases while Toyota’s sales have grown 14.3% during the first half of this year.

Honda is third, up 1% to 82, followed by Mazda (up 1% to 81), Buick (up 1% to 80), and Kia (up 4% to 80). Ford (up 3% to 79), Volkswagen (up 4% to 78), and Ram (up 4% to 77) all post strong ACSI gains as well.

Despite Ram and Jeep (up 1% to 75) posting satisfaction gains, Stellantis brands occupy the four lowest positions of the segment, with Dodge slipping 1% to an ACSI score of 74 and last-place Chrysler idle at 71.

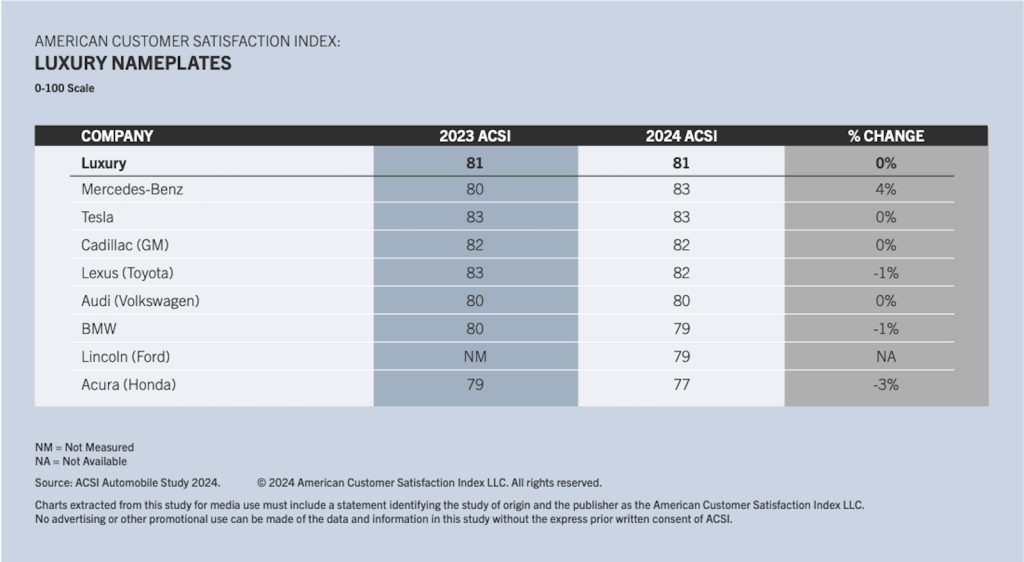

Luxury maker results

On the luxury side of things, Mercedes-Benz and Tesla tied for the No.1 position with 83. Tesla’s results were unchanged while Mercedes jumped 4% from 2023.

On the luxury side of things, Mercedes-Benz and Tesla tied for the No.1 position with 83. Tesla’s results were unchanged while Mercedes jumped 4% from 2023.

Mercedes-Benz’s customers are particularly satisfied with the company’s hybrid vehicles. Meanwhile, Tesla’s pricing strategy may be helping with value perceptions, while improved complaint handling appears to offset some customer concerns in other areas over the past year.

Last year’s co-leader Lexus slips 1% to 82 and is now tied with Cadillac (unchanged) for second place. Audi is next, steady at 80, followed by BMW (down 1%) and Lincoln at 79 apiece. Acura sits in last place after tumbling 3% to an ACSI score of 77.

More Vehicle Reviews

- First Drive: 2025 Hyundai Tucson Takes Aim at Toyota, Honda

- First Drive: 2025 Volvo EX90 Twin Motor Performance

- 2025 Hyundai Ioniq 5 XRT Adds Off-Road Chops

Other measurables

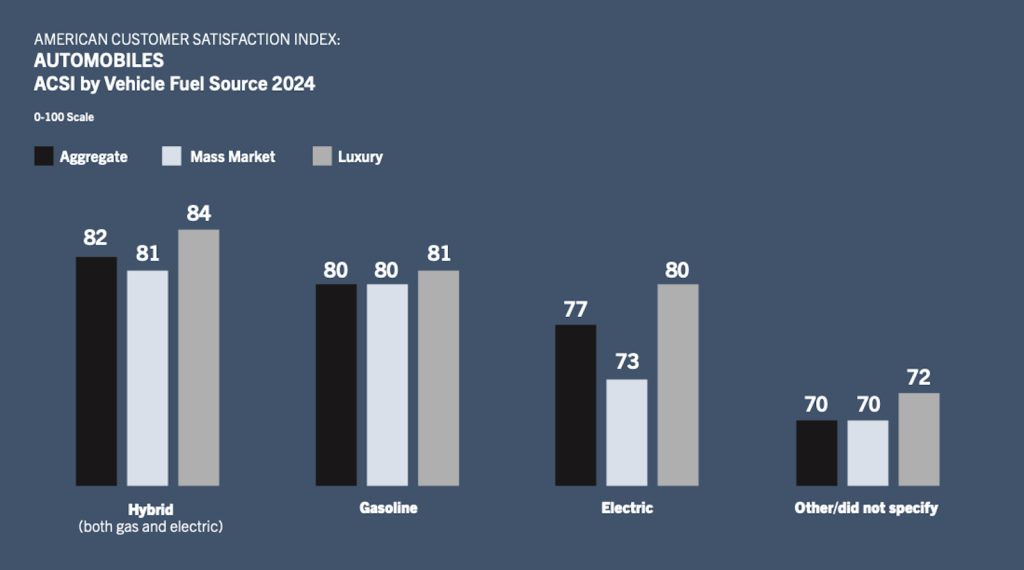

The recent trend showing buyers favoring hybrids over battery-electric models — and the adjustment by many makers to meet the demand — carried over to the ACSI study. Hybrid drivers scored the highest ranking with an 82.

The recent trend showing buyers favoring hybrids over battery-electric models — and the adjustment by many makers to meet the demand — carried over to the ACSI study. Hybrid drivers scored the highest ranking with an 82.

The number surpassed gas-powered vehicle owners at 80 and EV drivers at 77. Hybrid sales are up more than 40% in the first half of 2024.

“The surge in hybrid vehicle sales over the past year is a clear indication that consumers are seeking a balance between environmental consciousness and practical needs,” Morgeson noted.

“Hybrid owners are telling us they feel they’re doing something positive for the environment while still maintaining the flexibility and convenience they require. As automakers continue to invest in hybrid technology, we expect this trend to continue.”

0 Comments