New data reveals that consumers may be in the driver’s seat when it comes to getting a good deal on a new vehicle. According to Cloud Theory, new vehicle inventory levels are approaching oversupply, which shifts things in favor of new vehicle buyers.

The Grand Rapids, Michigan-based data company noted automakers have seen new inventory growth rise significantly during the past two months. The primary driver of the increase is the changeover to 2025 model-year vehicles.

Automakers are building the new vehicles faster than dealers are moving the 2024 models, with inflows of new vehicles outpacing the outflow of previous model year offerings by about 107, 000 vehicles last month.

“Vehicle movement hit a recent high in the past year,” according to the November edition of the company’s “On the Horizon” report, “though it is noted that November forecasts point to a decline that will bring that number back down into recent ranges.”

What does it mean

It means the impressive recovery we’ve seen in 2024 is expected to calm down with sales coming more in line with production. Dealers aren’t moving metal off their lots with any urgency as the turn rate remains relatively steady.

With no increase in sales, automakers generally look for levers to pull to sell some new vehicles and quickly. This means increased incentives and lower prices. The push to lower prices is already underway. Stellantis just announced it was cutting prices on the 2025 Jeep Wagoneer and Grand Wagoneer between $3,000 and $7,000.

With no increase in sales, automakers generally look for levers to pull to sell some new vehicles and quickly. This means increased incentives and lower prices. The push to lower prices is already underway. Stellantis just announced it was cutting prices on the 2025 Jeep Wagoneer and Grand Wagoneer between $3,000 and $7,000.

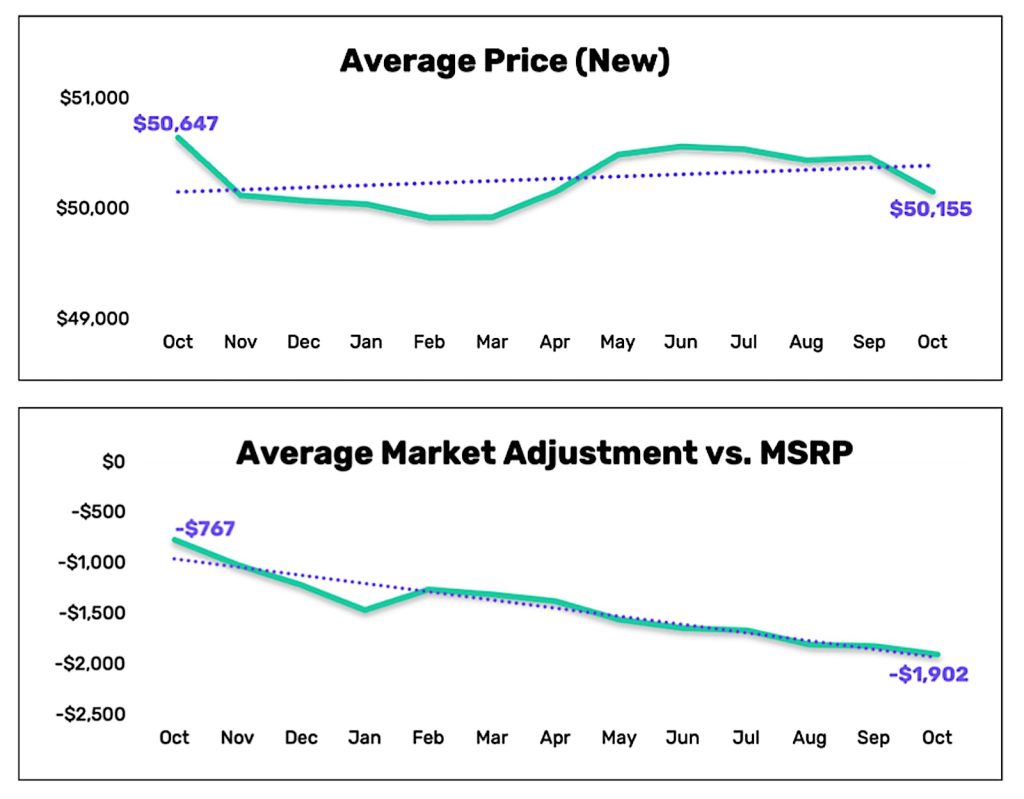

The average price of a new vehicle has dropped during the past 12 months, moving from $50,647 to $50,155, according to Cloud Theory data. Additionally, incentives have also risen dramatically during the same period jumping from $767 to $1,902.

“While we are not back to the oversupply situation that existed prior to the pandemic, we’re certainly getting closer,” said Rick Wainschel, Cloud Theory vice president of Data Science & Analytics.

“Pricing actions can mitigate sales velocity slowdowns, which appears to be the case currently. But the increasing aggressiveness on discounts and incentives may be a harbinger of other things to come.”

More Consumer Stories

- Consumers Showing a Bit More Confidence in Self-Driving Vehicles

- Fiat Stops Production of Fiat 500 Due to Low Consumer Demand

- Consumers Paying Less — Again — for New Vehicles in 2024

Where are the deals?

If you’re in the market, now may be good time to buy as inventory levels rise. However, you may not be able to buy the type or brand vehicle you want. Increased incentives and price cuts are typically the biggest or most plentiful with companies that take the longest to sell vehicles.

If you’re in the market, now may be good time to buy as inventory levels rise. However, you may not be able to buy the type or brand vehicle you want. Increased incentives and price cuts are typically the biggest or most plentiful with companies that take the longest to sell vehicles.

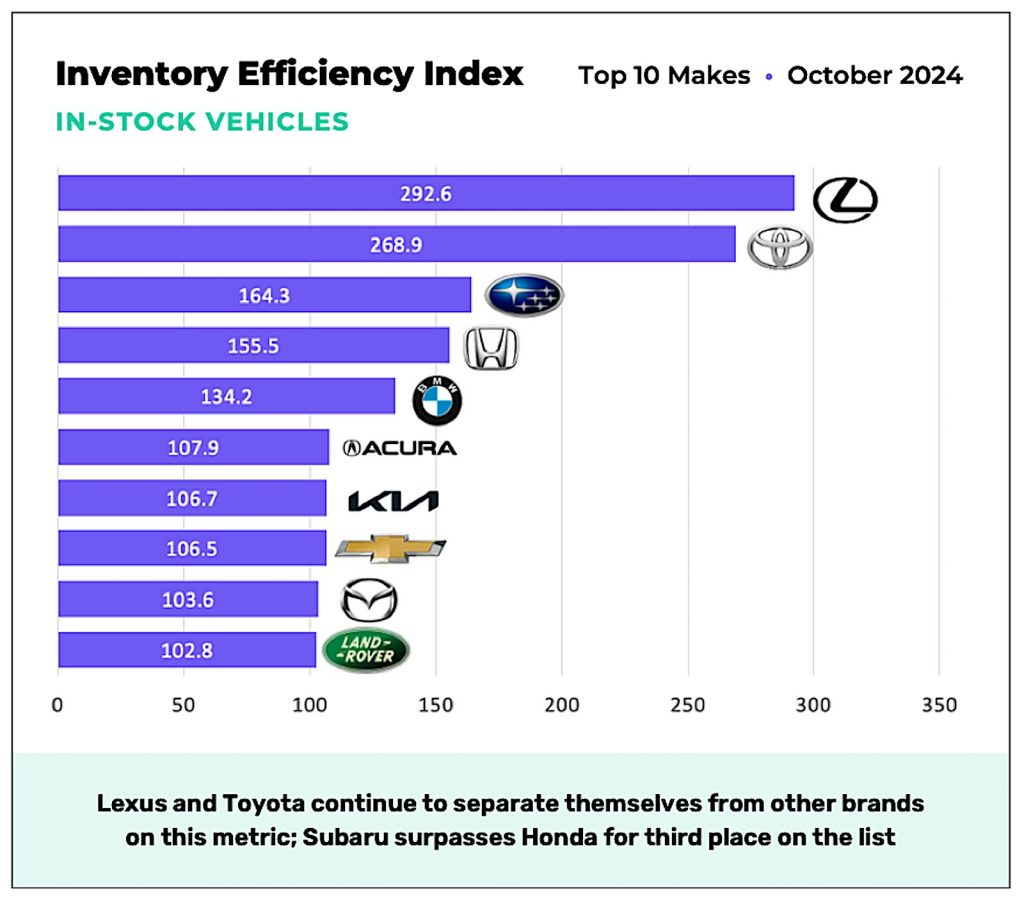

This means that you shouldn’t bother looking at Lexus, Toyota, Subaru, Honda or BMW. They’re all turning around vehicles at impressive rates, Lexus and Toyota in particular. The Inventory Efficiency Index is a measure of how quickly the dealers of each brand are selling things off. Lexus tops the list right now with Toyota nipping at its heels.

The rest of the top 10 includes: Subaru, Honda, BMW, Acura, Kia, Chevrolet, Mazda and Land Rover are all selling vehicles faster than they are taking them in. So the rest of the industry is fair game.

“Some makes have inherent advantages in their Inventory Efficiency Index performance based on factors such as brand appeal, segment scope, or inventory philosophy,” said Ron Boe, Cloud Theory’s chief revenue officer.

Boe also warns that the numbers can change fast depending upon moves made by the automaker.

Yeh, you will only have to pay $65K instead of $70K for that Jeep. Better get two.