Tesla’s second quarter results reflected the tough times the EV maker’s experiencing now that there is more competition and other issues impacting sales. While the company’s overall revenue rose slightly, its net income and automotive operations revenue took massive hits. That follows weak vehicle deliveries during the April-June period, the third consecutive down quarter. To the surprise of some, CEO Elon Musk didn’t seem too bothered by the numbers during his quarterly conference call with analysts and media.

Tesla CEO Elon Musk’s insights about the company’s tough second quarter didn’t fend off the ire of investors.

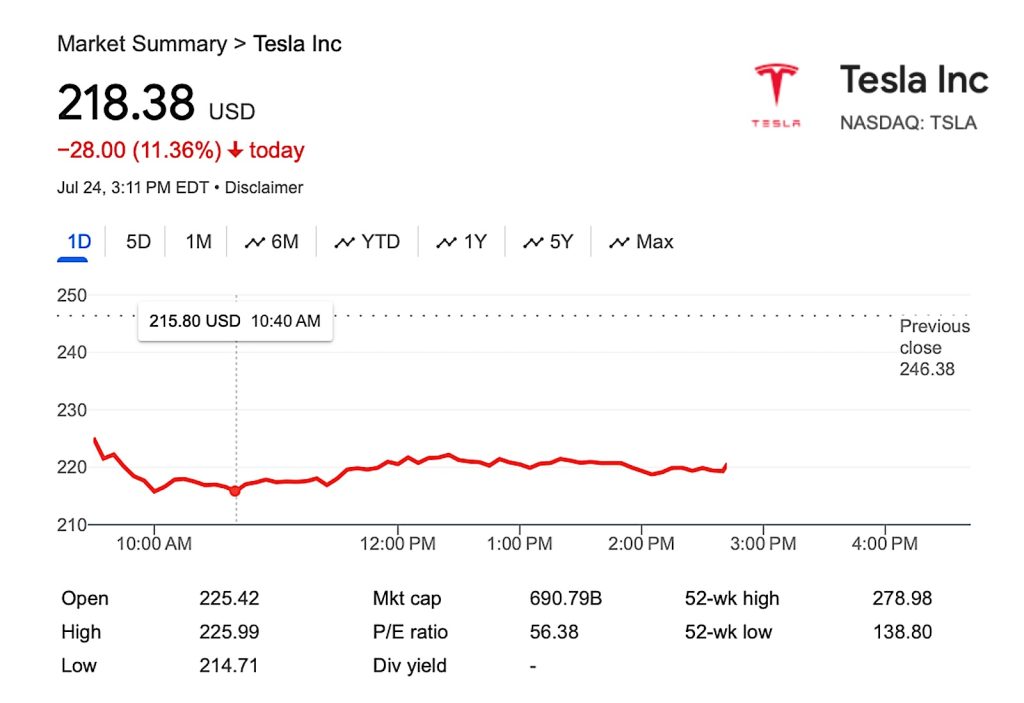

The company’s stock plunged more than 12% in Wednesday trading, falling $30.39 to close at $215.99. The question is whether investors displeased more by Tesla’s weak second-quarter results or Musk’s seeming lack of worry about them.

Overall, the company reported revenue of $25.5 billion, which is a 2% increase. However, Tesla’s net income came in at $1.48 billion, which is down 45%. Its EBITA-adjusted earnings were only slightly better at $3.67 billion, a 21% drop.

The Texas-based automaker took in $19.9 billion in revenue during the quarter, which was an improvement over Q1 results, but lagged the same period in 2023. Sales have been down through the first six months of the year, including being down 5% in the quarter just ended.

Change in the wind

Musk said during the company’s earnings call that the “value of Tesla overwhelmingly is autonomy.” He suggested anything else is “noise.”

Musk’s confirmation that the low-price Tesla is tracking to arrive early next year didn’t make investors happy.

“I recommend anyone who doesn’t believe that Tesla will sell people autonomy should not hold Tesla stock,” he said. “They should sell it as a stock. If you believe Tesla will solve autonomy, you should buy Tesla stock.”

However, it seems clear that not everyone believes that Tesla’s autonomous technology is what will keep the company in the black. They believe selling more vehicles and developing more new vehicles to sell, such as the low-priced EV, dubbed the Model 2 or Model C, and the second-generation roadster is what will keep the company in the black.

He also confirmed the former will arrive in the first half of next year, while the roadster is expected during the second half of 2025. He declined to comment further on the progress of the vehicles. However, he did address Robotaxi Day, which is now going to be held Oct. 10.

More industry news

Analysts like robotaxis

Musk said the extra time permits Tesla to add “a couple other things” to the robotaxi prior to its unveil. He noted he wanted to move it back to make some “important changes that I think would improve the vehicle.”

Analysts were pleased he didn’t gloss over that move, especially since Musk said if they can get the robotaxi business working the way he believes it should, it would push the company’s valuation to $5 trillion.

“Addressing the delay in Robotaxi Day and the new timing will be important to hear on the conference call as we believe a linchpin to Tesla reaching $1 trillion+ valuation and ultimately higher over the next year is contingent on the AI/FSD story materializing into a monetization path over the coming years,” Wedbush analyst Dan Ives wrote in a note before the earnings call.

Despite Musk throwing that tantalizing valuation number out there, it appears it wasn’t enough to offset investors who want to see more EV sales now while he works on making the company’s autonomous technology work.

0 Comments