Ending a nearly six-week walkout, Ford reached a tentative settlement with the United Auto Workers union providing it a 25% raise — its best deal in more than two decades. Now, the UAW has to wrap up talks with General Motors and Stellantis, but there are potential sticking points that could drag things out, reports Headlight.News.

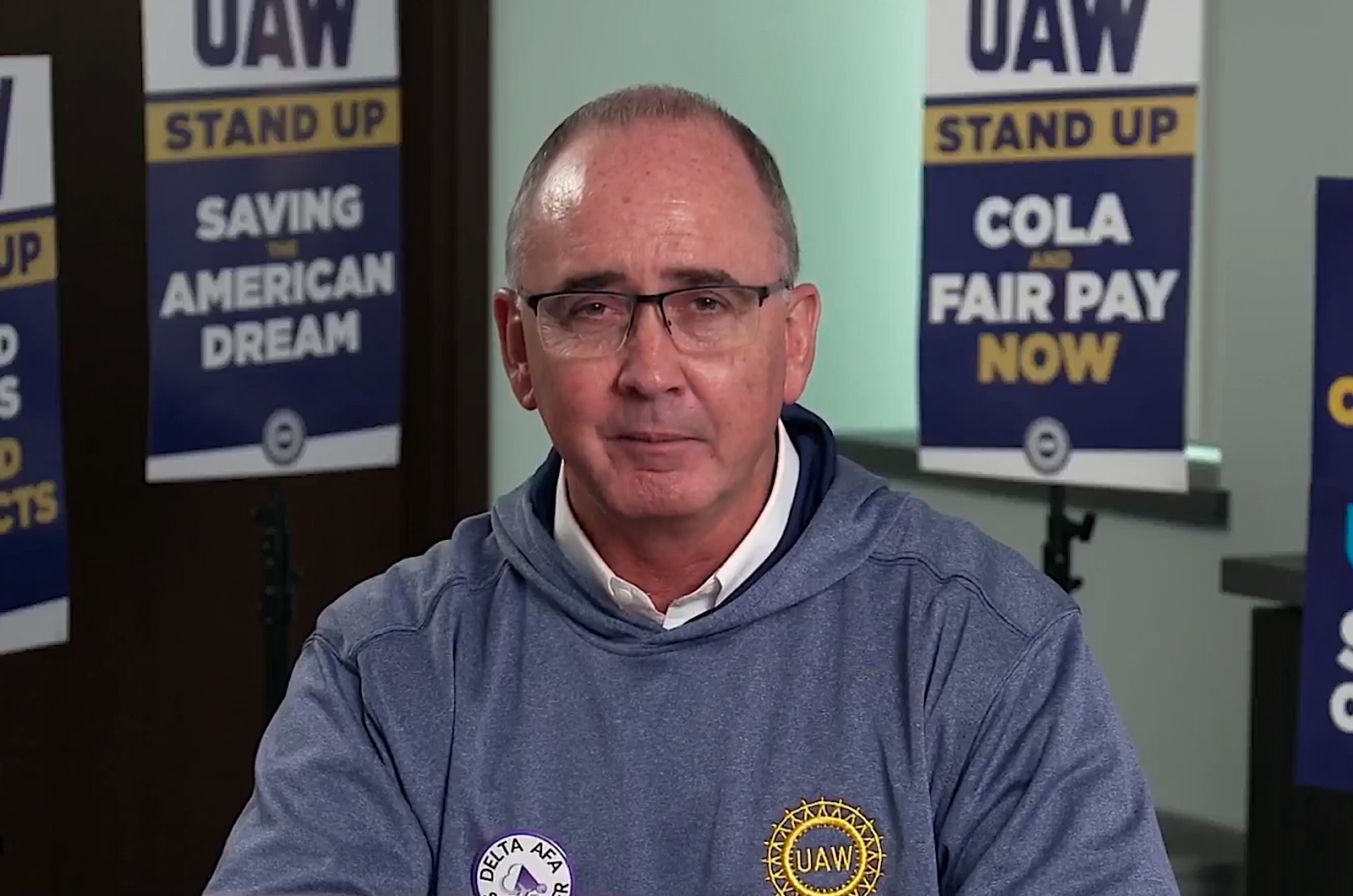

UAW President Shawn Fain gathered with striking workers at Stellantis’ Sterling Heights Assembly Plant.

The deal announced on Wednesday ends a 41-day strike against Ford Motor Co., the longest walkout the United Auto Workers union has staged in a half century. While rank-and-file members were told to report back to Ford plants immediately, this year’s contentious labor dispute is far from over. The UAW has yet to settle with the other members of the Detroit Big Three, General Motors and Stellantis.

The two manufacturers are “under enormous pressure to settle,” said John McElroy, a longtime industry analyst and host of the streaming program Autoline: Detroit. “It’s bad enough to compete against the imports, but even more of a problem having your major domestic competitor — Ford — settle with the union and go back into production.”

With the walkouts at GM and Stellantis set to enter a seventh week, the immediate question is what will it take to settle? But that raises an alternate question: are there issues unique to GM and Stellantis that will make a deal harder to achieve than with Ford. And there, it appears, the answer is yes, according to a number of the observers who spoke with Headlight.News.

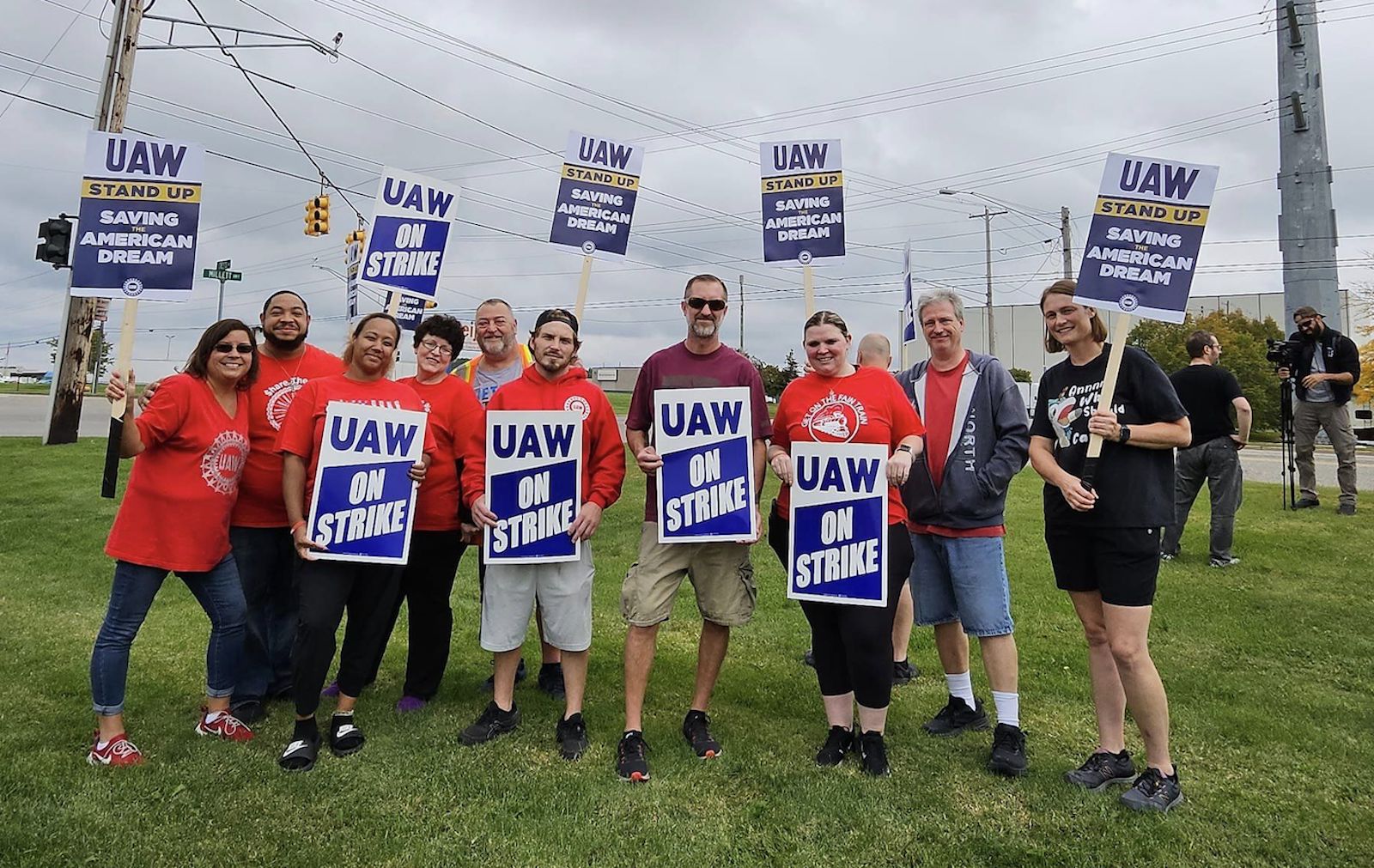

Workers at the Stellantis plant in Toledo, Ohio picket at the plant that makes the Wrangler and Gladiator.

The gaps are “bridgeable.”

By and large, most of the issues that matter seem to be falling into place, based on what UAW President Shawn Fain and others close to the negotiations have indicated. Take wages, for example. GM already upped its own offer last week to 23%. Pushing that to 25%, in line with Ford’s number, “is bridgeable,” said Sam Fiorani, chief analyst with AutoForecast Solutions.

When Fain held a Facebook Live presentation last Friday he outlined where the three manufacturers stood — and there were clearly differences on what each proposed on the return of cost-of-living allowances, revisions to retirement programs, the elimination of a two-tier wage system and time off. But those also appear to be resolvable issues, the experts agreed.

Yet, sticking points remain, and the one most of the experts pointed to centers around the UAW’s demand that workers be given the right to strike over proposed plant closings.

Plant closings could be the major sticking point

That was a proposal Ford ultimately caved on. But GM and, in particular, Stellantis, have been more reluctant to accept that idea. As Fain has pointed out, the three Detroit manufacturers have closed dozens of plants since 2007, when the Great Recession struck and GM and what was then Chrysler fell into bankruptcy.

Today, it’s the dramatic transformation reshaping the auto industry that threatens to upend the domestic industry’s manufacturing footprint, primarily the shift from conventional internal combustion engines to battery-electric technology.

UAW President Shawn Fain didn’t get everything the union wanted in the Ford deal, and that could be a problem going forward.

Electrification changes the equation

Last February Stellantis idled its aging assembly plant in Belvidere, Illinois, a statement from the automaker putting primary blame on “increasing cost(s) related to the electrification of the automotive market.”

With no new products scheduled to go into the facility, Stellantis wants to make that shutdown permanent — though it has told the UAW it “will make every effort to place indefinitely laid off employees in open full-time positions (at other Stellantis plants) as they become available.”

For its part, GM has not announced new plant closings, but Fiorani sees at least one facility at serious risk, the assembly line in Fairfax, Kansas producing GM’s slow-selling Chevrolet Malibu sedan. As with the Stellantis plant in Belvidere, there are no new products scheduled to go into the Kansas plant, those familiar with the GM product plan said.

Plans can change

Plans can change, of course. Despite strong opposition from the UAW, GM shuttered its big operation in Spring Hill, Tennessee following its 2010 emergence from bankruptcy. But, if anything, the facility has gained importance as one of the center sites for GM’s scheduled shift to become an all-electric manufacturer by 2035.

Fiorani believes there could be a way to shift products to keep Fairfax operating under a new UAW contract.

For now, GM and Stellantis officials continue to publicly fret about how the UAW’s demands could make them unable to compete with foreign manufacturers, especially those with factories in the U.S. But the union has rejected that argument. Several of the experts who spoke to Headlight.News agreed, forecasting that the labor cost gap shouldn’t rise much going forward.

The “transplants”

Since Honda opened the first “transplant” assembly line in Marysville, Ohio 40 years ago, non-union manufacturers have largely kept pace with what the Detroit Big Three have done when it comes to wages and benefits. And, said McElroy, they’re “likely to do it again this time,” raising wages and adding new benefits.

It’s not altruism. The non-union manufacturers know the UAW continues to aggressively court workers at facilities like the Toyota Camry plant in Georgetown, Kentucky, the BMW SUV plant in Spartanburg, South Carolina, and the Volkswagen factory in Chattanooga, Tennessee.

For four decades, workers have rejected those overtures. But the “mood of the country” has changed, said Brian Rothenberg, a former UAW official and now a political and labor consultant. With more strikes and threatened walkouts than have been seen in years, observers expect the foreign-owned operations will again stay close to the Detroit pattern — albeit staying a bit behind in terms of overall labor costs.

Who’s next?

A decidedly unscientific poll of those watching this year’s contract talks suggests Ford’s settlement will trigger a cascade effect.

“Both sides are trying to resolve things before the holidays,” said Rothenberg, adding, “I think GM will move fast.” But he warns that it could take a little longer for Stellantis to fold as the primary decisions are being made out of Paris, where its CEO and much of the rest of its senior managers are based, rather than Detroit.

0 Comments