The COVID pandemic and semiconductor shortage drained dealer inventories, leaving buyers scrambling to find the vehicle they wanted — even as dealers frequently tacked on thousands of dollars in markups. Now, however, inventory levels are rapidly getting back to normal — though the UAW strike did cause production delays for a handful of domestic models. Even better, you may find incentives on the model you’re looking to buy.

Dealers are nearly back to “fully stocked,” so buyers will likely be able to find the model they want.

After three years of shortages, dealer inventory levels are finally getting back to normal, meaning most U.S. buyers should be able to find the vehicles they want in U.S. showrooms. It’s the first time that’s happened since COVID struck, leading to lengthy factory shutdowns — a situation worsened by the global semiconductor shortage.

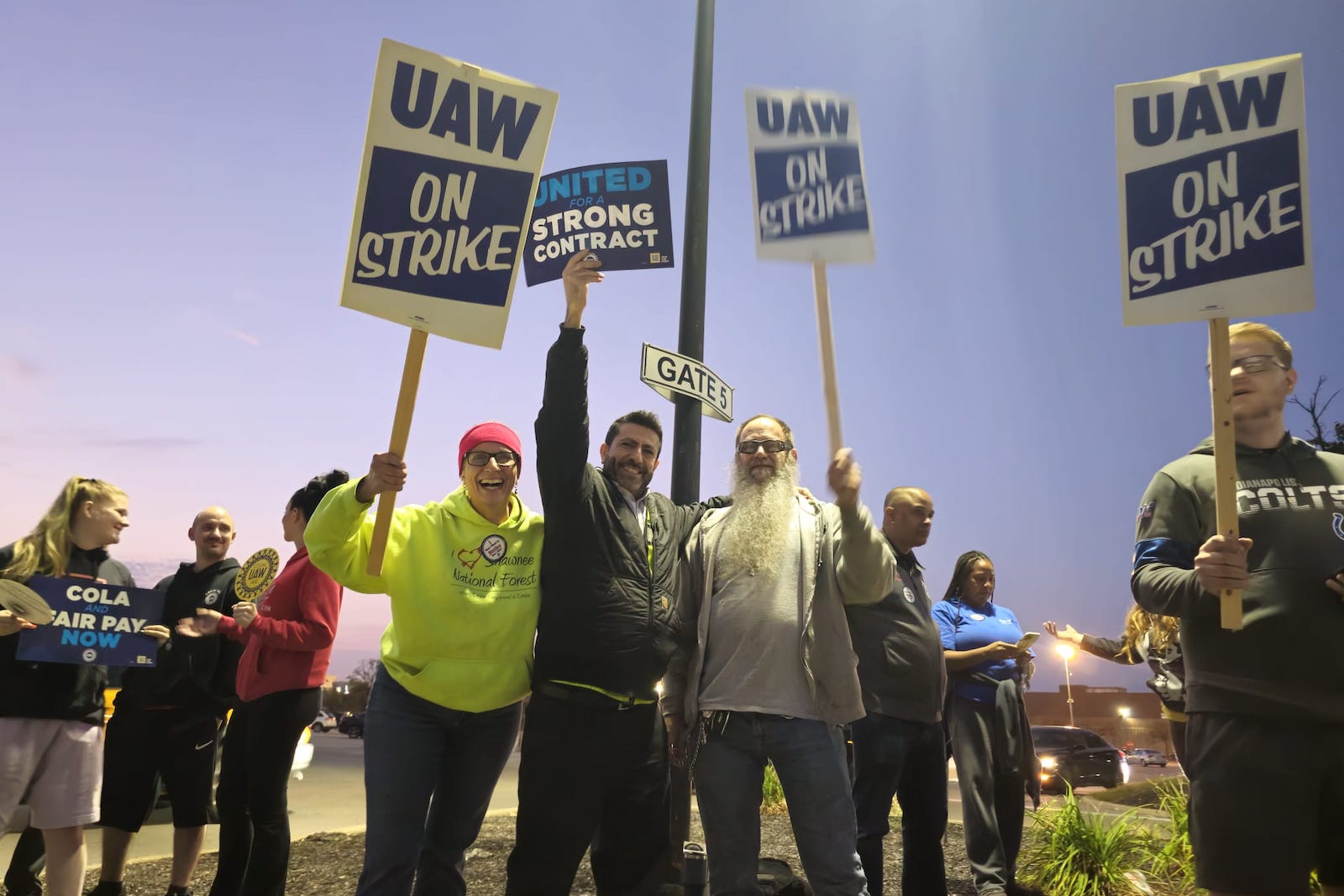

The six-week strike by the United Auto Workers did lead to production cuts by General Motors, Ford and Stellantis, but only a handful of models were affected, and some were already in good supply, according to Bank of America Research. But production is rapidly ramping back up and should soon be close to normal.

There’s more good news for shoppers looking for a new car, truck or crossover. Many dealers previously tacked on substantial markups, especially for the most popular vehicles, due to inventory shortages. Now buyers now are finding incentives and discounts on many models, according to reports from J.D. Power, Edmunds and other tracking services. Rebates, cut-rate loans and other incentives have averaged more than $2,000 per vehicles in recent months, reports Motor Intelligence, and ran as high as $12,907 on the Lucid Air sedan.

The six-week strike by the United Auto Workers did lead to production cuts by General Motors, Ford and Stellantis, but only a handful of models were affected.

COVID crushed production and its only now recovering

Prior to when COVID struck in early 2020, U.S. dealers tended to maintain collective inventories of about 3 million vehicles. But that fell to as low as 1 million through early this year, said J.D. Power data director Tyson Jominy. As a result, it could be difficult for many customers to find the vehicles they wanted. And, when they did, a number of buyers told Headlight.News, dealers were tacking on hefty premiums.

“Inventory remains below more ‘normal’ levels … but is moving closer” to pre-pandemic levels, Bank of America Research said in a new report. In October, the numbers were around 2.15 million, BoA reported, up 91,000 vehicles from the month before. That means things should reach “more normal levels,” it added, in the near future.

Exactly where inventories will level out is uncertain, however. A number of automakers have laid out plans to maintain lower dealer inventories going forward, including both General Motors and Ford. Manufacturers found during the pandemic that many U.S. car buyers were willing to shop online, even if that meant waiting weeks, perhaps months, to take delivery. Earlier this year, Ford CEO Jim Farley suggested the automaker would put an emphasis on advance orders for future battery-electric vehicles.

UAW strike hot some popular models

Inventory “remains below more ‘normal’ levels … but is moving closer” to pre-pandemic levels, Bank of America Research said.

While there continue to be occasional reports of spot chip shortages, according to AutoForecast Solutions, the impact has been minor to insignificant in recent months.

More worrisome was the strike by the UAW which began at 11:59 p.m. on Sept. 14 and continued for roughly six weeks. Workers at the three automakers are now voting on tentative contracts providing 25% raises, but many have already begun returning to assembly lines.

In an unusual move, the union struck all three companies simultaneously. But it turned to a targeted “stand-up” strike approach that limited the number of plants — and models — affected. In some cases, automakers prepared for a possible walkout by ramping up production ahead of the mid-September contract deadline.

Some models are now in over-supply

The factory building full-size pickups for Stellantis was hit late in the strike. And that’s likely to have relatively little impact on what turns out to be a glut of Ram 1500 pickups on dealer lots. Where retailers like to have enough vehicles in stock to cover 60 to 70 days’ worth of sales, they reportedly have a 238-day backlog of the mainstream Ram 1500 model in stock, and up to 460 days of the heavy-duty Ram 2500.

But it’s not alone. Jeep began the month with 336 days worth of Grand Wagoneers. BMW had a 288-day supply of the outgoing 5 Series model. And there are 212 days worth Mercedes-Benz EQS taking up space on showroom lots.

Return of the rebate and other incentives

Not surprisingly, those models now carry incentives meant to move the metal. Ram is offering up to $5,200 in “bonus cash” on the 1500 pickup, though buyers can opt, alternatively, for 3.9% loans. Dodge is offering up to $5,500 in cash on the Durango SUV. And Kia, Hyundai, Nissan and Subaru are using “subvented” loans of as low as 0.9% to draw in buyers.

There are plenty of lease deals, as well. The new and well-reviewed Honda Accord is available for as little as $289 a month with a $3,399 downpayment. Despite strong sales, Hyundai is leasing the Tucson for as little as $251 for 36 months, with a $4,011 up-front payment.

Big deals on EVs

Some of the bigger incentives can be found on battery-electric vehicles due to a flattening of sales. There’s a $7,500 “lease bonus” on the Hyundai Ioniq 5 and Lexus is offering $15,000 in “lease cash” on its first all-electric model, the RZ. Even Tesla has been discounting its two best-sellers, the Models 3 and Y, after announcing several price cuts earlier this year.

Buyers should expect more of the same, according to the various analysts who’ve spoken to Headlight.News in recent weeks. While vehicle sales are rebounding, industry planners want to keep momentum going as concerns about the health of the U.S. economy continue to grow.

0 Comments