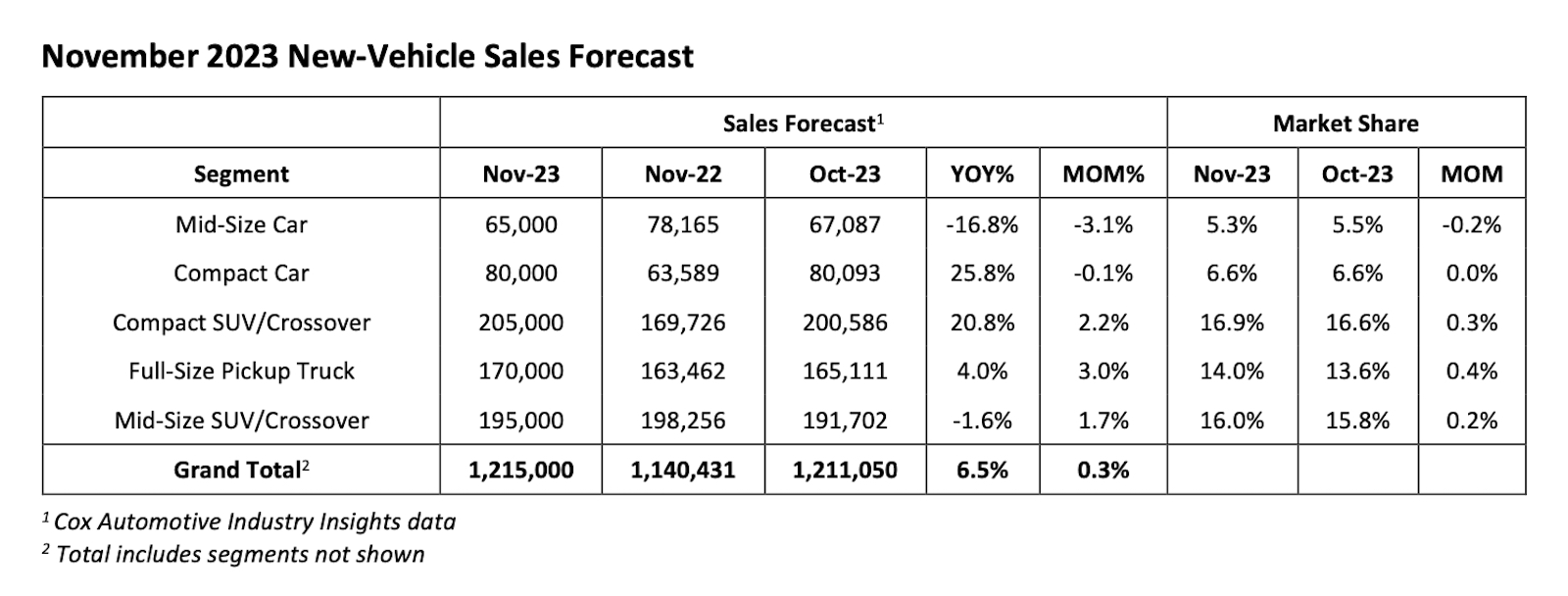

Analysts at Cox Automotive predict new vehicle sales will rise 6.5% in November. That increase is less about people buying a lot of vehicles this month and more about poor results from last November.

Last November, the industry was still dealing with inventory issues leaving dealer lots without the inventory they normally feature. That’s not a problem this year and new vehicle sales will come in at a seasonally adjusted annual rate of about 15.3 million, which is 1 million higher than last November.

However, it’s a decline from October’s 15.5 million rate, and that number is expected to drop again in December, according to Cox Automotive.

“A slight rise in sales volume is expected in November, but the sales pace will decline for the second straight month,” said Charlie Chesbrough, senior economist at Cox Automotive, in a statement.

“October is normally one of the slowest sales months of the year, and the buying pace generally increases in November and December. This year, however, despite more discounting and more promotion, we are expecting the sales pace to slow slightly in a weak buying climate.”

Optimism reigns

While the analysts at Cox are looking forward to a strong November, their counterparts at J.D. Power are simply buzzing comparatively. The company is predicting a jump of 10.2% for November, and that number rises to 13% if you only use retail sales.

The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.5 million units, up 1.4 million units from November 2022, Power analysts predict.

“Sales growth is being enabled by improving vehicle availability,” said Thomas King, president of the data and analytics division at J.D. Power.

“Despite the nearly six-week UAW work stoppage, retail inventory levels in November are expected to finish around 1.6 million units, a 7.5% increase from last month and 43.7% increase compared with November 2022, but still over 40% below pre-pandemic levels.

More buyers paying less

It’s good to have folks flooding showrooms filled with inventory, but there is a down side: more supply addresses demand and results in lower costs — or in this case, lower average transaction prices, King noted.

He’s also quick to note, the dealers are going to make it up on volume.

“As inventory and sales volumes improve, the average new-vehicle retail transaction price is declining to $45,332, down $873 — or 1.9% — from November 2022. However, even with the decline in average transaction prices, consumers are on track to spend nearly $44.5 billion on new vehicles this month — the highest on record for the month of November and 9.5% higher than November 2022.”

And dealers have plenty of vehicles to handle the increase, Cox Auto noted as inventory level was 2.4 million vehicles at the start of the month — nearly three times the 900,000 vehicles they had on their lots at this time last year.

Meanwhile, days’ supply had climbed to 67, up from 60 at the start of October and higher by 41% compared to November 2022.

0 Comments