Consumers actually paid more for a new vehicle in November than October but compared to last November prices fell 1.5%. It was the third straight month prices dropped when compared to year-ago numbers.

It appears that new and used vehicles are becoming more affordable as new vehicle incentives rose in November.

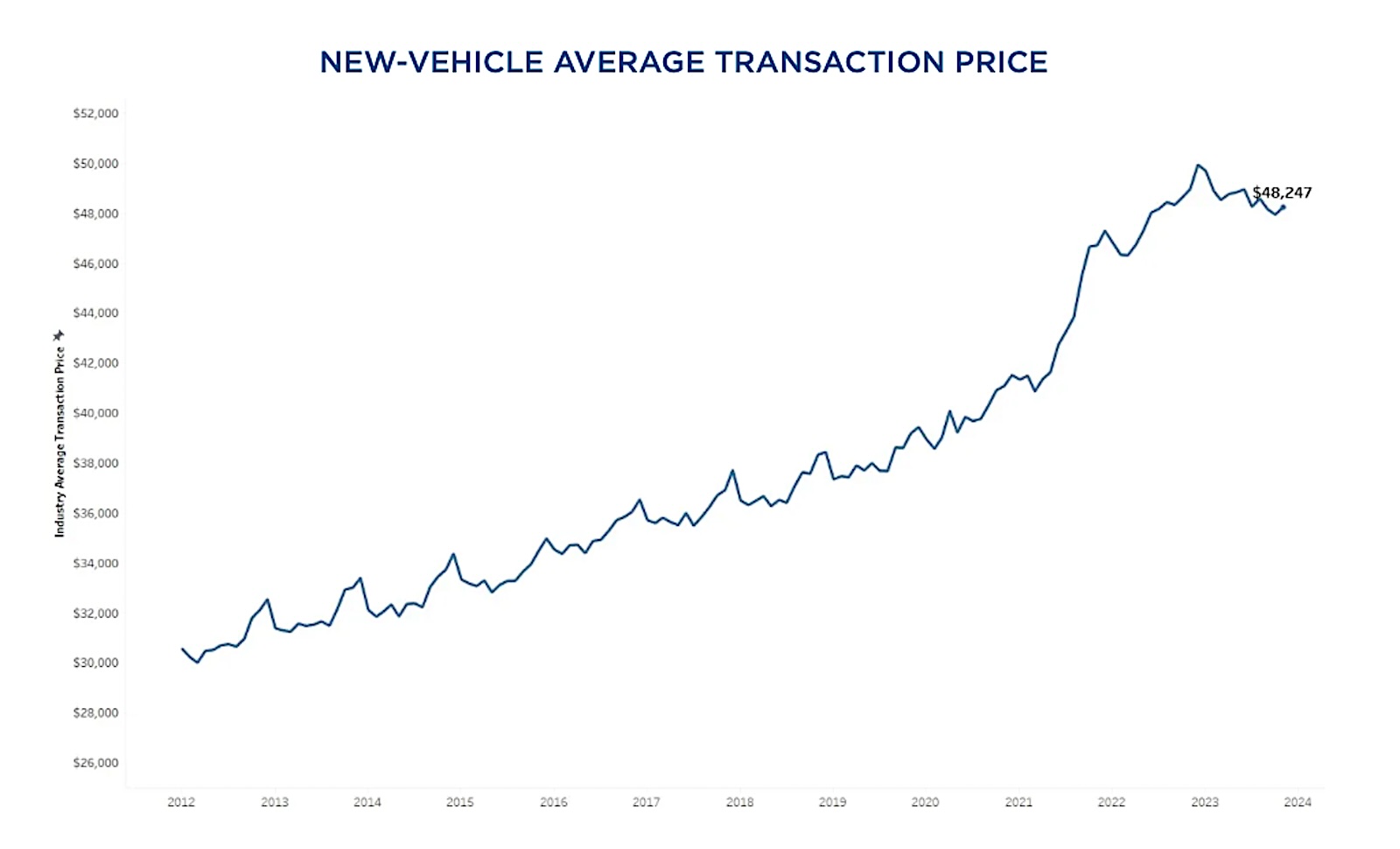

The average transaction price, or ATP, for a new vehicle in November was $48,247, according to Cox Automotive Inc. The average price paid for new cars, trucks and utility vehicles began rising dramatically in 2021 as demand rose coming out of the pandemic, topping the $50,000 mark in 2022 before beginning to steadily decline.

November marks the third consecutive month that new-vehicle transaction prices were lower year over year, a unique milestone for the industry, Cox analysts noted. In fact, the past three months mark the only time in the past decade that the monthly new-vehicle ATPs did not increase year over year.

The month-over-month price jump came despite a rise in incentives from automakers, accounting for more than 5% of the ATP for the first time since September 2021. Incentives have skyrocketed 136% since last November. Cox says that is a clear indication that it’s becoming a buyer’s market for new vehicles.

“While consumers may feel some relief in vehicle prices and incentives as we close out 2023, automakers and dealers are feeling the results of the downward price pressure,” said Rebecca Rydzewski, research manager at Cox Automotive.

Inventory on the rise

One of the drivers of incentives is inventory — too much inventory. After struggling for the past few years to keep new vehicles — and used sometimes — on their lots, dealers are finally seeing inventory levels returning to normal.

Available inventory on dealer lots reached 2.48 million units, up more than nearly 20% from August’s figure of 1.96 million, according to Cloud Theory, which collects and analyzes industry data. The impact is immediate as vehicle movement (primarily vehicles sold) is projected to rise only slightly from November (1.01 million) to December (1.03 million).

Inventory levels have risen steadily throughout the year as automakers have finally overcome the headwinds they’ve been battling much of the last three years, including microchip shortages, materials shortages and rising costs related to the material issues.

“For the better part of almost three years, the automotive industry has struggled to produce enough supply to keep pace with what has proven to be very resilient demand,” said Rick Wainschel, vice president of Data Science & Analytics at Cloud Theory.

“But the balance has definitely shifted in these past few months as OEMs have finally resolved their supply chain issues. With demand treading water and turn rates slipping, manufacturers will inevitably have to work harder to attract customers and move toward more aggressive incentives to fight for sales going forward.”

Cheaper vehicles result

With inventories on the rise, and automakers looking to discount them to keep sales moving, dealers are going to be busy.

Of the 35 brands that Kelley Blue Book included in its November analysis, 16 had year-over-year price declines in November, with the largest declines recorded for Tesla (-20.5%), Buick (-6.4%), Land Rover (-6.0%) and Nissan (-5.7%). The largest year-over-year transaction-price increases came from Dodge (11.2%), Ram (10.5%), Audi (7.8%) and GMC (7.8%).

“The latest dealer sentiment survey by Cox Automotive clearly indicates that dealers are seeing profits contract as inventory levels return to normal, and incentives are turned up to help stimulate sales,” said Cox’s Rydzewski.

0 Comments