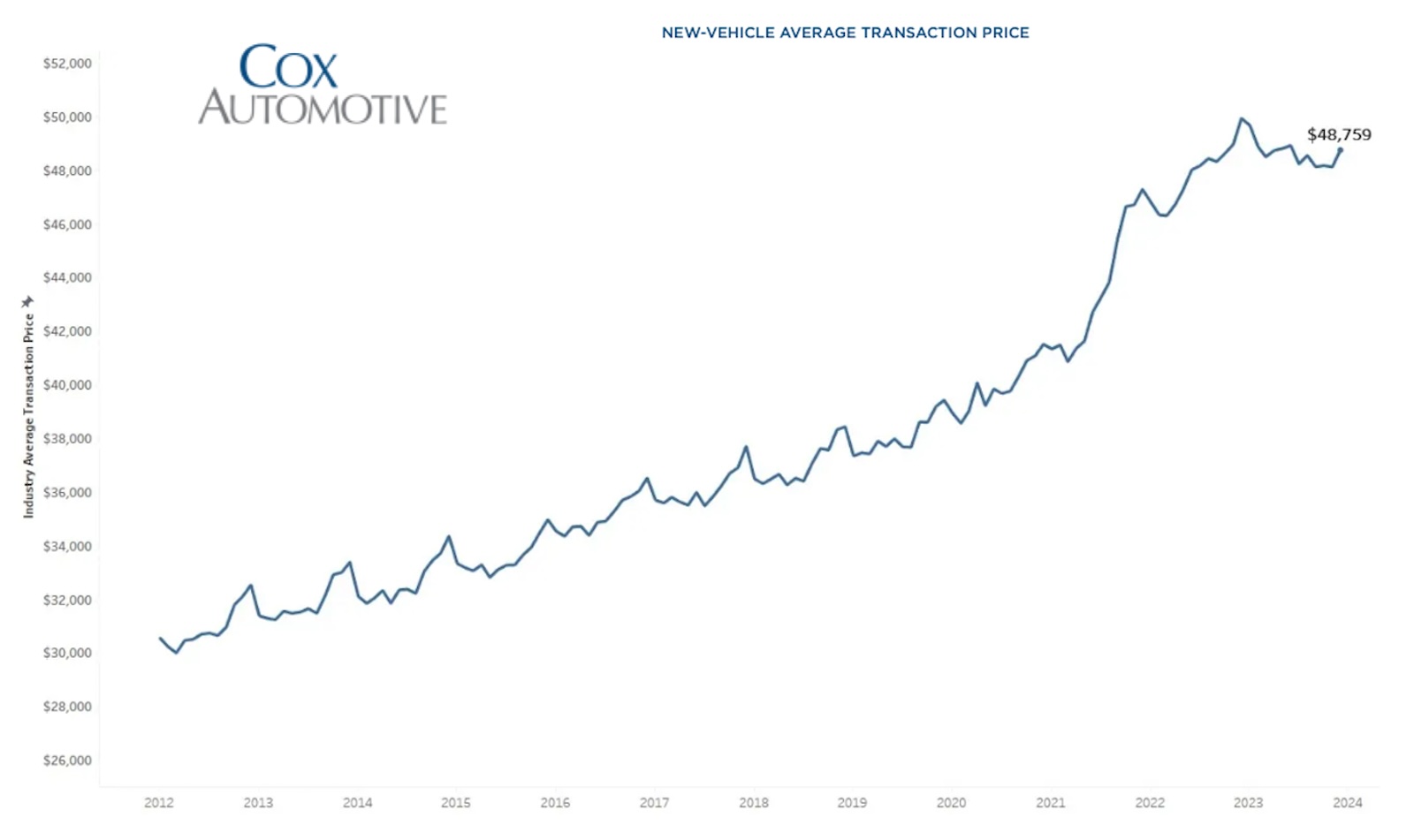

Everything seemingly costs more these days; however, consumers looking to buy a new vehicle saw the final amount they paid for a new car, truck or utility vehicle fall by 2.4% for the year.

The year-over-year drop in prices came despite an uptick of 1.3% in the year’s final month and higher interest rates. Part of the reason for the decline was increased incentives from automakers as inventory levels returned to normal levels.

The decline is unusual since prices usually rise from year to the next, according to Kelley Blue Book, which is owned by Cox Automotive Inc.

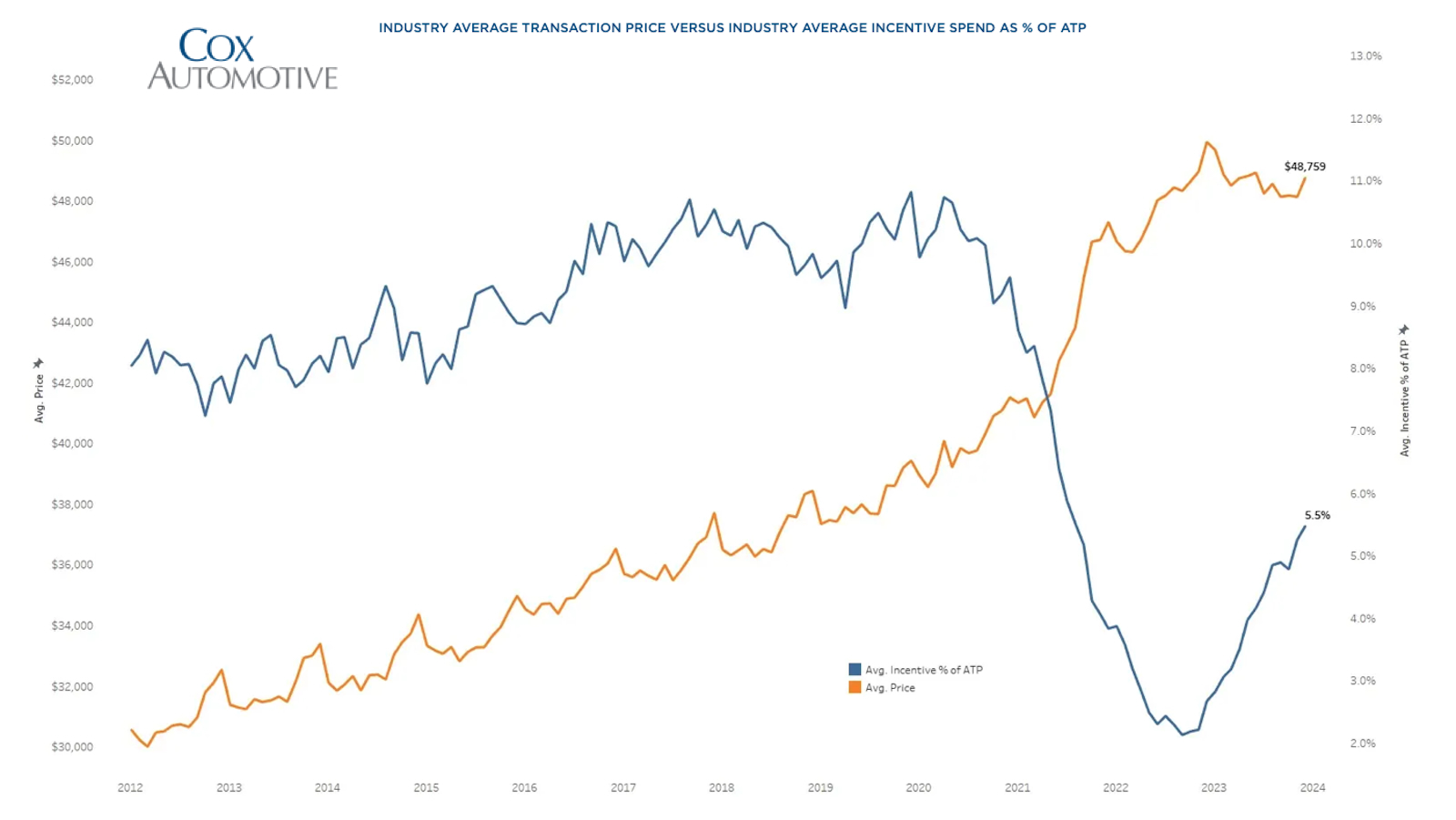

“When we look at price strength, the pandemic created a seller’s market in which new vehicles were transacting above manufacturers’ suggested retail price in 2022,” said Michelle Krebs, executive analyst for Cox Automotive.

“That market is all but gone now, as higher inventory has led to higher incentives and discounts — lower margins for dealers — and vehicles are now typically selling for under MSRP. The shift from a seller’s market to a buyer’s market is well underway.”

Money, money, money

The average transaction price, or ATP, for a new vehicle in December 2023 was $48,759, an increase from November 2023 but down 2.4% from an all-time high reached in December 2022, Cox reported. The market featured several unique scenarios that added up to lower prices paid for new vehicles.

As previously mentioned, incentives and discounts continue to increase as inventory climbs, reaching 5.5% of ATP in December. However, that’s more than double the 2.7% one year ago.

In December, incentives for luxury cars and electric vehicles were higher than 8%, well above the industry average. Conversely, full-size SUVs, minivans and small/mid-size pickups had some of the smallest incentives last month, all well below 3%.

The biggest declines in December were experienced by Tesla (25.1%), Land Rover (10.2%) and Volvo (6.7%). However, some brands enjoyed gains, such as Ram at 11.5%, Hyundai at 8.4% and Porsche coming in at 6.1%.

More sales stories

- Ford, Stellantis Sales Feel Impact of UAW Strikes

- Automakers Setting Records with November Sales Numbers

- Key Carmakers Post Strong Q4, Full-Year Sales Despite Challenges

EVs charging down

The average price paid for a new electric vehicle in December 2023 was $50,798, down from a revised $52,362 in November and supported by incentive levels well above the industry average. In December, EV incentives reached their highest point of 2023 at 10.6% of ATP. A year ago, EV incentives were less than 2% of ATP.

Thanks mostly to significant price cuts from Tesla, average EV prices in December were down 17.7% from January 2023. According to estimates by Kelley Blue Book, EV sales in the U.S. reached a record 1.2 million units in 2023, up 46.3% from 2022.

“2023 was a milestone year with 1,189,051 pure battery electric vehicles sold, accounting for 7.6% of all new-vehicle sales,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive.

“Last year’s main story was Tesla price cuts that shook up the market and challenged the profitability picture for all automakers. Tesla is by far the dominant force in electric vehicles – when they cut prices, everyone takes notice.”

0 Comments