Detroit-based automaker General Motors beat its internal guidance numbers for the 2023 earnings while raising the bar for 2024. The higher earnings forecast comes despite sizeable rise in costs expected due to the new UAW labor contract.

General Motors Chair and CEO Mary Barra told investors the company was going to “return significant capital” to shareholders.

The automaker beat its internal earnings goals despite lower-than-expected pre-tax profits during the fourth quarter. Regardless, the results gave the company’s senior executives enough confidence to predict better numbers for 2024.

GM reported fourth-quarter 2023 revenue of $43 billion, with net income of $2.1 billion. The earnings were down slightly but the net income was up 5.2%. The company also reported EBIT-adjusted earnings of $1.76 billion, or a margin of 4.1%, which was down significantly from the 8.8% reported for the year-ago quarter.

Full-year numbers

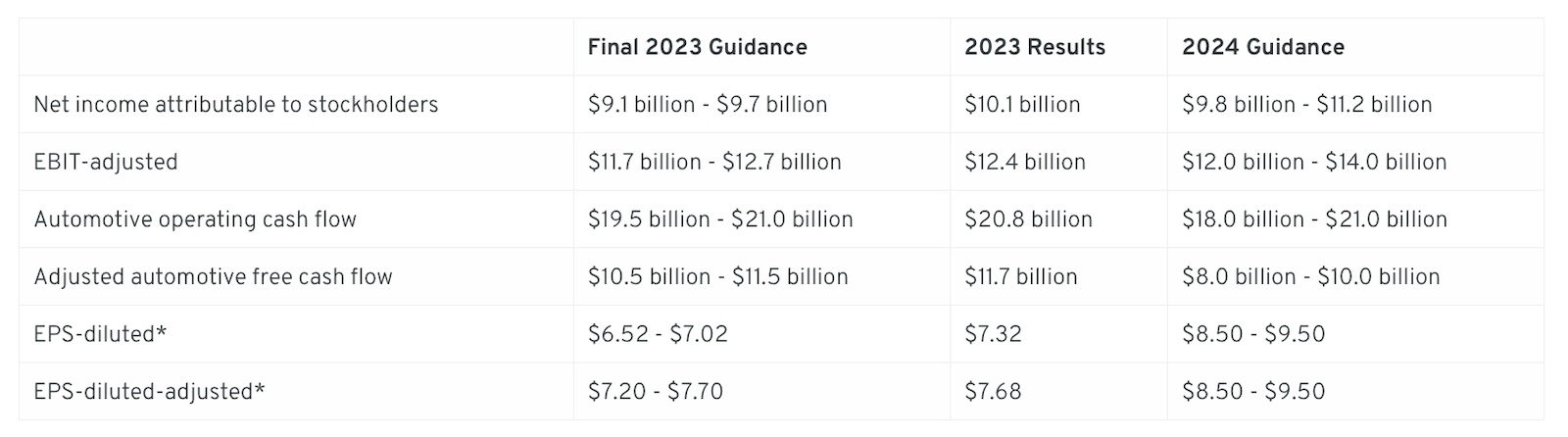

Overall, the company’s full-year 2023 revenue came in at $171.8 billion with net income of $10.1 billion and EBIT-adjusted earnings of $12.4 billion. Again, revenue and net income were up year-over-year, but on an adjusted basis, the company’s margins were down.

The company did offer a dividend, and that became the focus of CEO Mary Barra’s message to shareholders early Tuesday morning.

“Today, GM reported full-year net income attributable to stockholders of $10.1 billion and EBIT-adjusted of $12.4 billion with very strong free cash flow,” Barra wrote to shareholders, “which is allowing us to return significant capital to shareholders after reinvesting in the business. In fact, almost two-thirds of the $22 billion in adjusted automotive free cash flow that we generated in 2022 and 2023 is being returned to shareholders.”

More GM news

- GM, Honda Begin Joint Production of Hydrogen Fuel Cells

- GM Will Cover Federal Tax Credits Lost by Some of its EVs This Year

- First Look: 2025 Cadillac CT5-V and CT5-V Blackwing Balance Performance and Luxury

Optimistic about 2024

The company not only offered shareholders a bunch of money back, but also expected the overall economy to perform well.

“Consensus is growing that the U.S. economy, the job market and auto sales will continue to be resilient,” GM Chief Executive Mary Barra told investors in a letter.

The automaker forecast adjusted pre-tax profits in a range of $12 billion to $14 billion this year, compared to $12.4 billion reported for 2023. GM will hold capital spending roughly flat with the $10.7 billion spent last year.

The 2024 forecast translates to a range between $8.50 and $9.50 a share compared to $7.68 in 2023. The reduction in shares due to buybacks adds $1.45 a share to the 2024 forecast, GM said. That will be offset by 50 cents a share in higher taxes and interest payments.

The news excited shareholders as GM’s stock was up nearly 8% in late afternoon trading Tuesday.

0 Comments