EV maker Rivian reported first quarter earnings that were slightly better than its year-ago results but ended up falling short of analysts’ expectations. The company generated more revenue, but increased costs chewed up profits.

Rivian cut its losses on each vehicle during the first quarter, but it still fell short of analysts’ expectations.

Rivian reported an adjusted loss of $1.24 per share, which was a slight improvement over last year’s loss of $1.25 per share. However, analysts predicted the company would come in at a loss of $1.15 per share. Revenue of $1.20 billion was in line with expectations of $1.18 billion, but an 80% increase compared with the year before.

The company cut prices during the quarter — mirroring the moves of other EV sellers — cutting into profit margins. The company’s average selling price was $88,607 during the first quarter, which was down from $94,123 in the preceding period.

“First-quarter results exceeded our outlook and set a strong foundation for the remainder of the year as we focus on continued demand generation, delivering cost and plant efficiency improvements, advancing R2 development, and driving towards profitability,” CEO RJ Scaringe said Tuesday in the earnings release.

Rivian produced 13,980 vehicles and delivered 13,588 vehicles during the first quarter of 2024 — a 71% increase in deliveries and a 48% jump in production compared to the same timeframe last year. The company lost more than $38,000 on each vehicle it delivered during the quarter, but that’s a significant improvement as it lost about $67,000 on each one during Q1 2023.

Denial-ish

While the company’s cash bleed appears to be slowing, there are some who believe a well-funded partner would benefit Rivian immensely. Not surprisingly, there is speculation about what company that could be — Apple.

There have been reports that Apple is talking with Rivian about a deal, just weeks after the tech giant gave up on Project Titan, it’s not-so-secret project to build an electric vehicle. Scaringe declined to comment on the specifics of any talks with Apple.

However, he did note the company does have “a history of partnership,” pointing to its deal with Amazon.

“As we think about what we’ve built as a company, one of the core elements that makes this unique is just the level of vertical integration around our software and associated electronics platforms,” Scaringe said during the company’s earnings call.

More Rivian Stories

- Rivian Gets $827M to Expand Illinois Plant to Build New Vehicle

- Rivian Surprises with Three New Electric Vehicles: R2, R3, R3X

- Rivian Slashes 10% of Salaried Staff, Trims Production as EV Sales Growth Slows

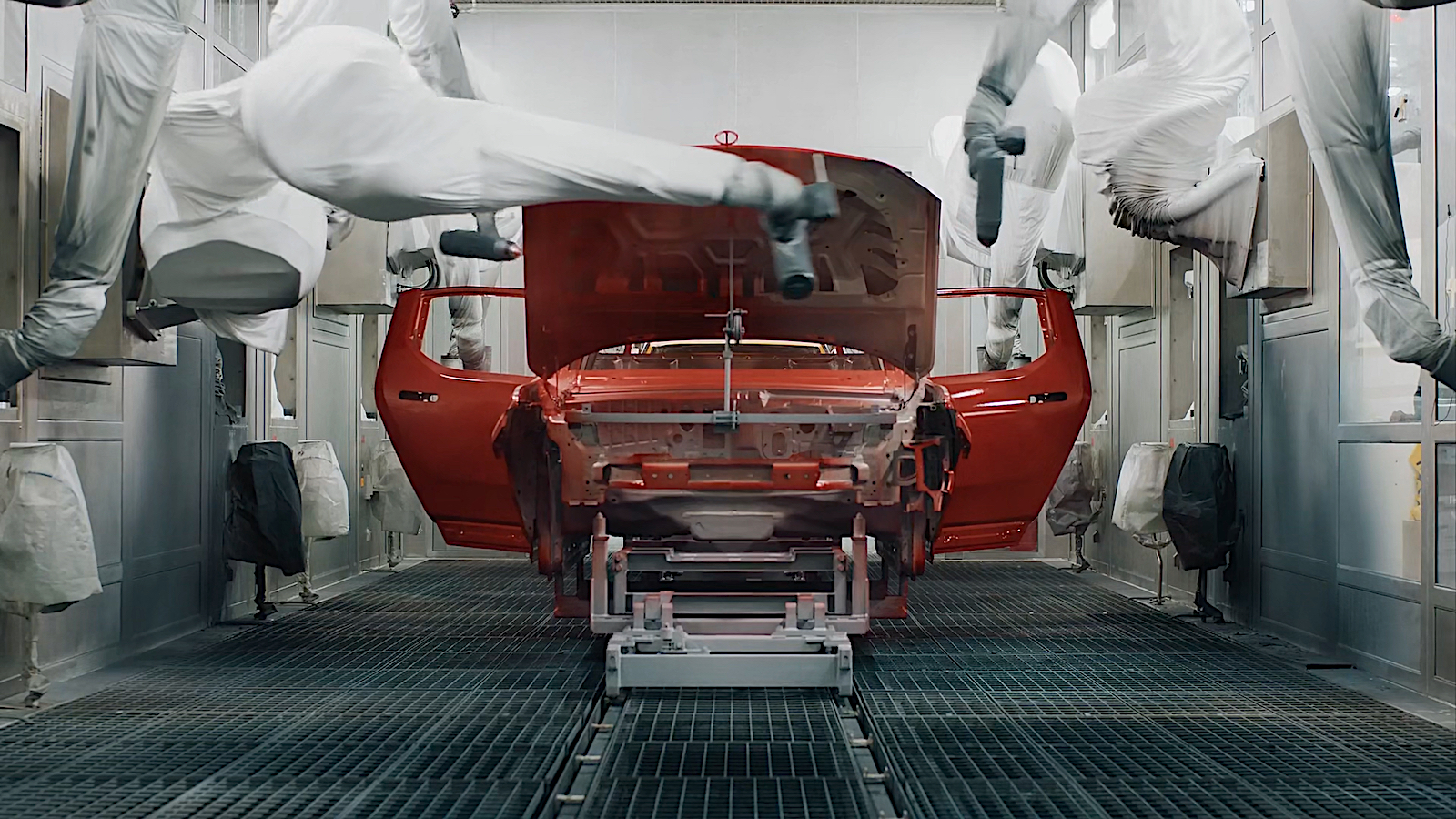

Tooling up

The company shut down for three weeks recently to retool its factory in Normal, Illinois. The move was designed to make long-term improvements that result in more efficient production. The R1 production line now enjoys 30% faster run rate. The company says it will produce about 57,000 vehicles in 2024. Nine analysts polled by Visible Alpha predicted more than 62,000.

Although Rivian spent money to upgrade its production lines, it plans to cut $550 million from its capital expenditure budget, dropping it to $1.2 billion overall. Rivian posted cash and cash equivalents of $5.98 billion, compared with $7.86 billion in the fourth quarter.

The company recently secured $827 million in incentives from the State of Illinois to help with expansion of the Normal plant to build the R2 midsize SUV. Initially, it was slated to be produced at its new $5 billion plant in Georgia — which is now on hold — but will now be built at the Normal plant.

The move to accelerate production of the new model while temporarily halting the plant just north of Atlanta will save the company more than $2 billion, officials previously stated.

0 Comments