A decline in interest rates wasn’t enough to improve the affordability of new vehicles in April. The average new vehicle payment rose slightly, and it’s taking a little bit more of your annual income to afford a new car, truck or SUV.

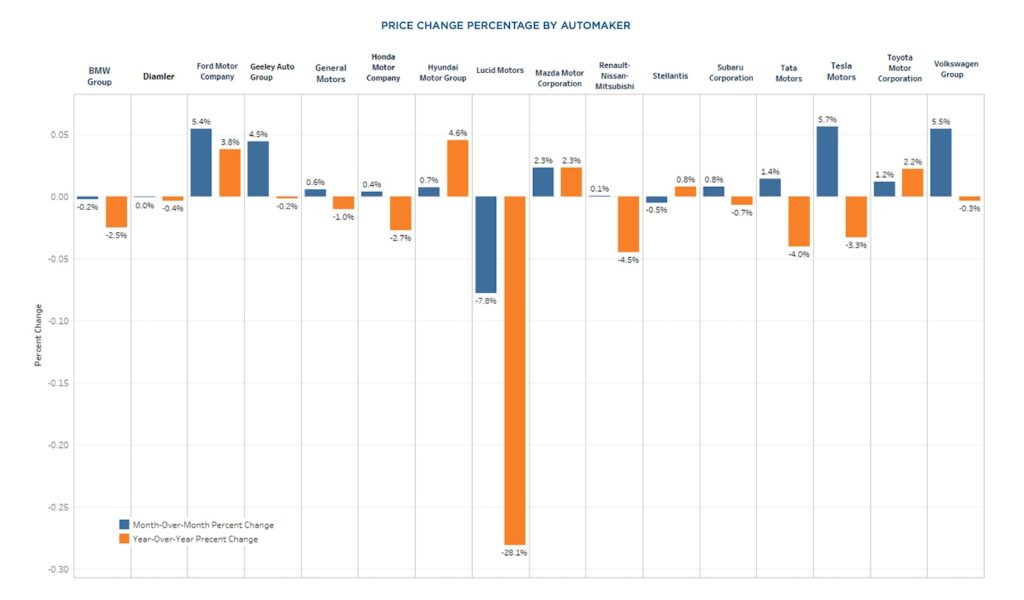

The two culprits buyers can lay the blame on? Higher prices and lower incentives, according to Cox Automotive.

“The decline in affordability resulted from negative trends in pricing and incentives, as manufacturers and dealers were less aggressive on promotions and discounting than they were for the quarter end,” said Cox Automotive Chief Economist Jonathan Smoke.

Automotive loan rates dropped to their lowest level in nine months to an average of 10.22%. However, that downward shift wasn’t enough to offset the 2.2% increase in average transaction prices (ATPs) — the final amount a buyer pays after incentives and other costs are factored in.

On the rise

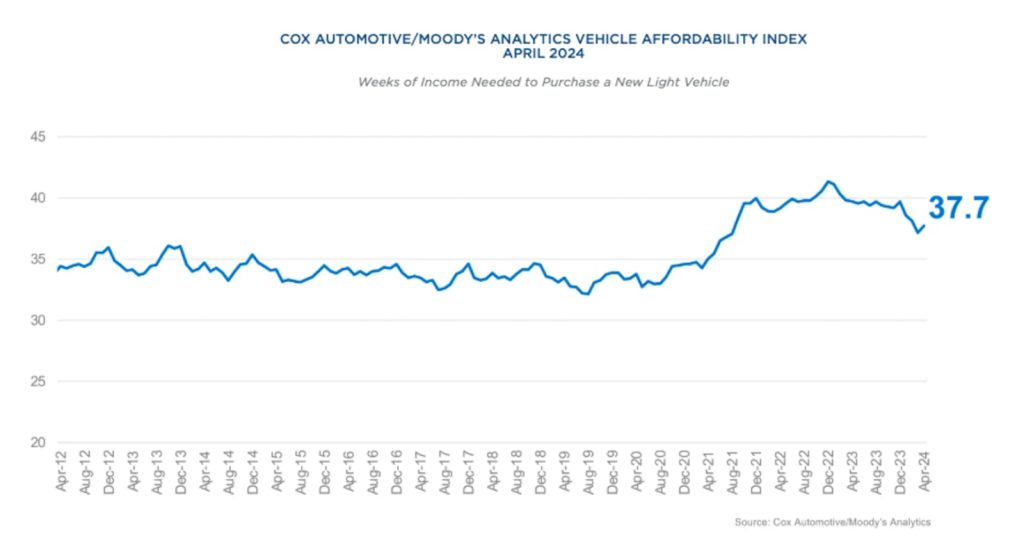

It’s no surprise that the average new vehicle payment rose by 1.8% in April to $762. While high, it’s still off the record set in December 2022 when the average hit $795. The number of median weeks of income needed to purchase the average new vehicle rose to 37.7 weeks from 37.1 weeks.

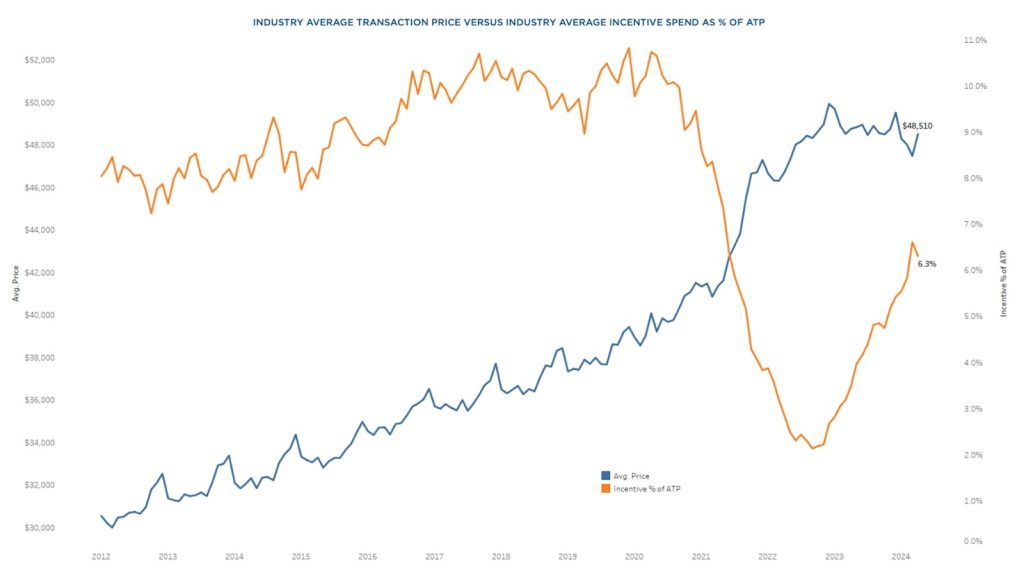

Those higher numbers are a result of a 2.2% increase in the ATP, which moved up to $48,510 — the highest number in five months. However, the number is down slightly, 0.5%, on a year-over-year basis, Cox noted.

New-vehicle incentive levels retreated last month as well. The average incentive package in April was 6.3% of the average transaction price, according to Kelley Blue Book estimates, down from 6.6% in the prior month. The incentive decline in April was the first decrease since October 2023, when incentive levels ticked lower to 4.7% from 4.8% in September.

Helping push the numbers up was the fact that luxury vehicle sales — and their big price tags — remained strong last month. They comprised 18.4% of the market, equal to March and slightly higher than last April. Luxury transaction prices increased 2.4% from the prior month and incentives were notably lower, at 6.0% of ATP, down from 7.4% of ATP in March.

More Car Sales Stories

- Japanese Automakers Post Strong April Sales Numbers, Korean Automakers See Sales Dip

- March Auto Sales Look Strong – But Affordability Remains an Issue

- Healthy January Sales Get Car Business Off to Good Start in 2024

Finding relief

Some consumers look to the used vehicle market for some relief from high prices and they found it in the previously owned segment where prices dropped 7% from March to April.

A total of 1.45 million used vehicles were sold at retail — from both franchised and independent dealers — during April, up 4.8% year over year. Days’ supply at the start of April was down from a revised 46 days at the beginning of March.

“As tax refund season winds down, it’s normal to see consumer demand for used vehicles back off in April, and that’s what we experienced this year as well,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive.

“With interest rates remaining elevated, consumers need a bit more of a push to buy at this time of year. While prices were lower against 2023, it was enough to attract more buyers from the sidelines at this point. Used retail sales were higher against last year’s levels, but tight inventory and affordability issues continue to be a challenge for the industry.”

0 Comments