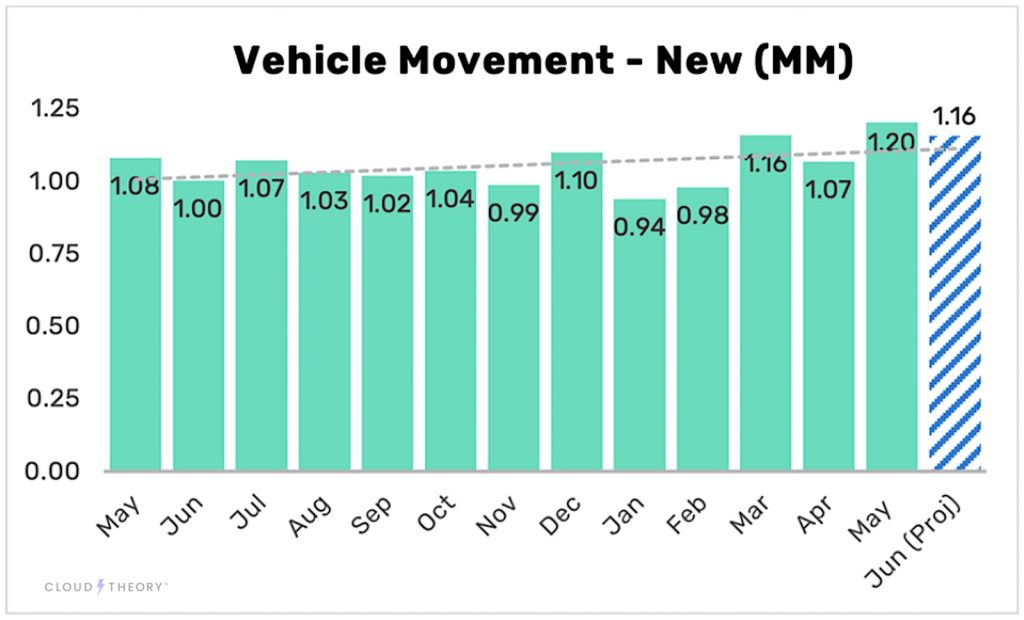

Automakers continue growing a previously tight inventory of new vehicles. Having these vehicles on dealer lots gives consumers more choices — choices that turn into purchases eventually. New vehicle movement hit 1.2 million vehicles in May, which is a good sign. However, which automaker is building inventory, and which is selling vehicles is the key differentiator.

The 1.2 million tally is the highest the industry has seen since May 2021, as automakers were struggling to escape the grip the pandemic had on its supply chain and dealers were just figuring out how to sell vehicles in a new COVID-19-dominated world.

This growth is largely being driven by continued momentum in new vehicle inventory, which grew 2.8% MoM in May and now sits at 2.89 million. In essence, this new vehicle movement is giving buyers some options they haven’t enjoyed in a long time, according to Cloud Theory’s “On The Horizon” report for June.

“New vehicle movement” is a representation of sales, and measures how many VINs “moved” from dealer websites over a given period of time. But that could mean the vehicle has been sold, transferred to another dealership, or simply was pulled from a dealer’s website because it hadn’t moved.

Moving metal

Dealers make money when they sell the vehicles. However, the strong “new vehicle movement” last month had more to do with building inventory than the bottom line for dealers across the U.S.

Dealers make money when they sell the vehicles. However, the strong “new vehicle movement” last month had more to do with building inventory than the bottom line for dealers across the U.S.

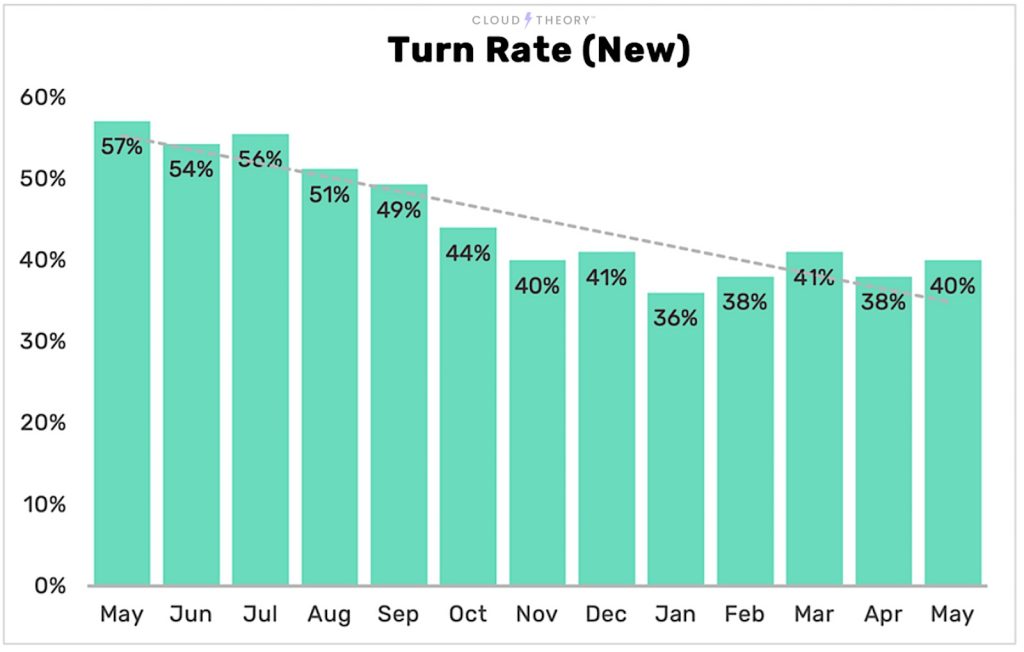

Turn rates remained in their recent narrow range at 40%, and that metric has been in the high 30s to low 40s since November 2023. New vehicle marketed prices, which had been declining since July 2023, ticked up for the second straight month — to more than $51,000 — and rose above the long-term trendline.

“The flat turn rate trend indicates that gains in movement are the result of increased supply rather than from higher sales efficiency,” said Rick Wainschel, vice president of Data Science & Analytics at Cloud Theory. “More supply means more competition for OEMs, and the recent ramp-up in incentives levels will need to continue in order to maintain the recent industry momentum.”

More Toyota News

- Toyota Highlander Set to Go All-Electric as Toyota Ramps Up EV Plans

- First Drive: Hybrid Power Takes the 2025 Toyota Camry to a New Level

- First Look: 2025 4Runner: More Power, More Features, More Options

Selling metal

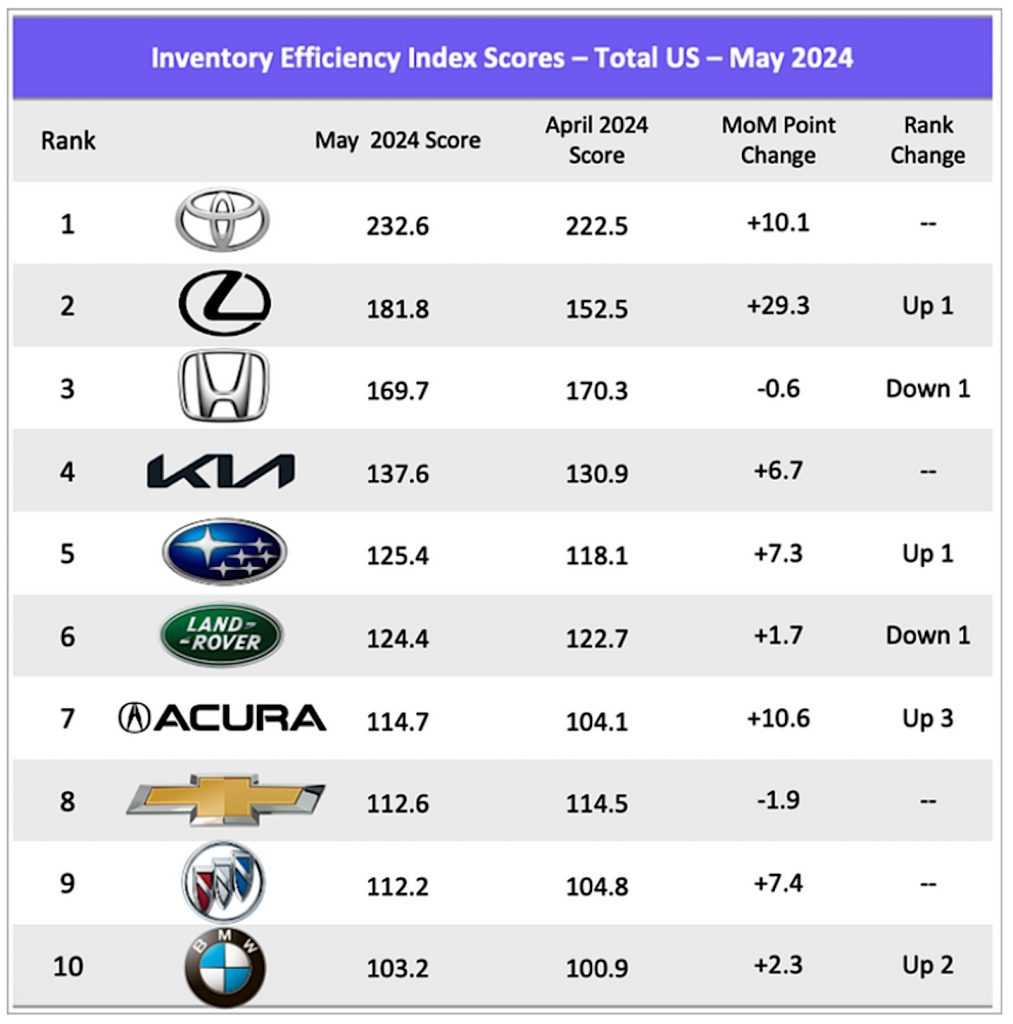

The most important statistic to review from the report is the Inventory Efficiency Index, which shows which companies are building inventory and which ones are selling vehicles. Not surprisingly, Toyota is leading the charge.

Toyota Motor Corp. asserted its dominance in terms of Inventory Efficiency Index, with Toyota and Lexus in the top two spots nationally and in 7 of the 9 regions. However, the way those two brands demonstrated that strength differed in May.

Toyota Motor Corp. asserted its dominance in terms of Inventory Efficiency Index, with Toyota and Lexus in the top two spots nationally and in 7 of the 9 regions. However, the way those two brands demonstrated that strength differed in May.

Toyota’s vehicle movement increased slightly (+1% MoM) even though its average inventory position degraded by 8%. Lexus, on the other hand, saw its movement jump by 34%, which far surpassed its supply growth (+5%), resulting in an increase in its score.

“Toyota Motor Corp.’s May performance demonstrates that there is more than one path to sales efficiency,” said Ron Boe, Chief Revenue Officer at Cloud Theory, “but the strength shown by both Toyota and Lexus speaks to the power of their two brands in the marketplace.”

Most efficient

Most efficient

Toyota and Lexus consistently posted the highest score on the index, 232.6, and Lexus was next at 181.8. Honda (169.7), Kia (137.6) and Subaru (125.4) round out the top five.

Cloud Theory’s Inventory Efficiency Index determines scores for vehicle makes or models based on relative inventory and movement data compared to competitors.

- A score of 100 means that an OEM’s demand is in balance with its relative supply in the marketplace.

- A score above 100 indicates that a make or model is selling its inventory more efficiently than average.

- A score below 100 means that there are opportunities to bring demand into better alignment with supply (or vice versa).

No automaker in the top 10 (Land Rover, Acura, Chevrolet, Buick, or BMW) finished with a score below 100. However, only to American brands finished in the top 10. Chevrolet and Buick are both held by General Motors.

Even broken down by region, No U.S. company cracked the top five, except Buick in the Pacific region, last month. In short, with new UAW contracts in effect, Detroit-area automakers need to be more efficient — and fast.

0 Comments