Larger automakers just can’t seem to stay away from EV startup Rivian. Ford Motor Co. once held a large, multi-billion dollar stake in the company and now Volkswagen plans to invest $5 billion in company.

Many felt like the Rivian R3 and R3X borrowed heavily from the VW Golf of years past. Now they’re working together in a $5 billion deal.

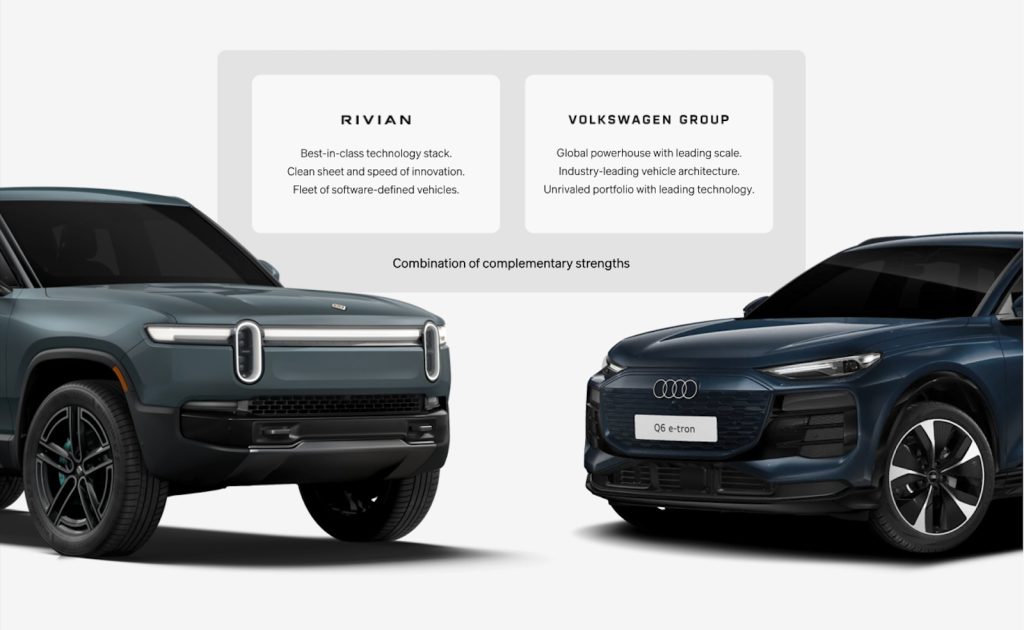

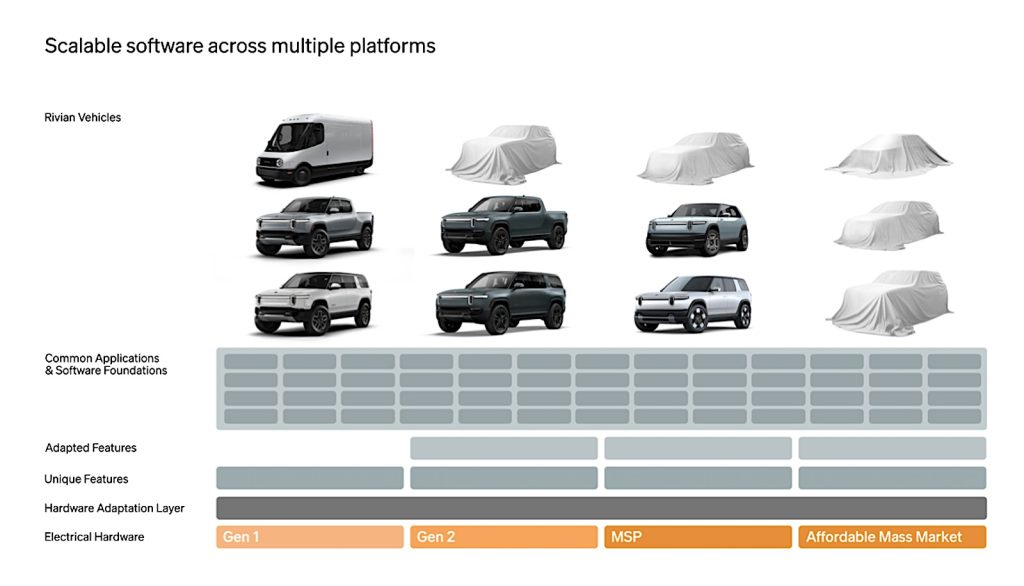

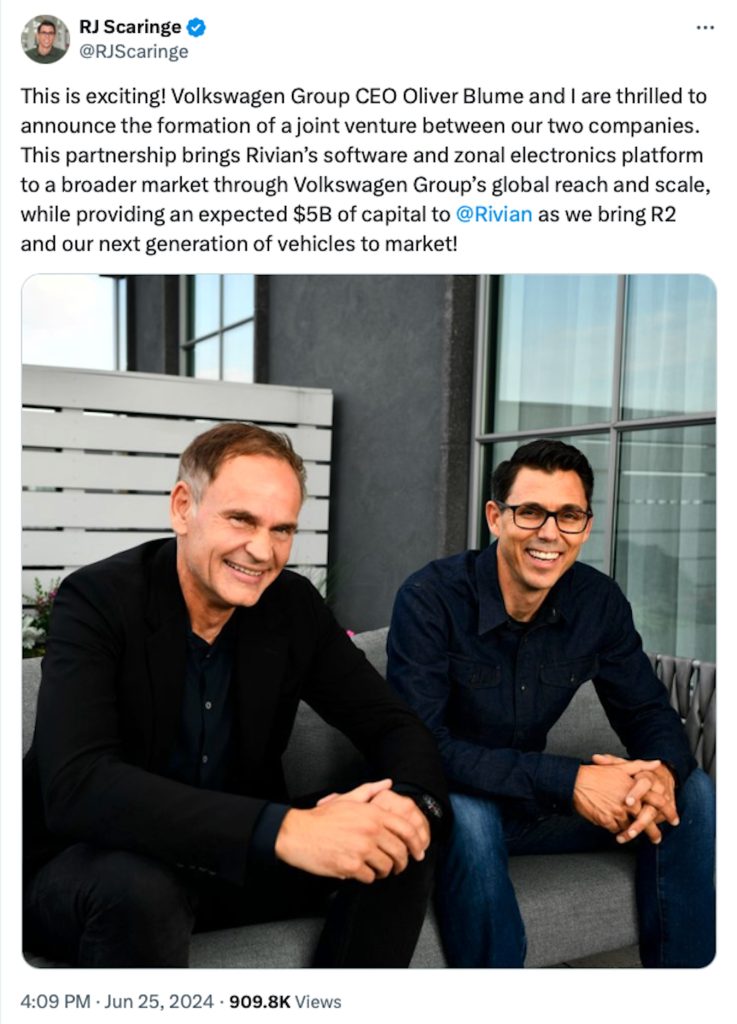

The investment is designed to form a new joint venture between the two companies that is “equally controlled” and will create next-generation electrical architecture and best-in-class software technology, Rivian claims in a release.

VW will initially invest $1 billion into the deal with another $4 billion coming in installments through 2026. The $1 billion is an unsecured convertible note that converts into Rivian common stock. That funding will actually aid Rivian with the expansion its product lineup, starting with the R2 revealed in March.

It will also help get the company’s factory in Georgia up and running. It was expected to produce the R2 there, but for the time being, it will be built at Rivian’s existing plant in Normal, Illinois. The remaining $4 billion is split into a $2 billion purchase of Rivian shares — $1 billion in 2025 and $1 billion in 2026 — and $2 billion into the new joint venture.

The investment of $2 billion related to the joint venture is expected to be split between a payment at the inception of the joint venture and a loan available in 2026.

VW gets what?

Volkswagen, which has been pushing electrification in the wake of dieselgate, will also benefit from using Rivian’s “zonal hardware design” and platform for its own future vehicles. No word if that includes its own all-electric startup company, Scout Motors, which is aimed at the American market.

“Not only is this partnership expected to bring our software and associated zonal architecture to an even broader market through Volkswagen Group’s global reach, but this partnership also is expected to help secure our capital needs for substantial growth,” Rivian CEO RJ Scaringe said in a statement.

The joint venture will use the aforementioned zonal hardware design and platform for future vehicles, plus Rivian’s electrical architecture expertise for the vehicles. Rivian will license its existing IP rights to the joint venture.

“The partnership fits seamlessly with our existing software strategy, our products, and partnerships. We are strengthening our technology profile and our competitiveness,” Volkswagen Group CEO Oliver Blume said in a statement.

More Rivian Stories

- Rivian Surprises with Three New Electric Vehicles: R2, R3, R3X

- Rivian Gets $827M to Expand Illinois Plant to Build New Vehicle

- Rivian Poaches Top Apple Exec, Other Talent, Despite Ongoing Problems

Rivian gets what?

Through the new investment, Rivian enjoys what all startups crave: security, cash and, in this case, a bump in its stock price.

The company’s been chewing through its cash as it makes the move from being a one-line vehicle maker to a multi-line auto company. Rivian said it had $5.98 billion at the end of Q1 versus $7.86 billion at the end of Q4. The prospect of $3 billion coming in the next two years to bolster its cash cushion buoys the hopes of investors.

Rivian’s stock jumped nearly 40% in early trading, moving from a close Tuesday of $11.96 to pre-market trading of $16.55 share. The news of a $5 billion investment deal raised the company’s overall value $6 billion due to excited and happy shareholders and investors.

The nascent EV maker recently announced plans to halt construction on its second plant, located in north Georgia, to save $2 billion in cash. Instead, it planned an expansion of its lines at its Illinois plant to handle production of its second product line, the R2. CEO R.J. Scaringe said at the time the delay, not cancellation, of the Georgia site was necessary because the company needed to accelerate the production of the R2 line in order to keep the business growing.

Bottom line

The investment by VW almost acts as a validation of the company and its plans, and certainly of Rivian’s technology.

“The proposed partnership with Volkswagen Group validates our vertically integrated technology approach and demonstrates the capability to create new business opportunities,” the company said in a letter to shareholders.

“As the auto industry transitions to smarter, more connected, and integrated vehicle architectures, we believe our technology is best positioned to deliver a modular and scalable platform that will help create highly compelling products and services that we expect will accelerate consumer’s shift to electrification.”

I hope Rivian is strong enough to take on the onslaught from VW. What’s the saying, “You can tell he’s German, but you can’t tell him much.”