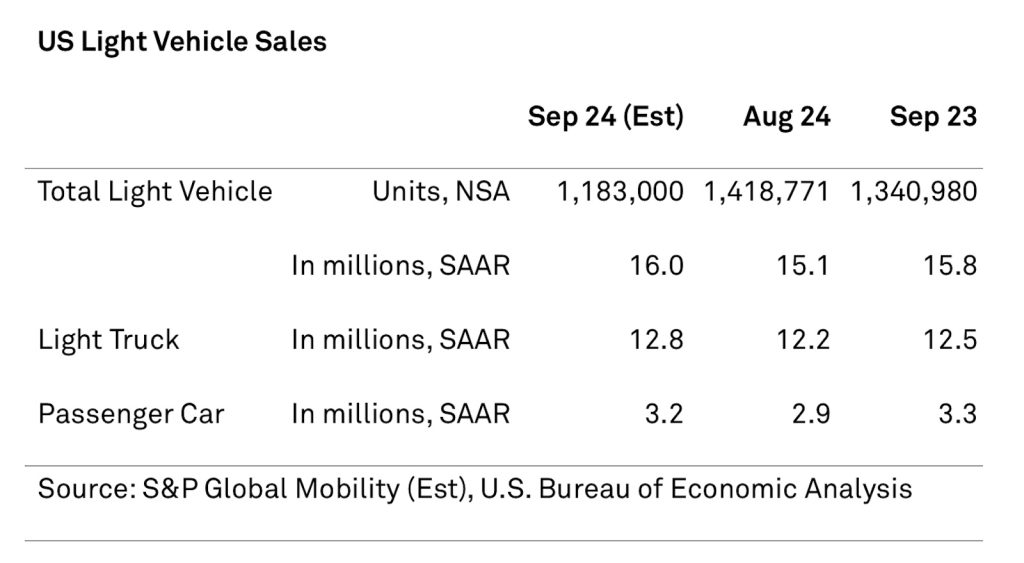

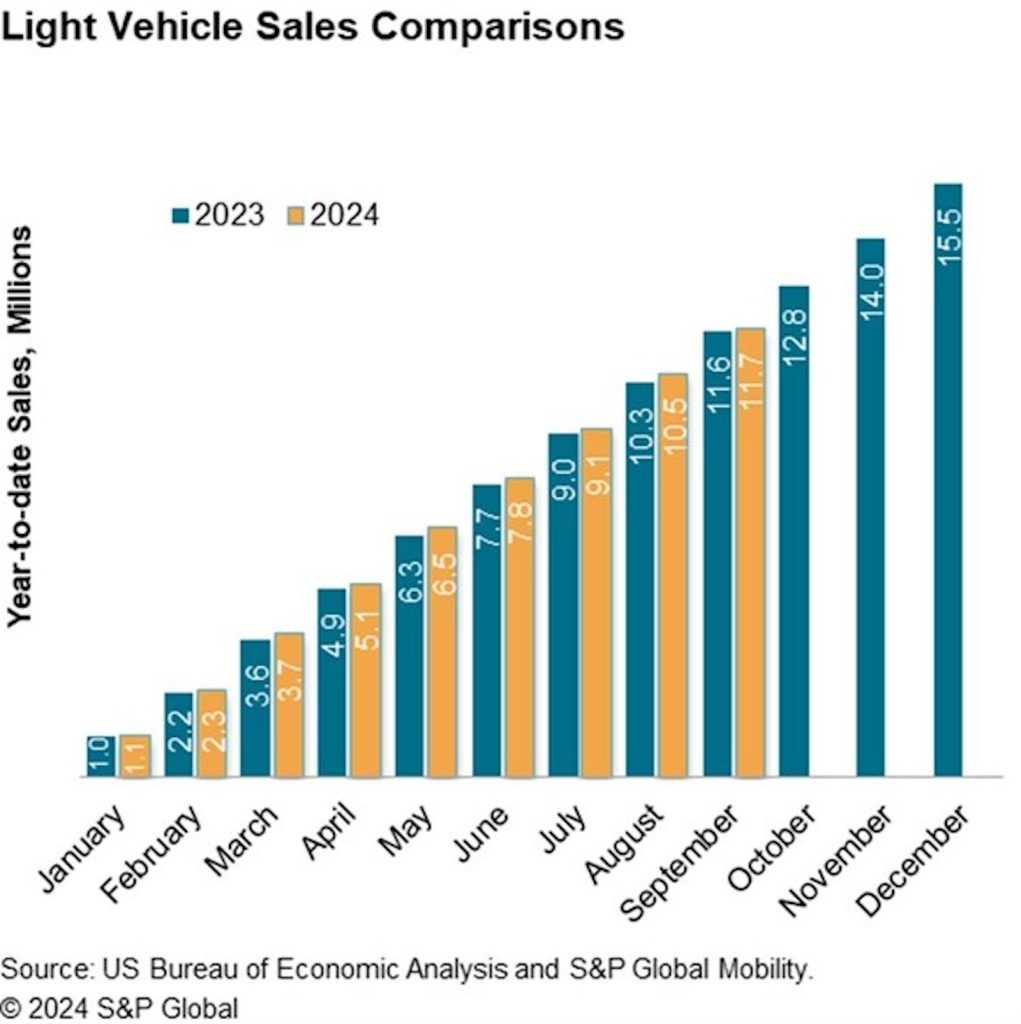

Analysts predict new vehicle sales will drop at least 12% on a year-over-year basis. However, it’s not all bad. If you compare apples to apples, the number is a lot more digestible: less than 2%.

Rising inventory levels gave buyers more options at lower prices last month, but sales still declined.

Depending upon which set of forecasts you listen to, new vehicle sales will drop between 12$ and 13.2% in September. This decline comes despite rising inventory levels, increasing incentives and lower prices.

However, a closer look shows sales are really down about 1.8%, according to analysts from S&P Global and J.D. Power. Each offering different final numbers, but both in agreement that the startling double-digit decline comes only because of a calendar issue: three more sales days.

Last September had 26 sales days while this year that number dropped to just 23 sales days. The result is some weird — contradictory in some cases — numbers when it comes to trying to sort out just how the automakers performed in September.

Not impressive

“New vehicle sales remain stuck in neutral,” said Chris Hopson, principal analyst at S&P Global Mobility. “The overall tenor of the auto demand environment remains one of consistent, but unmotivated volume levels as consumers in the market continue to be pressured by high interest rates and slow-to-recede vehicle prices, which are translating to high monthly payments.”

“New vehicle sales remain stuck in neutral,” said Chris Hopson, principal analyst at S&P Global Mobility. “The overall tenor of the auto demand environment remains one of consistent, but unmotivated volume levels as consumers in the market continue to be pressured by high interest rates and slow-to-recede vehicle prices, which are translating to high monthly payments.”

S&P Global expects dealers to sell 1.18 million vehicles this month compared with 1.34 million last month. Meanwhile J.D. Power & Associates analysts forecast shows 1.16 million new vehicles moving off dealer lots across the country in September.

“September sales volumes will be lower than a year ago because of a calendar quirk that saw the Labor Day holiday weekend fall into the August sales month,” said Thomas King, president of the data and analytics division at J.D. Power.

“This boosted August’s sales but will diminish September’s sales from a year ago. When August and September results are combined, retail sales increase 2.6% year over year.

“This boosted August’s sales but will diminish September’s sales from a year ago. When August and September results are combined, retail sales increase 2.6% year over year.

Trouble brewing

Inventory levels are basically back to normal. S&P put the number at 2.88 million at the end of August. Normal is about 3 million units. However, an increasing number of those vehicles are 2025 models, which means dealers are going feel pressure to move 2024 models — which could mean more discounts or incentives.

Power put retail inventory levels at about 1.8 million vehicles, which is up 6.2% over last month and 30.7% over last year at this time. While it’s good that inventory is up, retail sales are expected to be down this month with fleet sales carrying the day.

“Rising inventories are leading to larger discounts from both manufacturers and retailers,” J.D. Power’s King noted. “However, the inventory situation continues to be inconsistent across brands and models, with some popular vehicles remaining in short supply.”

More Sales Stories

- New Vehicle Sales Expected to Drop for Q3

- Sales of New Vehicles Increase in July Amid High Interest Rates and Computer Problems

- Hackers Hijack June Sales, Automakers Report Mixed Sales Picture

Profits down

Dealers are now going to have move 2024 models while 2025 models are being off-loaded from trucks onto the lots.

The average new-vehicle retail transaction price is down compared with this time last year courtesy of bigger manufacturer incentives, larger retailer discounts and increased availability of lower-priced vehicles.

Transaction prices are trending toward $44,467 — down $1,296 or 2.8% — from September 2023. The combination of lower retail sales and lower transaction prices means that buyers are on track to spend nearly $40.4 billion on new vehicles this month — 16.8% lower than September 2023.

“Total retailer profit per unit — which includes vehicles gross plus finance and insurance income — is expected to be $2,294, down 29% from September 2023,” King noted. “Rising inventory is the primary factor behind the profit decline and fewer vehicles are selling above the manufacturer’s suggested retail price (MSRP). Thus far, only 13.6% of new vehicles have been sold above MSRP, which is down from 26.1% in September 2023.”

Average monthly finance payments this month are on pace to be $734, up $11 from September 2023. The average interest rate for new-vehicle loans is expected to be 6.84%, down 46 basis points from a year ago.

0 Comments