General Motors brought in more money during the third quarter compared to a year ago, but those additional funds didn’t translate to bigger profits. However, the numbers did give the company reason to revise its earnings upward.

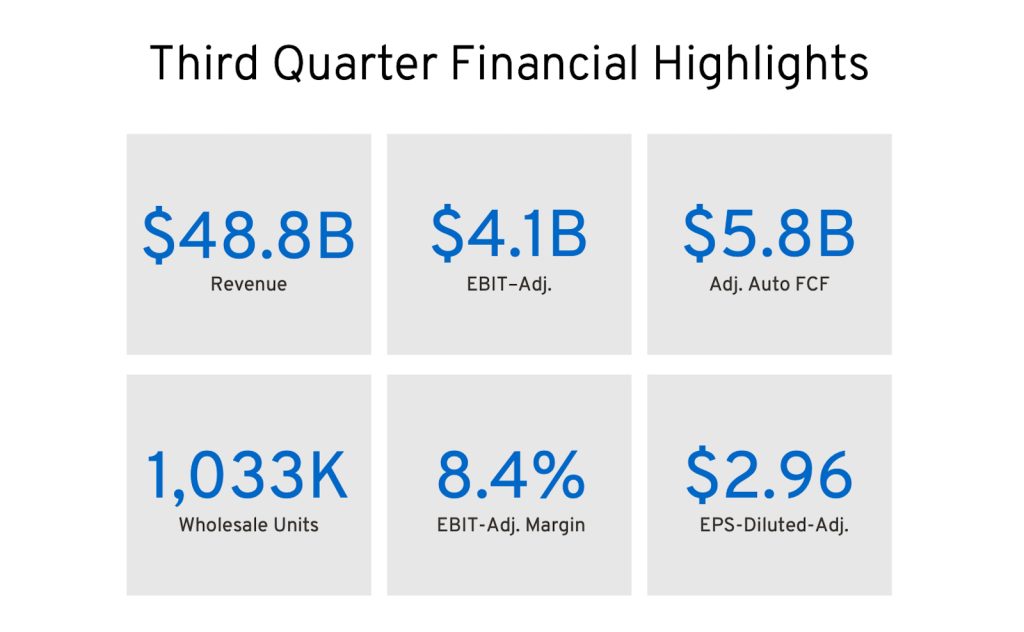

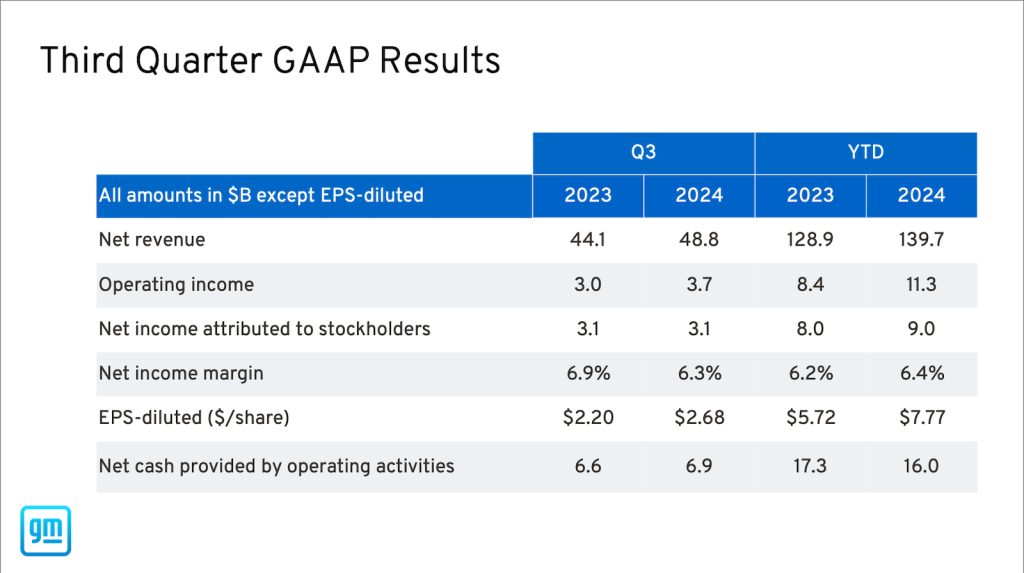

The Detroit-based automotive company reported net income of $3.1 billion for Q3 on revenue of $48.8 billion. The company’s operating income was up on a year-over-year basis moving from $3 billion last year to $3.7 billion in 2024.

The end result is that earnings per share rose more than 40 cents, from $2.20 to $2.68. GM’s EPThe numbers surpassed the expectations of Wall Street, which pegged the company’s adjusted EPS to come in at $2.43 a share.

Big results continue

GM’s enjoyed a strong 2024, resulting in the company again revising its earnings expectations. The company predicted $12 billion to $14 billion in pretax profit at the start of the year. It raised the forecast after the second quarter to $13 billion to $15 billion, buoyed by strong pricing and consumer spending.

GM’s enjoyed a strong 2024, resulting in the company again revising its earnings expectations. The company predicted $12 billion to $14 billion in pretax profit at the start of the year. It raised the forecast after the second quarter to $13 billion to $15 billion, buoyed by strong pricing and consumer spending.

On Tuesday, officials revised it again, saying the company expected to deliver between $14 billion and $15 billion in pretax profit. It also tightened up the EPS-diluted range to $9.14 to $9.64 for the year compared with a range of $8.93 to $9.93.

The company previously announced it expected its 2025 EBIT-adjusted to be at a similar range to our full year 2024 results.

More GM Stories

- GM Laying Off 1,000 Software, Service Staff

- GM Moving HQ — But Not Very Far

- Chevy Finally Launching Retail Sales of Silverado EV

Driving the results

Officials pointed to several things that helped to improve its bottom line, starting with progress on EV profitability, as well as rising sales and expanding market share in the segment. GM jumped to be a leader in the EV market, and despite a move to slow down those efforts, the company’s making good progress.

Additionally, its recently redesigned SUVs are more profitable than the vehicles they’re replacing. GM Chair and CEO Mary Barra also noted improved cost discipline and a focus on capital efficiency and better results in China are making a difference.

In the third quarter, GM grew its U.S. retail market share with above-average pricing, well-managed inventories and below-average incentives, according to the company. In China, sales improved from the second quarter, and dealer inventory fell sharply. In addition, the company remains on track to reach its 2024 EV production and profitability targets.

Push for excellence remains

Barra was quick to note in the letter that GM isn’t letting up on the gas pedal, or accelerator, depending upon what area of the business is being discussed.

“I’m proud that GM is delivering our best vehicles ever with strong financial results. But I want to be clear that we are not mistaking progress for winning,” Barra said in a letter to shareholders.

“Competition is fierce, and the regulatory environment will keep getting tougher. That’s why we are focused on optimizing our ICE margins and working to make our EVs profitable on an EBIT basis as quickly as possible.”

0 Comments