President-elect Donald Trump’s proposed 25% tariff on all goods form Canada and Mexico, plus on all Chinese imports could wind up costing automakers as much 17% from their annual earnings. The estimate comes from a new study from S&P analysts.

Trump said he plans to levy 25% tariffs on Mexico and Canada if they don’t meet certain demands. Chinese imports will be tagged with a 10% tariff.

The group believes that European automakers would be hit hardest as they import many of their vehicles and parts for the U.S. market from Mexico and Canada and the 25% tariff, plus their own vehicles are subject to a 20% tariff under the new administration.

“We expect mitigating actions will make potentially higher tariffs manageable, but the combined effects of tariffs, tighter CO2 regulation in Europe from 2025, and earnings pressure from stronger competition in China and Europe could increase the risk of downgrades,” S&P said in the report.

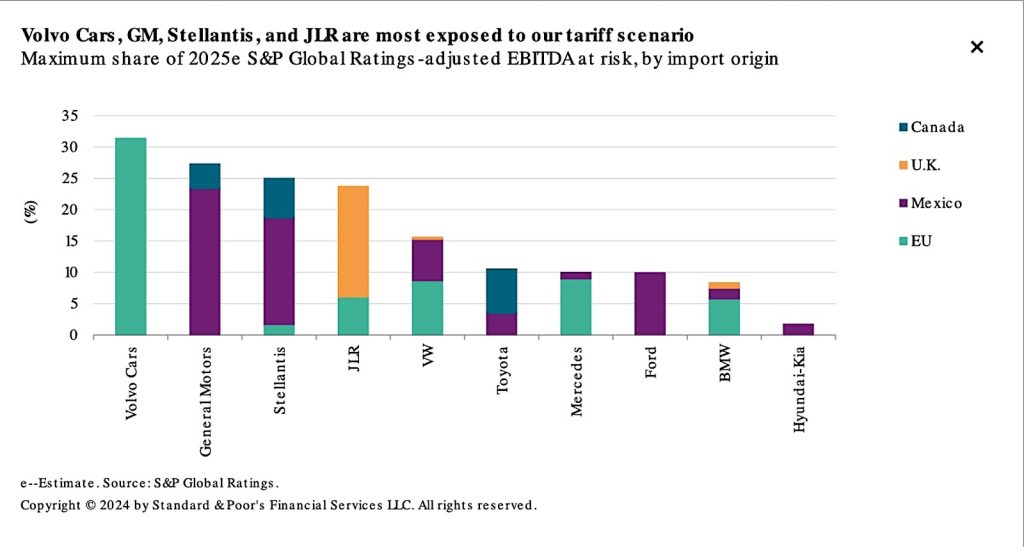

Particularly exposed to potentially higher tariffs are premium original equipment manufacturers (OEMs) Volvo Cars and JLR — given their high reliance on European production — and GM and Stellantis due to the volume of cars they assemble in Mexico and, partly, Canada. The risks for BMW and Mercedes are more contained.

Trump’s election portends problems

The reduction in profit could have multiple implications, starting with the potential ratings downgrades. This would make it more expensive for those automakers to borrow money in the future in addition to limiting the amount they could get.

The reduction in profit could have multiple implications, starting with the potential ratings downgrades. This would make it more expensive for those automakers to borrow money in the future in addition to limiting the amount they could get.

GM, Stellantis, Volvo and Jaguar Land Rover could see more than 20% of their projected adjusted EBITDA at risk in 2025, S&P analysis said. The risk is between 10% and 20% for Volkswagen and Toyota, and below 10% for BMW, Ford, Mercedes-Benz and Hyundai.

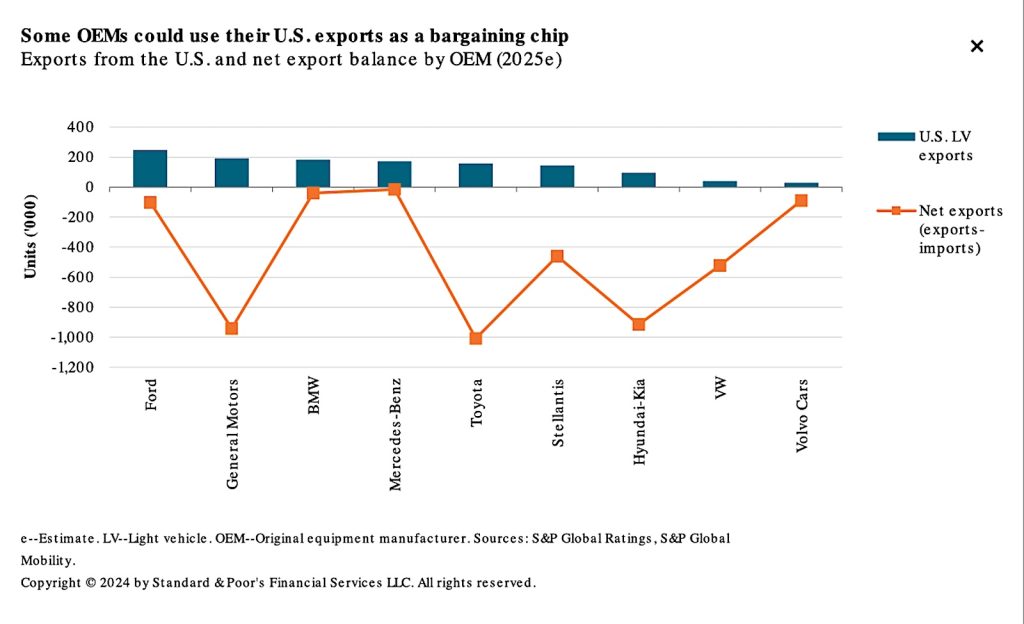

GM imports nearly 360,000 vehicles from Canada and Mexico. Most of those are highly profitable full-size pickups, which could mitigate of lost profits. However, Ford is next at about 195,000, but they are much less profitable. Nissan, which is already dealing with massive problem, is third at about 181,000 vehicles — mostly for Mexico.

More Trump Stories

- Trump’s Threatened Tariffs: Protectionism or Ploy?

- Tesla Strikes a Delicate Balance Between U.S., China — and Trump

- Trump Readying to Relax Autonomous Vehicle Rules

Up and down

Not only could the tariffs add to price of vehicles, reducing sales, Trump’s stated plans to get rid of the electric vehicle tax credit would crimp the purchase of EVs. That segment’s already enduring a slowdown from the red-hot purchases of just a few years ago.

Many automakers are now using the credit, which can be as much as $7,500, as part of the downpayment on these new vehicles. Leasing basically means all brands selling EVS are getting into the act.

For the most part, automakers have remained mum on the prospect of tariffs, although they have pushed for the incoming Trump administration leave the EV tax credits in place through their lobbying group, the Alliance for Automotive Innovation.

For the most part, automakers have remained mum on the prospect of tariffs, although they have pushed for the incoming Trump administration leave the EV tax credits in place through their lobbying group, the Alliance for Automotive Innovation.

The organization noted in a letter from its CEO, John Bozzella, removing the credit would cede leadership in the EV segment to “heavily subsidized” Chinese automakers. It’s a sentiment echoed by outgoing U.S. Energy Secretary Jennifer Granholm.

Another factor

S&P’s estimates ignore the parts flowing over the border as well.

“Our estimations do not include the effects of potential tariffs on vehicle parts shipments. Based on our analysis of global trade data, we assume that the effect on parts shipments from Mexico would be the most severe,” S&P said in its report.

“Tariffs on parts would worsen the cost structure of OEMs’ U.S. production and reduce any benefits for domestically made vehicles from a potentially higher overall level of pricing after the imposition of tariffs.”

0 Comments