With dozens of new models set to debut in the U.S. in the coming months, this should be a big year for Toyota. But the automaker’s plans have been put in a “wait and see mode,” as executives struggle to figure out how to respond to the new Trump import auto tariffs.The tariffs could bring more Toyota jobs to the U.S. – but they might also price some products out of reach, hammering sales. Headlight.News has more.

At a well-attended media event at its headquarters in Plano, Texas, Toyota has been rolling out an assortment of new products this week. They include critical new models such as the sixth-generation Toyota RAV4 and eighth-generation Lexus ES. All told, the two brands will launch 24 new or refreshed products in the coming year.

What was expected to be a relatively smooth rollout is running into a series of unexpected speed bumps, however. Like the rest of the industry, Toyota is struggling to figure out how to deal with the new tariffs on imported autos and auto parts enacted by the Trump administration on May 3. For Toyota, the new trade sanctions could dramatically impact things like pricing, production and product availability.

It’s more than just the prospect of significant price hikes, senior Toyota officials said. Like their competitors, they told Headlight.News that the Trump administration’s tariff guidelines have yet to be locked in place. “We need to understand the rules,” one executive said.

As a result, Toyota is finding itself in a “wait and see mode.”

Priced out of reach

Toyota has five models priced under $30,000. The Corolla is its entry line, starting at $22,000, though this GR Corolla hatch is significantly more expensive.

Looking ahead, Toyota now has to consider whether the scheduled product roll-out remains viable as originally planned. It must consider where it will build those and the rest of its product line-up. And there is the question about the broader impact of the tariffs on the U.S. economy and overall vehicle sales – which may wind up falling well below earlier expectations.

Toyota builds roughly 50% of the vehicles it currently sells in the United States. at 11 U.S. plants. That climbs to 80% if you include three Canadian and Mexican assembly lines. But even those could be impacted by the new trade sanctions due to their reliance on imported parts and components.

“Adding a 25% tariff on imported vehicles (and parts) would put them out of reach for a lot of Americans,” said Mark Templin, executive vice president and chief operating officer, Toyota Motor North America.

Diminished expectations

Toyota dealers could take hits if tariffs force the automaker to raise prices beyond what buyers are willing to accept.

Going into 2025, there was a widely held expectation that U.S. new vehicle sales would reach somewhere north of 16 million for the year. Toyota’s target was 16.1 million, with some bullish estimates aiming as high as 16.5 million.

But there’s widespread expectation that this will drop sharply should the tariffs Pres. Donald Trump officially enacted on 3 May remain in effect for an extended period. Cox Automotive now forecasts a figure of around 15 million – 14 million should the new trade sanctions trigger a recession.

What is particularly problematic for Toyota – and the industry at large – is that the new rules covering tariffs are far from clear, Templin noted as he prepared to leave Monday’s event for a trip to Washington, D.C., hoping to get more clarity from administration officials. Until the rules are finalized, there’s no way to fully measure what the impact actually will be – and then decide how to respond.

More Toyota News

- First Look: 2026 Toyota RAV4

- Toyota Has a Dozen New Models Coming This Year

- Toyota May Seek a Bargain in Nissan

“Wait and see mode”

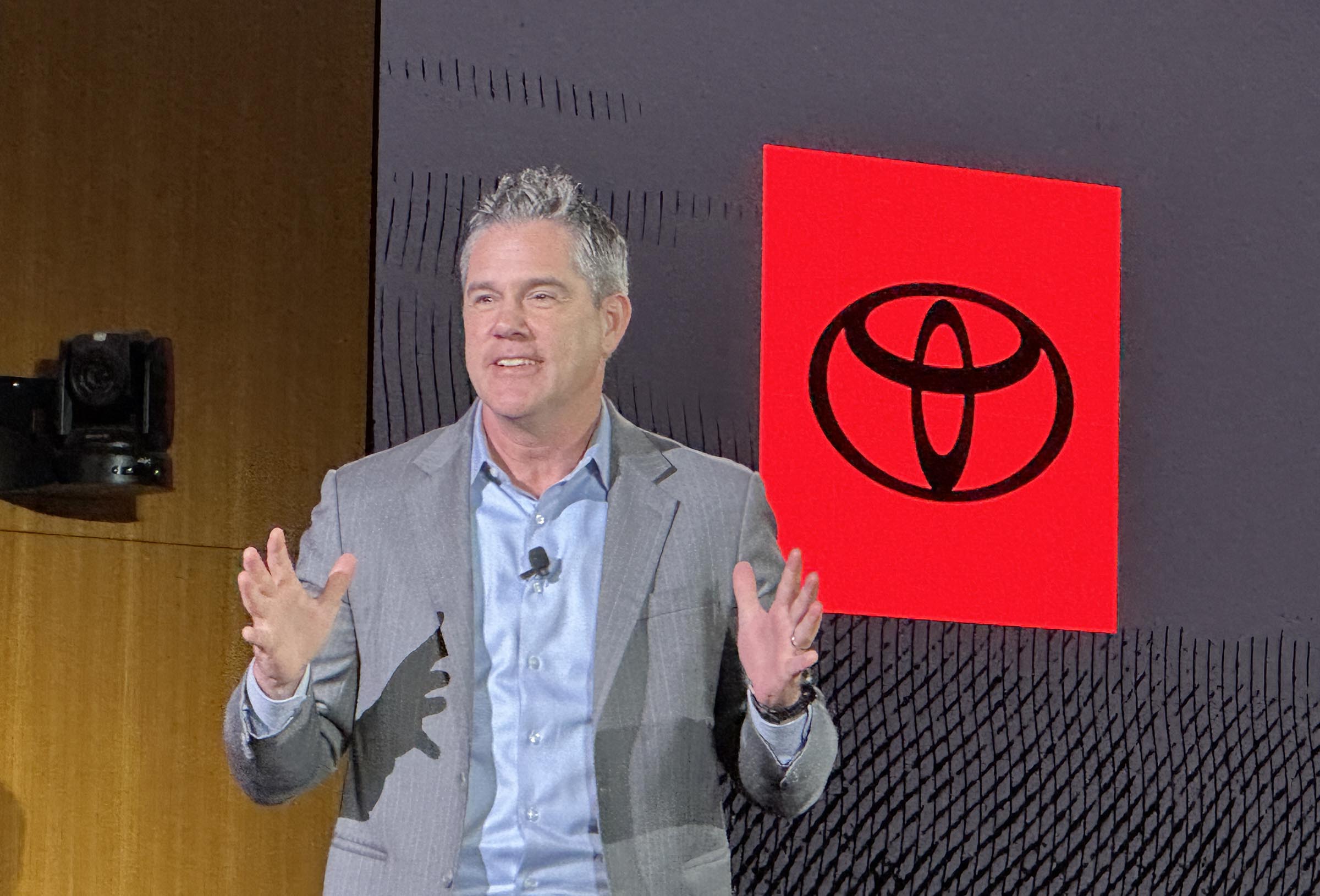

“We’re in a wait and see mode,” David Christ, a group vice president and general manager of the Toyota Division, told Nikkei in an interview, adding that “We really haven’t decided our long-term plan.”

Even though Toyota produces a large share of its U.S. line-up in North America, all models will feel the heat of the tariffs to varying degrees since each and every product relies on at least some imported parts and components. In some ways, Toyota is particularly vulnerable as Christ said it expects to see sales of its electrified models – including conventional and plug-in hybrids, as well as EVs – rise to “over” 50% this year. It thus relies heavily on chips, magnets, batteries and rare metals imported from China. And the tariffs currently stand at 30% on Chinese imports – Trump temporarily reducing the duties from 145%.

Toyota hopes to reduce this vulnerability with a new, $13.9 billion battery plant going into North Carolina. But it will remain dependent on many Chinese parts and materials, even then. And China has laid out the specter it could halt supplies of rare earths if it can’t come to a long-term settlement with the U.S.

Price hikes unavoidable

Industry officials say they’re still waiting for clarification on tariff policies from the Trump administration.

In the weeks leading up to the enactment of its import auto tariffs, Trump warned automakers not to pass higher costs onto consumers. While some brands, such as South Korea’s Hyundai and Kia, have announced temporary pauses, analysts like Cox, don’t see that as a long-time solution due to the hit manufacturers would take. General Motors, for one, forecast it could see a $5 billion impact.

Toyota planners are struggling to figure out how they would handle tariff costs and Christ said the amount it passes on to consumers likely will vary by model line and market segment. For one thing, it needs to see what the competition is doing.

No matter what product, “a 25% increase hurts” buyers, he said, though “maybe the higher-end customer has a little more flexibility in their budget than a low-end customer.”

Low-end buyers could be priced out

Toyota is particularly vulnerable at the low end, acknowledged Christ, noting that it has six product lines available under $30,000, starting with the Corolla which carries a base price of $22,035.

The problem is that for entry-level buyers, even “a 1% increase (in price) could take away 10% of the market” for affordable vehicles, said Jonathan Smoke, chief economist at Cox Automotive, during a meeting of the Automotive Press Association.

While Christ said “We really haven’t made any long-term strategic decisions,” including how to recoup tariff costs, he indicated the carmaker might need to show restraint when it comes to hiking prices on models like the Corolla.

You can’t shift production overnight

Among other decisions Toyota will need to make as the tariff picture becomes clearer: whether to further increase U.S. production and, if so, by how much.

“We want to be a great developer of U.S. jobs,” the Toyota division chief said. That was echoed by Templin who said he “expects….more vehicles to be built here in the U.S.”

But that isn’t as easy as simply throwing a switch. “You can’t simply move production facilities overnight,” cautioned Templin.

With production at the company’s current North American network largely maxed out, there’s likely little opportunity to increase output, at least by much, in the short-term. Among the topics Toyota will have to consider is whether to add even more parts and assembly plants in the U.S.

0 Comments