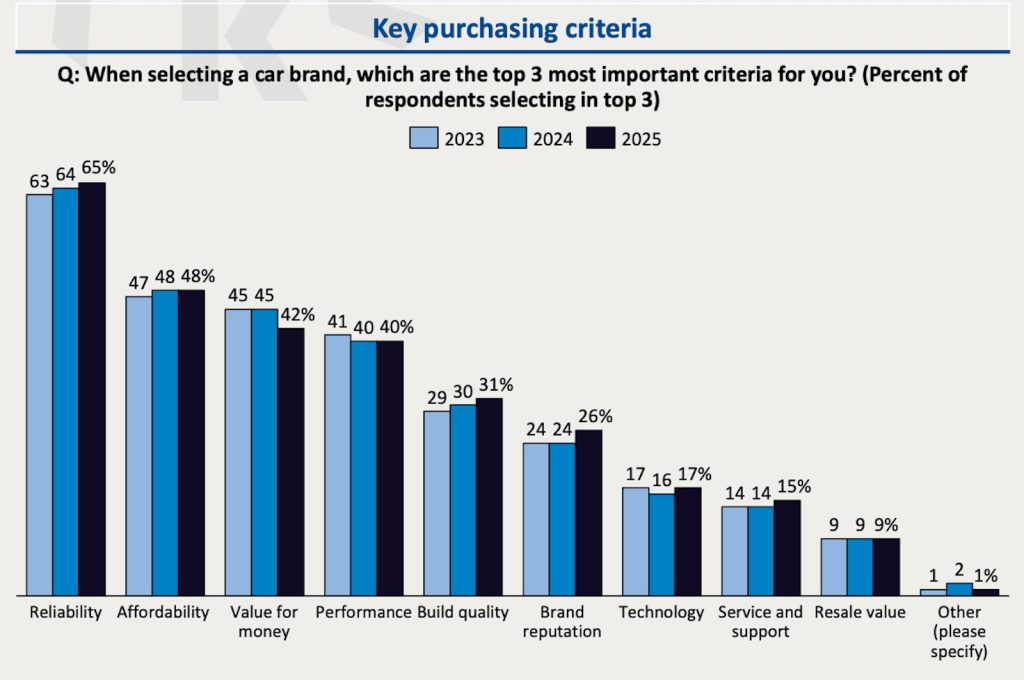

The jump in new car prices coming out of the pandemic hasn’t subsided, and when combined with the rise in interest rates, vehicles are more expensive than ever. A new study shows consumers are now focused on affordability than any other factor when it comes to buying a new car.

Buyers are facing increasing financial pressures, and as a result, affordability is a top concern when it comes to buying a new vehicle.

According to a new study, affordability may be the most important buzzword the auto industry faces, especially in light of the uncertain impact higher tariffs implemented by the Trump administration will have on vehicle prices.

The study, a midyear update of the 2025 Market Outlook Report by the Dave Cantin Group, reveals three trends have risen out of the focus on vehicle costs: Chinese automakers will gain a foothold in the U.S. market soon, the EV market is maturing, and car dealers are coming out ahead in the tariff battles.

The Dave Cantin Group acts as an adviser to automotive retailers, and it works with Kaiser Associates to produce the market report annually.

Make ’em cheaper

“Affordability is the dominant theme at the midpoint of 2025, and it has implications across nearly every other issue facing the automotive industry,” said Dave Cantin Group President Brian Gordon in a statement.

“Affordability is reshaping purchase decisions, driving interest in cheaper Chinese vehicles, and making any manufacturer decision to pass on tariff costs to consumers virtually impossible without the risk of losing market share.”

While automakers grapple with tariffs, dealers have leveraged diversified revenue streams in parts, service, finance, insurance and used vehicles to post record profits.

“U.S. dealers are proving once again how resilient they are and how sophisticated their customer-focused business models have become,” Dave Cantin Group CEO Dave Cantin added. “Affordability challenges are forcing adaptation, and dealers are leading the way.”

“U.S. dealers are proving once again how resilient they are and how sophisticated their customer-focused business models have become,” Dave Cantin Group CEO Dave Cantin added. “Affordability challenges are forcing adaptation, and dealers are leading the way.”

Adjustments coming

With the average new vehicle price hovering around $38,000 before the COVID pandemic hit in 2020 and now hovering close to $49,000, consumers have been scrambling to find ways to lower their monthly car payment.

That monthly payment, by the way, has risen about $200 a month during that same time frame. It has move from $563 a month to $745 a month. Additionally, rising interest rates have acted as a catalyst for buyers to move into auto loans with longer terms. While the 60-month loan was once considered stretching, lenders now offer 72- and even 84-month loans, the latter being the fastest growing segment of new car loans.

Consumers are also reexamining the types of vehicles they’re buying. Many are staying in their favorite segments but scaling down — opting for smaller versions of trucks, SUVs and crossovers or lower trims to stay within budget.

Automakers are responding by introducing value-focused models, expanding lower-end trims and absorbing tariff costs rather than risk losing share. Challenger brands like Buick and Mazda, which pair affordability with reliability, are seeing gains, according to the report.

More Consumer News

- Trump Tariffs Likely to Drive Budget Buyers Out of New Vehicle Market

- Car Prices to Rise Average $2,000 as Tariffs Take Hold

- June Car Sales Stall Under Weight of Tariffs

A new source

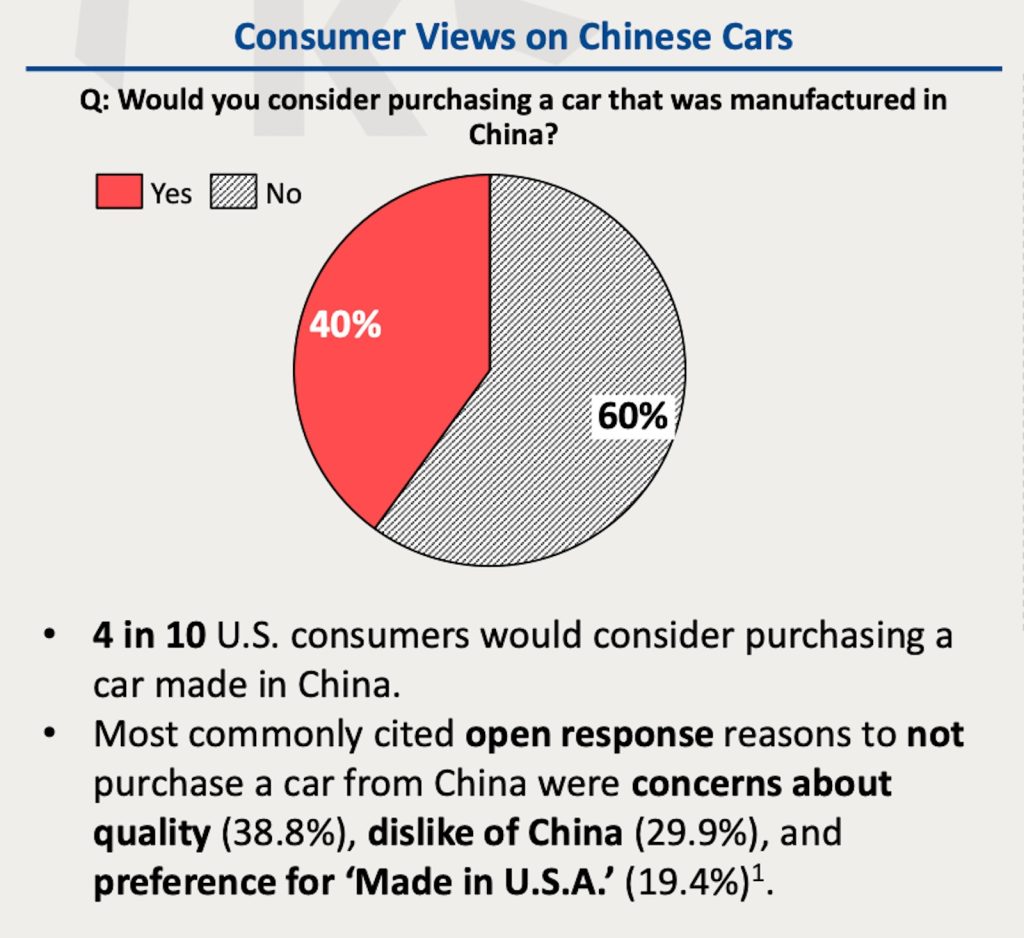

As they begin looking for a new, less expensive version of familiar vehicles, potential buyers are also looking at vehicles from China with new eyes.

Forty percent of U.S. consumers say they would consider a Chinese-made vehicle, according to the study, and 75% of dealers expect Chinese brands in the market within a year. This openness is rooted in price sensitivity, with buyers motivated by even modest savings over U.S., European, South Korean or Japanese options.

Americans are getting some exposure to Chinese-made vehicles as Buick offers the Envision while Polestar vehicles are also built in China.

While large-scale entry in 2025 is unlikely, a controlled rollout under the Trump administration is plausible. Abroad, Chinese OEMs doubled EU market share in the first half of 2025, with sales up 91% year-over-year and BYD outselling Tesla in Europe for the first time in April.

Dead EV driving?

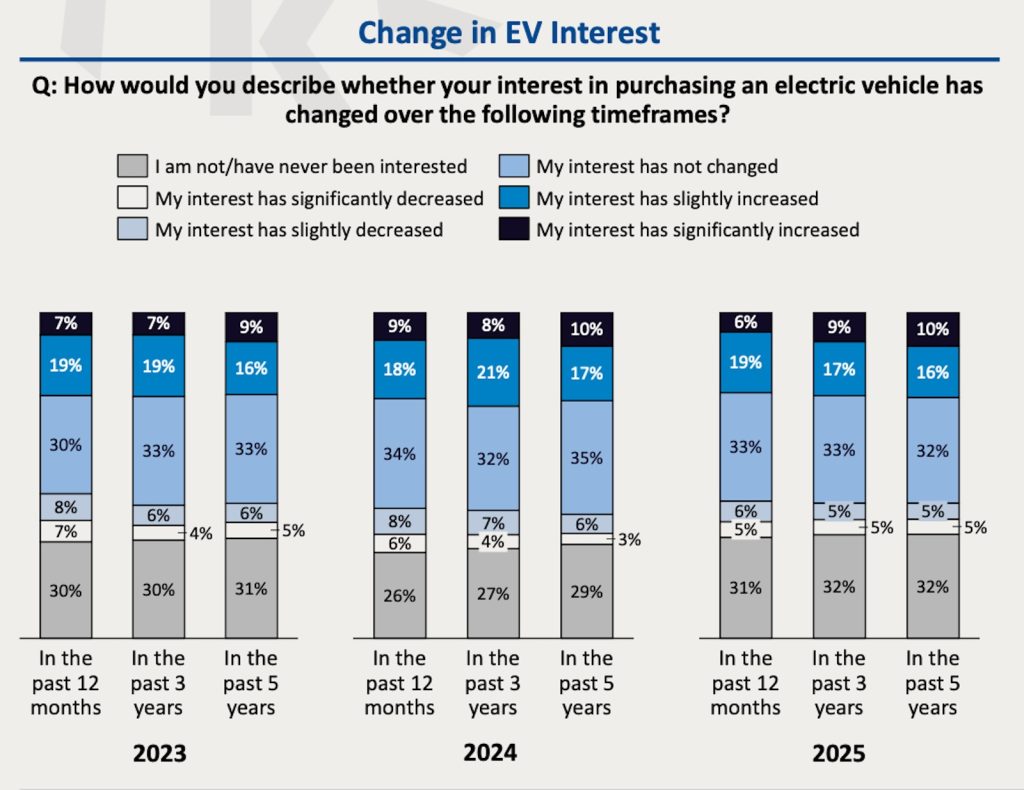

Another reason for the rise in the average price of new vehicles in the U.S. has been the growth of electric vehicle sales. They range from $3,000 to $10,000 more expensive than comparable gas- and diesel-powered models.

And until 2024, sales were skyrocketing with consumers attracted to the instant torque making even the tamest looking EV a potential supercar. Additionally, the appeal of charging a vehicle from home for pennies on the dollar compared to gas prices combined with ever-increasing range drove sales upward.

However, sales have slowed to more modest levels. Total U.S. EV sales hit a record 607,089 units in H1 2025, up 1.5% year-over-year, though Q2 volumes dipped 6.3%. Tesla remains dominant but saw its market share erode as GM’s EV sales surged 111%, driven by the affordable Chevrolet Equinox EV. Lucid and Nissan also posted gains.

Affordability fueled a 32% year-over-year jump in used EV sales in May, with depreciation making them cheaper than comparable ICE used cars.

However, the $7,500 federal tax credit that helped fuel sales ends Sept. 30, and what will happen to EV sales is not certain. However, many expect a precipitous drop, especially has hybrid sales continue to make substantial gains.

Terrible tariffs?

Automakers absorbed multi-billion-dollar tariff impacts in Q2 to protect sales in an already affordability-sensitive market, squeezing margins and limiting flexibility.

Dealers, whose profits are less dependent on new-vehicle margins, are leveraging strong parts and service revenue, finance and insurance products, and used vehicle sales to project average profit margins of 4.7% in 2025, up from 4.1% in 2023. Sixty-one percent expect record revenue growth this year.

“Consumers Weary from High Auto Prices” they say, but will order the biggest vehicle out there with every option offered.

One of the big ironies — until you think that those left in the new vehicle market are more likely to be positioned to get the vehicle they want, as they want it. The rest are now more likely to get a CPO vehicle.

Paul E.