Americans are swimming in automotive debt — and an increasing number are underwater on those loans. According to a new study, the average gap between what consumers owe and what they’re vehicles are worth at trade is growing.

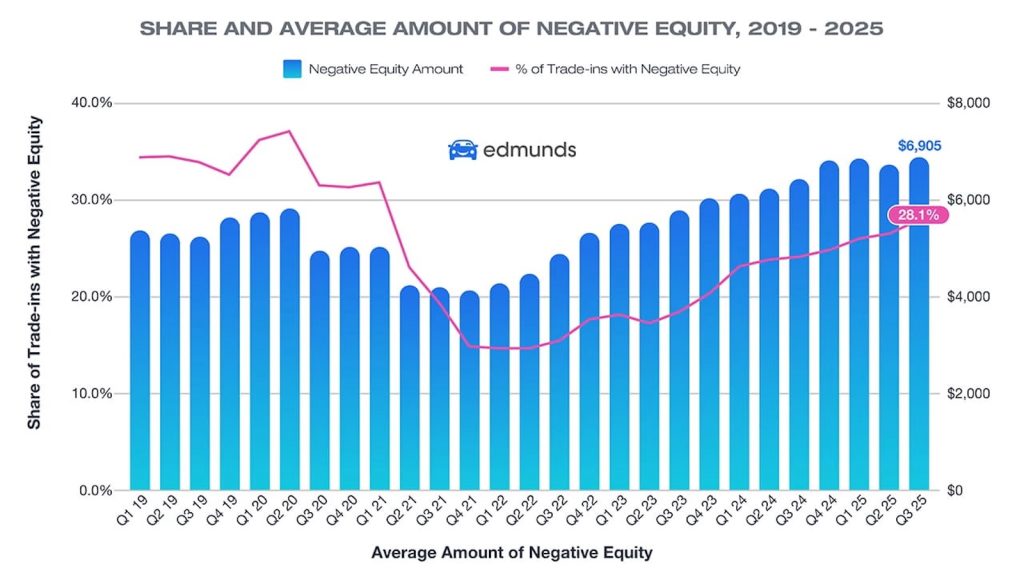

During the third quarter of this year, the number of potential buyers trading in vehicles that are underwater — worth less than what’s owed — hit its highest level since 2021. According to a study by experts at Edmunds.com, 28.1% of trade-ins were underwater. That’s up from 26.6% in the second quarter of this year.

Perhaps more importantly, the amount owed on average is now at record levels: $6,905. That beats the previous high of $6,880 in the first quarter of this year.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” said Ivan Drury, Edmunds’ director of insights. “Nearly one in three upside-down car owners owe between $5,000 and $10,000 — and a growing share owe far more than that.”

Big numbers, big problems

The push by Americans to buy more expensive vehicles, but spread out the term to pay it back is becoming problematic. Most experts recommend car loans shouldn’t exceed 36 or 48 months. However, the fastest growing segment of the lending arena has been 72-month and 84-month loans.

With rising prices as well as rising interest rates, it’s tough for consumers to get the well-contented vehicle they thought they were building toward. As a result, they elect to shop for a monthly payment they can afford rather than the total price of the vehicle. When they decide it’s time for a new vehicle, they’ve not paid enough on their current car, truck or SUV to keep pace with the market value.

Nearly one in three underwater car owners owe between $5,000 and $10,000 in debt — a new record high, Edmunds noted. And third, 32.9%, of negative-equity trade-ins fell into this range in Q3, up from 32.6% in Q2 and continuing a steady climb since last year.

A record share of underwater car loans are carrying five-figure debt. Nearly one in four (24.7%) trade-ins with negative equity carried more than $10,000 in debt in Q3, surpassing the previous high of 24.6% set in Q4 2024. Another 8.3% of trade-ins with negative equity carried more than $15,000 in debt, up from 7.7% in Q2 2025.

Ugly cycle

“Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs. Those choices are now catching up, making it far harder to buy again without piling on even more debt,” Drury said.

However, consumers are now facing just that prospect: more debt. According to Cox Automotive, the average new vehicle monthly payment in the third quarter was $766, a 1.9% increase over the previous quarter.

But when you add in the carryover debt many buyers are facing, it pushes the monthly payment to levels once only imagined.

The average monthly payment for buyers who rolled negative equity into a new loan was $907 in Q3, down slightly from Q2’s high of $915 and $140 more than the overall industry average monthly payment of $767. They also financed $11,164 more than the typical new-vehicle buyer.

More Consumer News

- No Tax Credit? Give Me Gas, Americans Say

- Americans Need to Work More to Afford a New Car

- Tariffs Could Drive Budget Buyers Out of New Car Market

Solving a problem

Once you begin the cycle of rolling in debt from your trade-in, it can be tough to get off the hamster wheel — and the potential of a four-figure monthly payment.

“For many car owners, there’s no quick fix for being underwater. It’s about minimizing how much deeper you go,” said Joseph Yoon, Edmunds’ consumer insights analyst. “If you can, wait until you’ve paid down more of your balance before trading in.

“But if you do need to replace your car, make sure your next purchase fits your budget, not just your needs. The right vehicle choice can prevent a short-term decision from becoming a long-term setback.”

Edmunds analysts also advise that before turning in a vehicle, consumers should review their loan paperwork for add-on products like extended warranties, service contracts, or wheel-and-tire protection. Canceling these agreements, even if the refund is prorated, can help chip away at the amount owed on the loan and slightly improve the payoff-to-value balance.

Buy the car you can afford. No one need a 38-speaker audio!

Thankfully we have a president that won’t allow us to be infiltrated with cheap Chinese cars.