It’s getting easier — or at least less expensive — to buy a new car, truck or SUV for American consumers.

Buyers that headed to showrooms in January found vehicles to be the most affordable they’ve been in nearly a year.

According to the latest numbers from Cox Automotive, lower interest rates on loans helped to drive down the average price for a new vehicle by 2.2% for January. After peeking over the $50K figure late last year, the average price consumers paid for a new vehicle in January came in at $49,191, the company reported.

“Income growth remained strong at 3.7% year over year. Lower prices, lower rates and higher incomes combined to improve vehicle affordability conditions,” officials noted in a release.

Price drop

The lower prices mean a lower monthly payment, which dropped 1.4% to $756 a month. That is still up 1.7% compared to January 2025, but continues the trend of dropping prices. It’s also the lowest figure since last March.

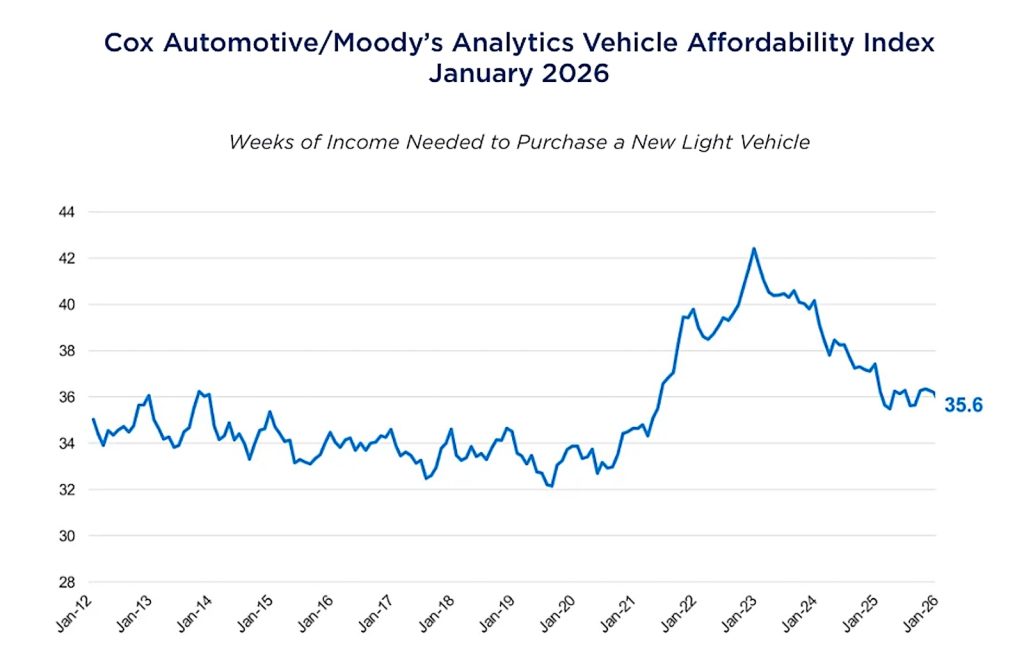

The number of median weeks of income needed to purchase the average new vehicle declined to 35.6 weeks from 36.2 weeks in December. The average monthly payment peaked at $795 in December 2022, Cox noted.

Automakers offered fewer incentives this January than a year ago. They were down 6.4%, and despite prices being lower last January, interest rates were higher. That combination helped to improve the affordability of a new vehicle.

More Car News

- VW Reveals Redesigned 2027 Atlas SUV

- VW Won’t Offer ID.Buzz in the U.S. in 2026

- Uber Set to Launch Fleet of Autonomous VW EVs

Interest rates

Those lower interest rates made lenders happy, as access to credit improved. Cox noted subprime and longer term loans were more readily available. However, negative equity also increased in January, after an improvement in December.

“Negative equity surged to 56.3%, subprime share climbed to 15.7%, and yield spreads widened 31 basis points — suggesting lenders are pricing in additional risk even as they expand access,” Cox added.

0 Comments