Elon Musk has staked out a big claim in the auto industry, outer space and, now, in Donald Trump’s new administration. But even some of his allies are beginning to wonder if it is all too much for the world’s richest man.

TikTok, exploding rockets, fights with MAGA overlords, a controversial salute at Trump’s inauguration plus dabbling in European politic. Even some of Elon Musk’s close allies have begun wondering if he’s spreading himself too thin.

One big question, automotive industry analysts, in particular, have been asking: does the world’s richest man still have the time — or the inclination — to continue serving as Tesla’s chief executive officer.

The breadth of Musk’s interests has grown rapidly in the past couple of years, seemingly shifting his attention from the EV manufacturer to a broad range of other businesses and, now, to the highest levels of American politics. He’s even begun stepping into the European political arena.

Tesla’s success made Musk an international celebrity and the world’s richest man. But his celebrity and his politics also have opened him up to criticism.

Cuban takes aim at Musk

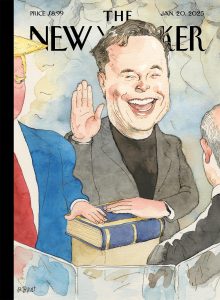

Musk’s growing role in the Trump administration was parodied by a New Yorker magazine cover this week.

Billionaire and Musk critic Mark Cuban observed in a recent interview with news site Benzinga, “Tesla’s customer base is composed of environmentally conscious individuals who are unlikely to align with Trump’s policies or rhetoric.”

Musk’s decision to lean heavily into Republican politics, Cuban argued, seems to abandon the very audience that helped Tesla rise to prominence.

“If you’re the wealthiest person in the world and you have effective control, you’re the Puppet Master of the president, the most powerful person in the world,” Cuban continued. “That’s… intoxicating. That is the definition of power corrupts, but absolute power corrupts absolutely.”

Bank of America sees risks for Tesla

Bank of America’s widely followed analyst John Murphy downgraded Tesla stock in his latest report – even while raising its price target from $400 to $490.

Despite writing that the stock is “trading at a level that captures much of our [long term] potential,” Murphy noted that there are “catalysts” that carry as much significant risk as potential benefit.

In the report, he named the launch of a low-cost model by the end of the first half of 2025 and the launch of Cybercab robotaxi planned for 2026 as potential catalysts with “execution risk,” alongside other ventures like increased Chinese production of its Megapack beginning in Q1 2025.

Despite recent hits to sales and earnings, Tesla CEO Elon Musk believes sales could rise 20% in 2025.

Murphy cited a variety of other risks including increased competition in China, weaker EV demand, product launch delays, changes in EV regulation and incentives, as well as the risk of government policies not changing in favor of autonomous technology.

“On vehicle launches, that’s probably the greatest risk,” Murphy said. “That’s something that historically, the company has struggled with as there haven’t been that many new vehicle launches.” Referencing the introductions of Tesla’s current portfolio, from the original Model S to the Cybertruck, noted Murphy, “none of those have gone that well in the past.”

More Tesla News

- Is Musk’s Political Shift Hurting Tesla

- Judge Again Rejects Musk’s Massive Pay Package

- Tesla, Musk Strike Delicate Balance Between Business and Politics

Tesla’s faces decline in sales

A big test for Tesla and Musk will come with the promised launch of the self-driving CyberCab scheduled for 2026.

For the first time in over a decade, Tesla’s EV sales fell last year. The automaker sold 1.79 million vehicles in 2024, marking a 1.1% decline year-over-year despite a record-breaking fourth quarter with 495,570 EVs delivered. The automaker doesn’t break out sales by market but Cox Automotive estimated the decline was closer to 4% in the U.S. based on registration data.

Cybertruck sales, in particular, have been disappointing, with the automaker reportedly shifting workers off the electric pickup line to handle other chores in recent weeks. Meanwhile, Tesla has yet to bring on a delivery vehicle EV, ceding a critical niche to Amazon-backed Rivian and Ford Motor Co.

During a conference call with investors after Tesla released its third-quarter earnings, Musk predicted Tesla sales would increase by 20% in 2025.

But Tesla revenue growth fell short during the third quarter, and while the company’s profit margin make gains, it was boosted by a growing energy storage business and sale of regulatory credits. Tesla’s once spectacular margin on sales of vehicles, while better than other EV makers, have fallen despite a drop in the cost of batteries.

Time for a new CEO at Tesla

SpaceX was hit by the catastrophic explosion of a Starship this month, the company trying to downplay the event as an “rapid unscheduled disassembly.”

Over the years, there have been a steady stream of suggestions on social media that it might be time for Musk to step aside as Tesla’s CEO, in some cases coming from some of the company’s biggest shareholders. Musk’s attention, now critics contend, has been diverted by his high-profile engagement with Donald Trump, who has named him head of the Department of Government Efficiency, or DOGE.

Musk is certain to be dragged into the chaos on which Trump seems to thrive, pulling him further away from the challenges facing Tesla, including fierce competition from EV rivals in China – where nearly half of the company’s revenue now comes from. Thus, it is no surprise the Daily Telegraph, one of Great Britain’s most conservative papers, has suggested it is time for Musk to give up the reins at Tesla.

As if Tesla doesn’t pose enough challenges, a rocket from SpaceX failed to complete its mission earlier this month.

“Starship experienced a rapid unscheduled disassembly during its ascent burn,” a SpaceX spokesperson wrote in a post on the company’s seventh test of the giant Starliner after it blew up – a euphemism that generated sharp mockery on social media.

But while the Trump administration is likely to favor SpaceX with huge new government contracts, other nasty political fights loom ahead for Musk and his empire.

Musk faces nasty political season

Musk was called out by media around the world for appearing to give something resembling the Nazi salute during the ceremonies following Trump’s second inauguration.

Steve Bannon, the godfather of the MAGA movement, has vowed to take down Musk after the Tesla CEO said he needed special visas for skilled immigrants to fill jobs at his various companies. But opposition to immigration, legal of not, is a core MAGA principle And Bannon has vowed to fight the special interest H-1-B visa sought by Musk and his Silicon Valley cronies.

Musk also is being prominently mentioned as a buyer for TikTok, the Chinese-owned, social-media platform adored by young Americans. Lawmakers, both Republicans and Democrats, voted to ban TikTok because they said it was spying on Americans. The law was upheld by the U.S. Supreme Court this month, but the Trump administration quickly offered at least a temporary reprieve after TikTok briefly went dark.

The pressure for the Chinese to sell hasn’t been mitigated. Now, Musk is being seen as a possible purchaser as he would be acceptable to both Trump and the Chinese government — with whom Musk has notably close relations.

But that could raise further questions about whether Musk, as an advisor to the new president, may be a little too closely intertwined with the Peoples Republic of China and its leaders. The question is whether the Republicans, now in control of the White House, as well as both houses of Congress, may be willing to examine Chinese influence in the U.S.

Controversy could curb Musk’s influence.

The number of controversies swirling around Musk have steadily grown over the last several years. They were accelerated by his controversial takeover of social media giant Twitter – soon renamed X. While he has billed himself as a “free speech absolutist,” Musk has shown a willingness to cut off access to critics and political foes – even within the GOP – while opening the door to neo-Nazis and other extremists.

Add to the list: his questionable, $52 billion compensation package, allegations of misusing stockholder funds for an investment in AI, and even claims he has cheated online gamers. For some investors it’s all a bit too much.

Some significant investors have begun to make their concerns public. Stichting Pensioenfonds ABP – one of Europe’s largest pension funds – sold its entire 2.8 million shares in September, valued at the time at $585 million, Bloomberg reported.

In a statement to the NL Times, a spokesperson for the Netherlands-based fund said, “We cannot and do not need to invest in everything.” While Musk’s massive pay deal was a factor, a spokesman said it was “by no means the only reason’ for the divestment.

Musk has become increasingly unpopular in some European circles, the controversy growing after he lent support to one of Germany’s most far-right political parties.

“Only the AfD can save Germany,” he wrote in December, in a post accompanied by a video of ar-right political activist Naomi Seibt.

Ian Hislop, the editor of Britain’s satirical magazine, Private Eye, took aim at Musk, writing that, “He’s riddled with contradictions, and at some point, I am hoping that even his followers will begin to notice that from sentence to sentence, he makes no sense.”

Perhaps, but Musk shows no sense that he is backing out of his newfound global political pulpit – nor of the many other roles he has added to his bio over the last few years.

Paul A. Eisenstein contributed to this story.

The guy went from wanting to save the world from global warming to giving Nazi salutes at inauguration events. Crazy. This should cost him a lot, at least on the Tesla side. He is alienating his customer base and appealing to people who don’t want electric cars.

Musk was fine when you thought he was a Dem, now he’s Satan.

Love it!