A growing number of investors, including some of Tesla’s traditional bulls, are pressing the automaker to replace CEO Elon Musk despite the rebound in the company’s stock this week. That has led to growing speculation over who might come in to replace him, with founder and former tech chief J.R. Straubel in the spotlight. Headlight.News has more.

Musk, during an appearance on Fox Business, admitted he was having “great difficulty” running his businesses while at DOGE.

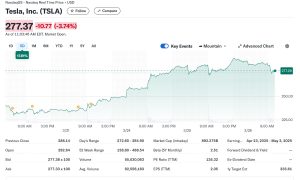

For the first time in nearly two months, Tesla stock has rallied this week, closing over $280 on Tuesday after bottoming out around $220 a share earlier in the month.

The rebound follows a push by members of the Trump administration, including the president himself, to trigger a rally, and translates into a nearly $200 billion increase in Tesla’s market capitalization. But it’s still down about $600 billion since Tesla’s post-election peak on the NASDAQ. The wild ride has raised growing concerns about the company’s future as its sales tumble amidst a growing worldwide boycott triggered by CEO Elon Musk’s political shift to the right.

A number of major investors are asking whether it is time for CEO Elon Musk to step aside to prevent further damage to the company’s value. Disgruntled investors are now openly talking about Musk’s potential replacement, with one of Tesla’s founders, J.R. Straubel, now CEO of battery recycler Redwood Materials high on the list.

Musk’s political turn costs Tesla

Reports that key investors want Musk to step aside have been circulating for months as the Tesla CEO steadily ramped up his involvement in politics.

Musk, despite his deep ties to the Chinese government, has become an integral part of President Donald Trump’s inner circle of advisers. As the informal head of Trump’s Department of Government Efficiency, Musk has overseen major cuts in federal programs and advocated eliminating Social Security.

He hasn’t limited himself to U.S. politics, openly advocating for the AfD in recent German elections. The Ultra-Conservative party failed to gain control but the move has triggered a widespread public backlash, Tesla sales falling last month by 67% in the key German market, and 50% in Europe overall.

Chinese sales fell 59% in February, and early data suggest U.S. demand is off sharply, as well. JPMorgan last week issued a revised forecast estimating the global numbers will fall 20% lower than originally anticipated, to around 355,000 vehicle deliveries for the first quarter. Adam Jonas, a long-time bull and the lead auto analyst at Morgan Stanley, has revised his Q1 forecast and expects sales to be down 9.3% year-over-year. He now foresees a 9.8% decline for all of 2025, at 1.615 million vehicles.

Investors seek candidate to replace Musk

Critics have argued that Musk’s foray into politics has hurt Tesla in a number of ways. Among other things, they contend, he’s diverted his attention at a time when Tesla needs active leadership to guide its response to a growing list of competitors. For one thing, China’s BYD is positioned to pass Tesla as the global EV sales leader in 2025.

The concern is that sales could continue to suffer, even if Musk backs away from his role at DOGE, a number of analysts and investors have warned.

Ross Gerber of Gerber Kawasaki in a recent interview on CNBC said the time had come for Musk to turn over the job of CEO to another executive, who could begin the job of rebuilding Tesla’s damaged reputation.

More Tesla News

- $1.4 Billion Goes Missing at Tesla

- Musk Under Growing Pressure to Quit Trump or Leave Tesla

- Tesla Recalls Cybertruck for the Eighth Time for Flyaway Body Panels

Tesla’s founder in the spotlight

Gerber said a good fit would be J.R. Straubel, the CEO of Redwood Materials, which now recycles the mineral content of depleted lithium-ion batteries.

Straubel, 49, was one of the so-called “founding five” who created Tesla, starting out in 2003. He spent 15 years as its chief technical officer and later wound up on its board of directors. Like the other original founders, Straubel was pushed aside by Musk who came onboard at a time when Tesla’s weak cash balance made its future uncertain. The South African entrepreneur later waged a battle with the original team to call himself a Tesla founder.

Straubel founded Redwood in 2017 and has built the company into an enterprise currently valued at $5 billion dollars. Backers say it’s positioned to become a leader in the battery recycling market as EV sales grow, and has formed close ties to automakers including Ford, General Motors and BMW.

Roadblock could protect Musk

Tesla Chair Robyn Denholm was one of four top Tesla officials selling off a collective $100 million in stock this past month.

While opposition to Musk has been growing outside Tesla, it’s uncertain whether he has lost any support inside the company, specifically among its board members.

Chairman Robyn Denholm pointedly refused to answer any questions related to the CEO this week during a Q&A session at a conference in her home country of Australia. That has been interpreted in a number of ways, though Musk critics point out that she has traditionally been vocal in her backing of the chief executive.

Notably, several key players at Tesla, including Denholm and board member James Murdoch — son of Fox News founder Rupert Murdoch — have collectively sold over $100 million worth of shares during the past month. The board has traditionally lined up behind Musk, no matter what problems he has faced. It’s unclear if this signals any change.

New competition limits Tesla growth

There remain plenty of bulls, such as Cathie Woods, of Ark Investment Management, who expect a full rebound of Tesla stock. But there’s growing uncertainty about the company’s future. As Headlight.News reported, Morgan Stanley has advised clients shares traded on the NASDAQ under the ticker TSLA could triple to $800. But it also warned the price could fall back as low as $200. JPMorgan’s target now is a mere $120, the lowest of Wall Street firms tracking Tesla, reported FactSet.

One reason for the concern: growing competition. In the U.S., Tesla has lost more than a third of its market share over the last three years and could drop below 40% by the end of 2025, said Sam Abuelsamid, head of data at Telemetry Research.

Among the EV market’s leaders, China’s BYD is fast approaching Tesla’s global sales level, even while being locked out of the U.S. It launched the Qin L, a new sedan roughly matching the specs of the Tesla Model 3, this week at less than half the price, about $16,500 at current exchange rates.

Stock’s rebound could help

Long-time investors know that Tesla shares have a history of wild swings. They hit a 52-week low last spring of $138.80 but surged post-election to a $488.54 high. Since then, shares have largely had downward momentum, losing ground for eight straight weeks before leveling off late last week.

The last several days have eased tensions a bit, especially after the Trump administration weighed in to lend Tesla its support. Earlier this month, the president held an event on the White House lawn, praising Tesla products.

Treasury Secretary Howard Lutnick, in an interview on Fox News last week, told viewers to “buy Tesla.” Lutnick, who personally owns Tesla shares, further pumped the stock by saying, “It will never be this cheap again.”

But how long the rally will last is uncertain, Tesla stock opening Wednesday morning on the weak, side and quickly losing about $10 a share.

As long as the general direction was up, investors seemed ready to ride things out. The growing skepticism raised by long-time bulls such as Gerber, could, break that pattern and continue to raise questions about Musk’s future role at the carmaker.

Paul A. Eisenstein contributed to this report.

If Tesla replaces Musk and you don’t dump your stock you’re an IDIOT.

LMFAO…at this point, he brings absolutely nothing to the game. No one in the EV market anymore is buying Teslas because of him. He is largely absent from management. They are falling further and further behind in terms of product. Unless his Cybercabs come out on time next year AND really work, Tesla will plunge.

Irony is, you would have said the same thing or worse before Musk signed on with Trump, Jim.

Paul E.

Just remember your (very wrong) views. Tesla is what they are because of one person, Musk.

Still laughing because you so often have trashed them and other EVs.

Musk definitely played a critical role in building up Tesla. But the same could be said about how Iacocca saved and then nearly crashed Chrysler. There are countless examples of execs who built up a company…or who became wildly famous in some other field…only to come crashing down. It’s exactly your mindset that is a major risk for Tesla — and for others who think someone cannot be replaced. Everyone can. And Musk has gone from major asset to liability. He will NEVER win back the buyers who built up Tesla. And YOU aren’t going to suddenly reverse your long-standing disdain to rush out and buy one now. They aren’t coming back. Unless Musk can find a new line of business and somehow salvage himself, he will remain a liability. That is not speaking from politics. That is a classic business reality.