Rivian CEO RJ Scaringe says he has “never been more confident than I am today” about the future of the struggling EV manufacturer. That’s despite a series of challenges facing the battery-electric vehicle sector in general – including the loss of federal EV tax credits and the rise of the low-cost Chinese competitors who are threatening to enter the U.S. market. A critical test will come early next year with the launch of Rivian’s more affordable R2 model line. But it’s also counting on joint ventures and alliances like those with Volkswagen and Amazon, reports Headlight.News.

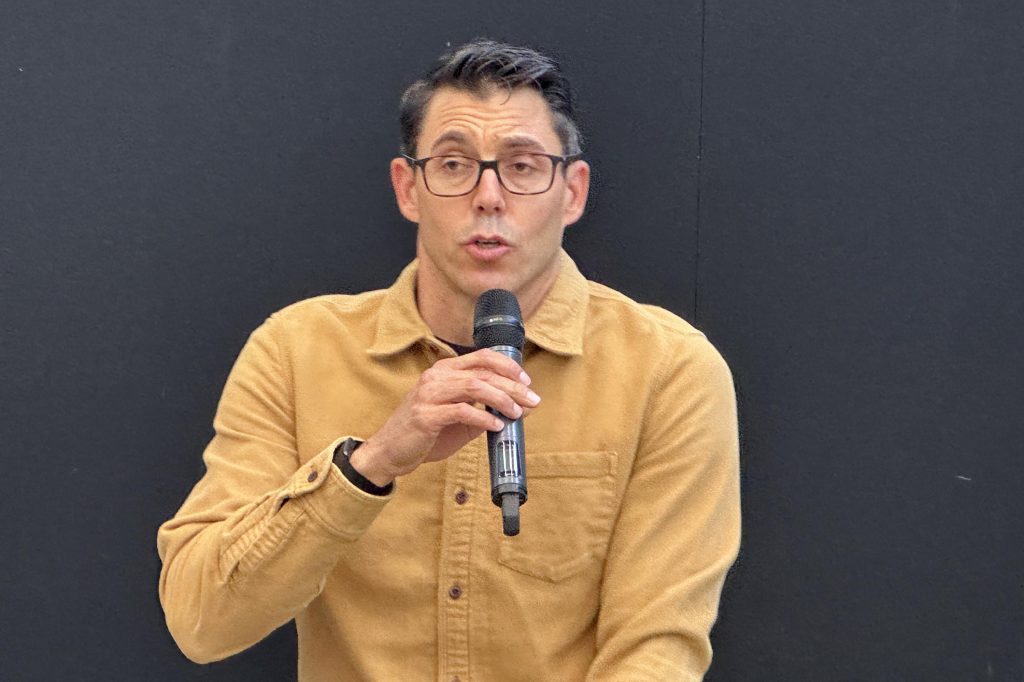

Rivian CEO RJ Scarange said he first dreamed of starting a car company when he was 10 years old. As an adult he’s learned just how difficult that is.

Half empty or half full? When it comes to battery-electric vehicles, that depends on your point of view. On the positive side, EV sales set an all-time record last month. But that was largely due to the fact that federal tax credits ended on September – which leads many industry-watchers to worry that demand will collapse in the months ahead.

For his part, Rivian CEO RJ Scaringe sounded an optimistic note during a media gathering Monday, telling reporters “I’ve never been more confident than I am today” about his company’s future. And, Scaringe added, he’s confident EV sales, in general, will hold up as more “compelling” products come to market.

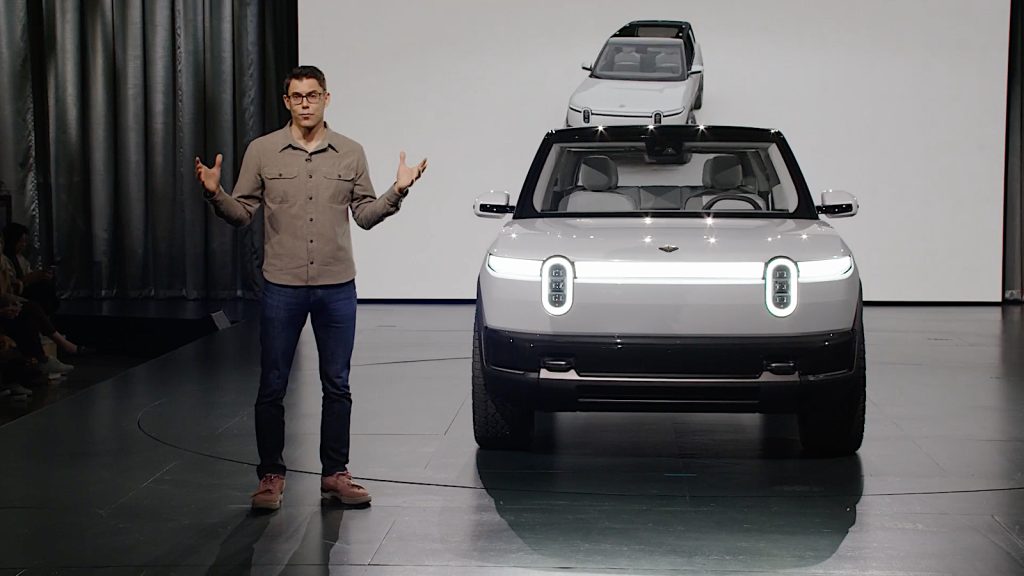

The real test for Rivian is fast approaching, the automaker set to launch its first mainstream product, the all-electric R2 SUV, during “the first part of next year,” Scaringe noted during a presentation to the Automotive Press Association held at Rivian’s technical center in the Detroit suburb of Plymouth.

A 10-year-old’s dream

“From about the age of 10 I knew I wanted to start a car company,” Scaringe said during a personal aside. He finally started to make that dream a reality “the day after I finished my graduate work.” But he’s since learned just how difficult that can be.

Unlike its most direct competitor, Tesla, Rivian continues to struggle financially. Despite strong third-quarter sales, up nearly 32% year-over-year, it last week lowered its guidance for the full year. And that sent Rivian shares tumbling. A number of industry observers have questioned whether the company can hang on, warning Rivian might face the same fate as other wannabe EV start-ups like Fisker, Nikola, Lordstown and Canoo.

Scaringe says it has helped him to maintain “a healthy dose of optimism,” insisting that while “the likelihood of success was extra low in Rivian’s early years, there’s reason to believe it is ready to move past those struggles. “The brand,” he said, “is resonating (with consumers) in ways we only hoped we could achieve.”

A small company with big partners

VW Group CEO Oliver Blume and Rivian CEO RJ Scaringe first revealed plans to form an alliance in a June 26, 2024 tweet.

There are several reasons for Scaringe’s optimism, starting with its two biggest shareholders: Amazon and the Volkswagen Group. The giant retailer has also been Rivian’s largest customer, currently operating more than 30,000 all-electric vans through its Prime delivery service.

Volkswagen, meanwhile, announced a joint venture with Rivian in June 2024, the following November increasing the size of that deal to $5.8 billion. For the moment, the relationship focuses on software, Rivian providing VW with its centralized computing technology.

Today’s vehicles are computers on wheels, with an average of more than 100 onboard microprocessors operating everything from mirrors to seats, radar sensors to powertrain systems. Most manufacturers use this “distributed” processing approach, but Rivian is one of a handful of companies – a list including Tesla and several Chinese automakers – who have adopted a “centralized” approach, with one to two three primary computers handling all processing needs. This approach is seen as more efficient – and far more cost-effective.

More Rivian News

- A Week With the 2025 Rivian R1S

- Ben & Jerry’s Scoops Up Two Rivian Vans

- Rivian Announces 3 New Models: R2, R3, R3X

Expanding opportunities

But it’s also extremely difficult to adopt. With its own, internal approach faltering, VW inked its deal with Rivian. The U.S. start-up’s processing system is now set to be used in at least 30 different models being developed by the Volkswagen Group’s many brands.

It will first appear on the little VW ID.1 EV debuting next year in Europe. An all-electric version of the VW Golf will be the first targeting the U.S. And a flagship model, widely believed to be either a Porsche or Audi EV, will follow.

Looking further ahead, Scaringe said there are “lots of ways” Rivian and Volkswagen might yet expand their relationship.

Asked whether the partnership could eventually involve joint vehicle development or manufacturing, Scaringe said there “could be something in the future,” though h stressed there is nothing currently in the works.

R2, R3

Rivian CEO R.J. Scaring, right, and Chief Design Officer Jeff Hammoud, talk about the all-new Rivian R2.

Rivian’s relationships with Amazon and Volkswagen have pumped some desperately needed cash into the start-up’s coffers. Along with a federal loan, that’s allowed Rivian to resume construction on a second assembly plant in Georgia.

For now, though, the original factory in Normal, Illinois is its primary manufacturing site and will get its next big test early in 2026 when Rivian begins production of its new R2 sport-utility vehicle. The midsize EV is set to start around $45,000 – about $10,000 less than what the typical EV has been going for in the U.S. and barely half the average transaction price of Rivian’s original SUV, the R1S.

The R2 will be followed by the smaller, sportier R3 and other “variants,” Scaringe hinted. They will all share the same basic underpinnings, including their platforms, motors, electric architecture and other components, helping slash development and production costs. And that, Rivian has been promising, will help it get its balance sheet solidly into the black.

“Quite aligned” with Trump

The anticipated slowdown in the U.S. battery-electric market has been widely blamed on the Trump administration, the president taking a number of steps reversing the pro-EV policies of his predecessor, Joe Biden. That includes cutting funds for the rollout of a nationwide public charging network, as well as the elimination of federal tax credits.

Surprisingly, Scaringe insisted “We’re actually quite aligned with the administration,” noting that Rivian’s plans call for significant increases in U.S. production. The original Normal plant has grown to 6 million square feet, allowing the addition of the R2 line. And the Georgia plant will eventually be large enough to roll out 400,000 EVs annually.

In the first few months, batteries for R2 will come from South Korea, said Scaringe, but Rivian is working with its supplier, Korea’s LG, to set up a new battery plant alongside the Illinois assembly plant.

The Chinese are coming

Scaringe said he was ready to compete against Chinese brands like BYD if a trade deal offsets unfair cost advantages.

As Headlight.News reported last Friday, the Trump administration is expected to include auto imports as part of what the president has called a “grand” trade deal with China. There has been strong resistance from the U.S. auto industry to opening the door to Chinese auto imports – of which there are only a handful today. Pres. Biden slapped 100% tariffs on Chinese EVs, Pres. Trump increasing tariffs on all other auto imports from China.

Allowing more to enter the U.S. is “probably” going to come out of a trade deal, Scaringe said during a conversation with Headlight.News following his presentation. “It’s conceivable we’ll have to compete with them.”

“The question is how high the tariffs” will be, should Chinese autos be allowed to enter the U.S. in large numbers, said Scaringe, adding that it will be essential to offset unique advantages China’s domestic automakers, brands like Geely and BYD, have, the Rivian CEO stressed.

That includes not only low labor costs but highly subsidized land, loans and energy, sharply reducing capital demands, Michael Dunne, head of Dunne Insights and a specialist in the Asian auto industry, told Headlight.News.

There’s been speculation a U.S.-China trade deal might hold Chinese automakers to the same sort of restrictions foreign manufacturers — such as General Motors and Ford — face in that country. They can only enter the Chinese market as part of a joint venture with one of that country’s domestic manufacturers. Scaringe said he “could see” the same rules being applied here.

0 Comments