Ford set a new revenue record during the third quarter, and beat Wall Street predictions for their results. However, supplier issues forced the automaker to cut its full-year earnings guidance.

Ford CEO Jim Farley said the company enjoyed another strong quarter and will continue to improve next year.

The automaker reported $50.5 billion in revenue for the quarter, with net income of $2.4 billion and adjusted earnings of $2.6 billion. The company noted that those numbers include $700 million in losses related to Trump administration-instituted tariffs.

“Ford posted another strong quarter, delivering more than $50 billion in revenue powered by our incredible products and services, the durability of Ford Pro and our disciplined focus on cost and quality,” said Jim Farley, Ford president and CEO.

“We are heading into 2026 as a stronger and more agile company. We will continue to focus on execution and on quickly making the right strategic calls on propulsion, partnerships and technology that will create tremendous value for our customers.”

Supplier fire impact

The record revenue is good news, but that’s offset by the impact of the fire at aluminum parts supplier, Novelis, on Ford’s bottom line. The company expects a $1 billion or less “headwind,” related to the fire.

“The Ford team, including myself, have been onsite at the Novelis plant in Oswego, New York,” said Farley. “We are working intensively with Novelis and others to source aluminum that can be processed in the cold rolling section of the plant that remains operational while also working to restore overall plant production. We have made substantial progress in a short time to minimize the impact in 2025 and recover production in 2026.”

As a result, the company revised its full-year earnings guidance. It now sees adjusted EBIT of $6 billion to $6.5 billion (prior $6.5 billion to $7.5 billion), and adjusted free cash flow of $2 billion to $3 billion (prior $3.5 billion to $4.5 billion).

The disruption in production “results in an oversized short-term impact on our working capital, which will reverse next year — and capital expenditures of about $9 billion,” which is unchanged.

Production increase

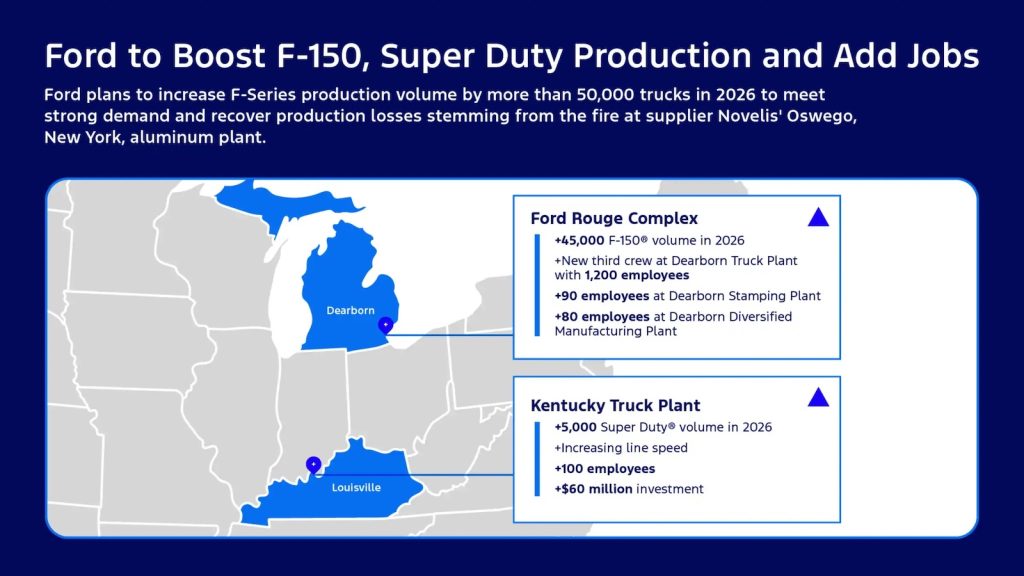

Ford plans to boost production its F-Series pickup by more than 50,000 trucks in 2026. That effort begins in Q1, and will create up to 1,000 new jobs and “transferring additional employees into Ford’s American truck assembly powerhouses,” the company noted.

“The people who keep our country running depend on America’s most popular vehicle – F-Series trucks — and we are mobilizing our team to meet that demand,” said Ford Chief Operating Officer Kumar Galhotra in a release. “As America’s leading auto producer, we will work with the UAW and our suppliers to quickly increase output at our F-Series plants in Michigan and Kentucky.”

“The people who keep our country running depend on America’s most popular vehicle – F-Series trucks — and we are mobilizing our team to meet that demand,” said Ford Chief Operating Officer Kumar Galhotra in a release. “As America’s leading auto producer, we will work with the UAW and our suppliers to quickly increase output at our F-Series plants in Michigan and Kentucky.”

The company’s Dearborn Truck Plant, just west of Detroit, is targeting production of more than 45,000 additional F-150 gas and hybrid trucks in 2026. Ford plans to add a third crew of 1,200 employees. Additionally, Ford will add 90 employees at Dearborn Stamping Plant and 80 employees at Dearborn Diversified Manufacturing Plant.

F-150 Lightning assembly at the Rouge Electric Vehicle Center will remain paused as Ford prioritizes gas and hybrid F-Series trucks, which are more profitable for Ford and use less aluminum. Those employees will move over to the Dearborn plant to be part of the new third shift.

Kentucky Truck Plant aims to increase its F-Series Super Duty assembly line speed by one job per hour – or more than 5,000 trucks per year – with the addition of more than 100 employees. Ford will invest $60 million in the plant for training and other needs to support the line speed increase.

More Ford News

- Ford Sets All-Time Annual Recall Record – by June

- Another Major Ford Recall

- 1 Mil More Fords Recalled for Faulty Backup Cameras

Behind the numbers

The company’s Ford Pro business continues to be an impressive profit center, recording nearly $2 billion in EBIT for Q3.

In addition to the strong profits, the company reported cash flow from operations during the quarter was $7.4 billion and on an adjusted basis it was $4.3 billion. Ford had about $33 billion in cash and $54 billion in liquidity.

In addition to the additional jobs, the company plans to make shareholders happy, declaring a fourth-quarter regular dividend of 15 cents per share. The company’s Ford Pro business continues to be an economic powerhouse for the company, with nearly $2 billion in earnings before interest and taxes on revenue of $17.4 billion.

The company’s legacy production unit, Ford Blue, also enjoyed a strong quarter, reporting $1.5 billion in EBIT on $28 billion in revenue. Ford continues to see losses on its Model e unit. The electrification business took a $1.4 billion EBIT loss on revenue of $1.8 billion.

0 Comments