With EVs mandated to reach 50% of new U.S. vehicle sales in 2030 — and to replace internal combustion models by 2035 in the EU — the search is on for the battery technology that can win over consumers with longer range, lower costs and quicker charging speeds. But solid-state, the technology expected to replace today’s lithium-ion batteries, is so far failing to live up to its hype.

Toyota is pushing hard to develop its new battery technology, including its new plant in North Carolina.

While EV sales surged nearly eightfold between 2019 and 2023, the growth rate has slowed as manufacturers reach out to mainstream motorists, as well as the early adopters who drove the initial surge. But these buyers are looking to make fewer sacrifices when making the switch and want improved range, performance and charging speeds, as well as lower production costs and a reduced risk of fire.

To get there, “we need battery breakthroughs,” said Stephanie Brinley, lead automotive analyst with S&P Global Mobility.

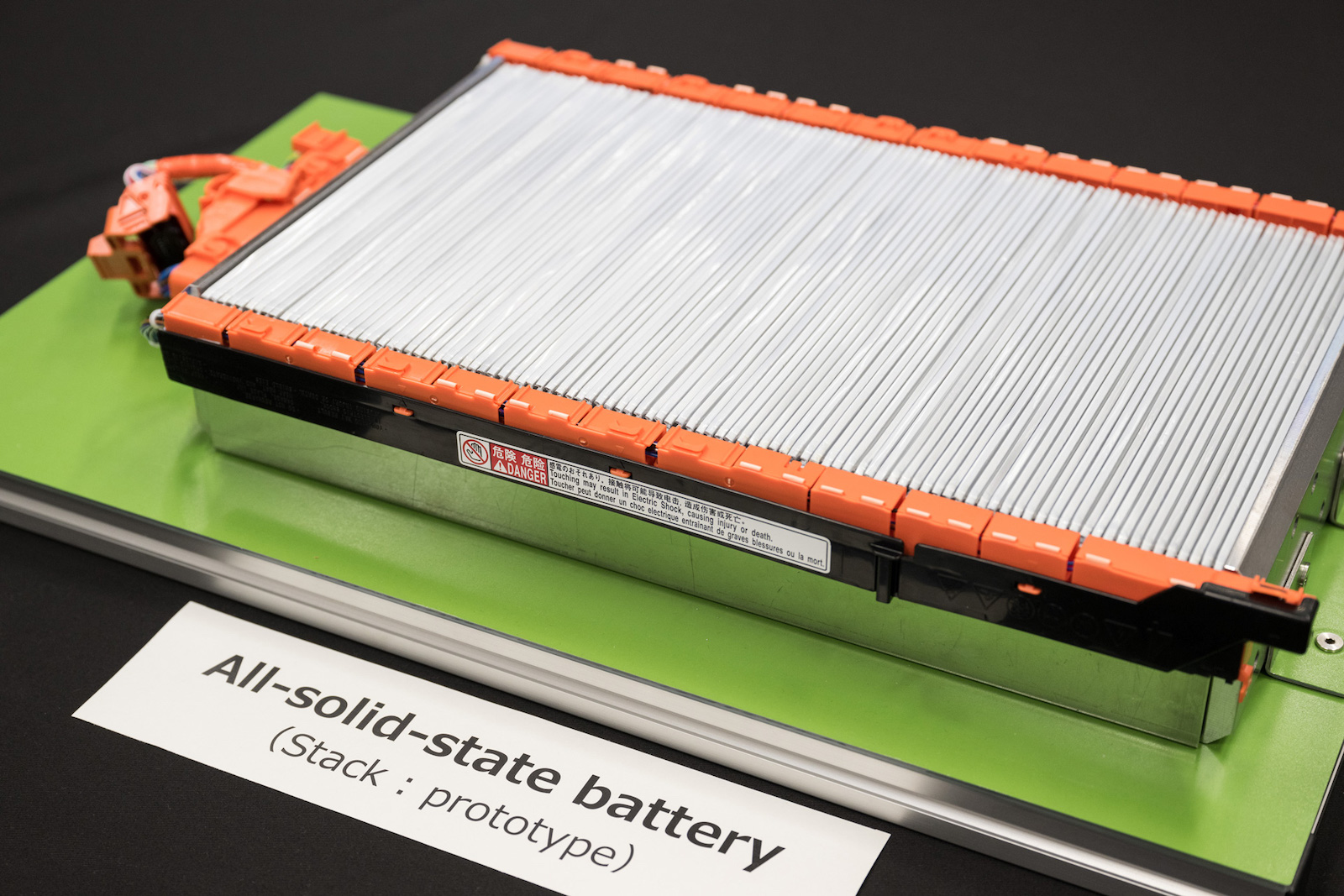

The question is when such a breakthrough will appear — and what form it will take. Over the last few years the focus has been on a promising battery chemistry known as solid-state. In extremely simplified form, it eliminates the liquid electrolyte found in conventional batteries, such as the lithium-ion cells used in most of today’s EVs. But while it promises to deliver on all those key demands, it’s proving far tougher than expected to move solid-state technology out of the lab and into production.

Seeking the EV Holy Grail

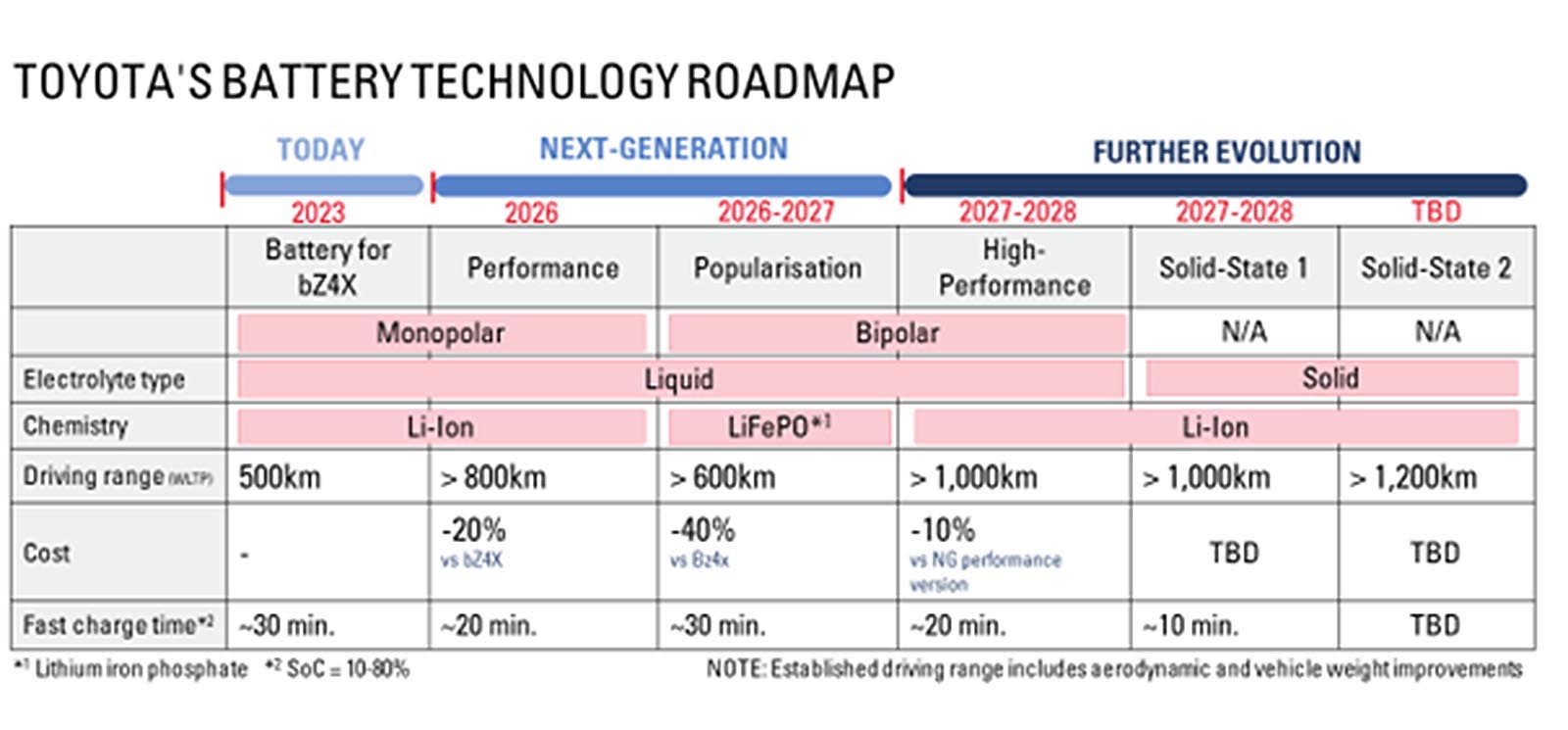

A number of manufacturers have announced plans to put solid-state batteries into their vehicles. Toyota, for one, has laid out the possibility of beginning that changeover as early as 2027. Last October, it announced a new partnership with the Japanese chemical giant Idemitsu Kosan to speed up development and commercialization of the technology. Toyota was optimistic enough to reveal plans for a new EV delivering up to 621 miles range, with recharging expected to take just 10 minutes — little more than what’s needed to fuel up a vehicle with an internal combustion engine.

“Through this collaboration, the two companies, which lead the world in the fields including material development relating to all-solid-state batteries, seek to ensure the successful commercialization of all-solid-state batteries in 2027-28,” Toyota and Idemitsu Kosan said in a joint statement.

And Toyota isn’t alone. Ford, BMW, Volkswagen and a number of other major brands have expressed goals of commercializing solid-state batteries.

Vaporware?

“I wouldn’t rule out that solid-state batteries will work,” said Sam Abuelsamid, principal auto analyst with Guidehouse Insights. “But we still don’t have evidence it will work at automotive scale, the cell sizes and volumes needed for automotive applications.”

After showing some early promise, QuantumScape’s technology is struggling to meet expectations or that it will ever be able to meet market demand.

Last year was supposed to be a critical one for several companies working on solid-state technology. Colorado-based Solid Power had begun pilot production and was expected to deliver automotive-scale prototypes for field testing by two of its major investors: BMW and Ford. But that program is running well behind schedule.

Volkswagen is among those growing concerned about whether it can make solid-state batteries a reality — at least anytime soon. It’s been working with QuantumScape, a startup based in San Jose, California and backed by Bill Gates that’s been hailed as one of the front-runners in bringing the technology to market. After a series of delays, and with rising concerns about whether QuantumScape will ever achieve high-volume production, VW is now talking to a competitor, Blue Solutions, according to Reuters.

More EV News

- Dodge releases “spy shots” of the 2025 Charger Daytona all-electric muscle car

- Twin Toyota concepts tease future EV performance models

- Elon Musk demands even more control over Tesla

Limited success

Concerns about QuantumScape’s technology has sent the company’s stock price skidding. It’s loss almost a third of its value since hitting nearly $10 a share earlier this month. Investors have been bouncing around looking for alternatives, such as Blue Solutions.

Volkswagen was working with QuantumScape, but is now talking with another battery supplier, Blue Solutions.

The French company, a subsidiary of the conglomerate Bollore, has been one of the rare success stories in the chase for solid-state batteries. It’s providing such cells for use in Daimler electric buses. But they can’t meet the sort of targets that would work in automobiles, at least not yet. Most notably, its cells require lengthy, overnight charging, That’s not a problem for buses, but wouldn’t fly with retail consumers.

Then there’s the Chinese EV company Nio which claims to be using a “semi-solid-state” battery in some EVs now on sale, but it continues to use a mix of solid and gel electrolytes and doesn’t meet the full definition of solid-state in other areas.

Automakers — and investors — look elsewhere

Investors, including manufacturers like VW, Ford, BMW and Toyota, have reduced the amount of capital they’re putting into solid-state battery companies, according to Reuters. The numbers were off 72% last year, to $146 million.

“Investor interest in solid state batteries has waned. They are questioning whether the risk of solid state is worth it,” Ibex Investors partner Jeff Peters said.

But the search for a better battery has, if anything accelerated elsewhere.

Alternatives

While solid-state technology may be less promising than it seemed a few years ago, there are a number of intriguing alternatives. That includes variations on the lithium-ion theme, said analyst Abuelsamid, researchers looking at ways to increase energy density and reduce charging speeds by, among other things, using silicon-based anodes.

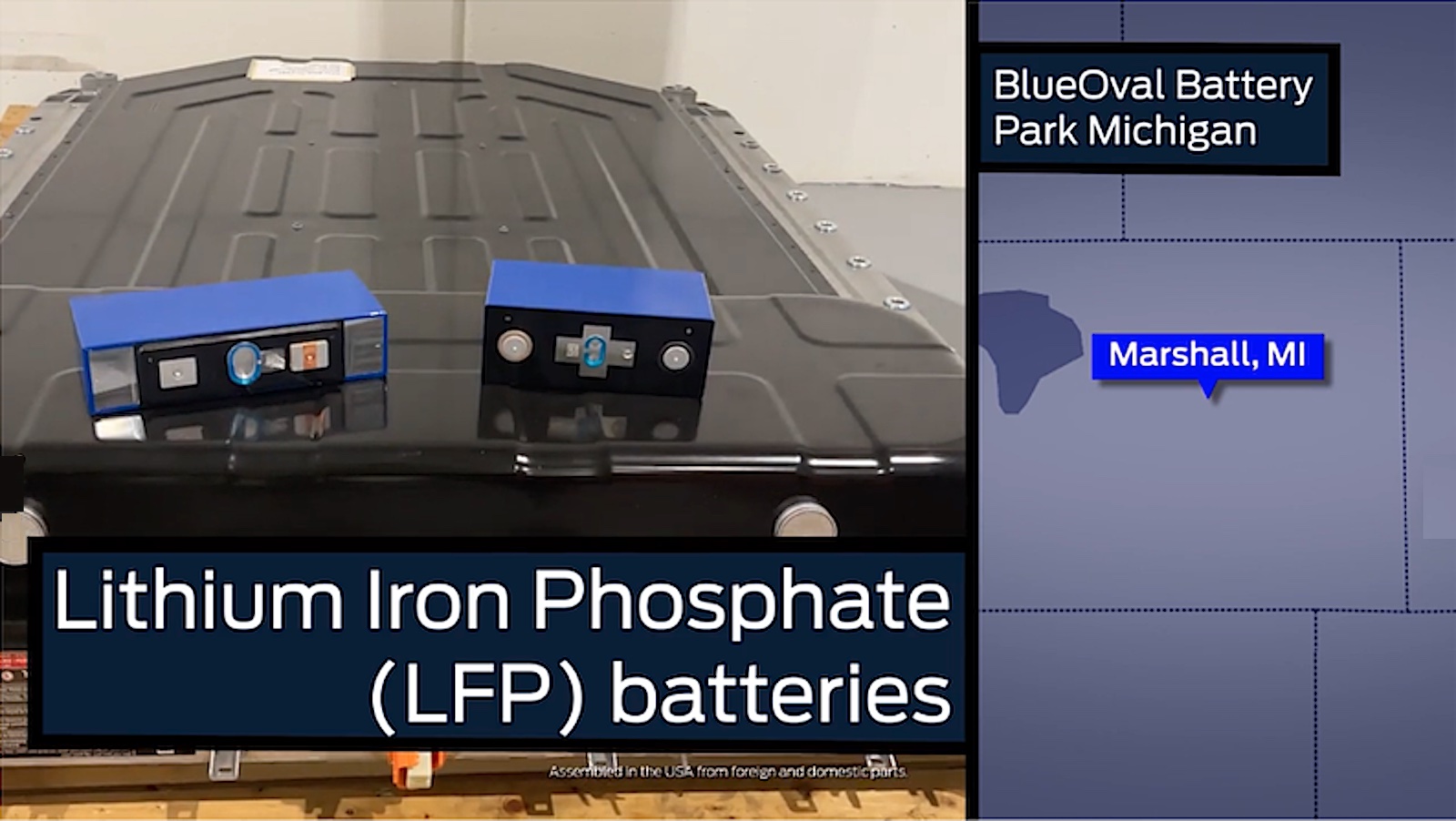

Suburban Detroit startup Our Next Energy, or ONE, is already field-testing a battery pack using two different chemistries. That includes a more stable and less expensive relative of lithium-ion, known as lithium-iron-phosphate. The pack pairs it with a proprietary, anode-free technology that is one of the highest-density battery chemistries currently known. But it’s still unclear if the so-called Gemini pack can live up to the demands of automotive applications.

Other potential battery technologies use graphene and minerals such as sodium and lithium. So far, they’re still not ready for prime time, however. Some can’t last the expected 10 years of road life, others don’t have the energy density — which translates into range — or simply cost too much.

Despite the lack of clear success so far, the search for the battery Holy Grail moves forward — driven by the strict zero-emissions mandates countries like the U.S. and China, as well as the European Union.

“Even without solid-state there are a number of other pathways that will get us to lower cost and improved energy density,” said Abuelsamid, And he’d be surprised if the better battery doesn’t show up before the end of this decade.

0 Comments