Calling the deal “unfathomable,” a Delaware court has blocked the $55.8 billion pay plan awarded Tesla CEO Elon Musk in 2018. The move could spell trouble for Musk’s current demand for 25% control of the EV maker while also raising concerns about his floundering social media site, X, which relied on loans backed by Tesla stock.

Musk’s 2018 pay deal made him the richest man in the world. But the court’s ruling could knock him off that perch.

The richest man in the world may soon loose that perch, at least if Elon Musk can’t overturn a ruling by a Delaware court that annulled the $55.8 billion pay deal the CEO won from Tesla in 2018.

The plan was controversial from the start and led to a lawsuit by Tesla shareholder Richard Tornetta. With other investors joining the case, the issue went to trial in Delaware Chancery Court in November 2022, Judge Kathaleen McCormick on Tuesday issuing her 201-page ruling.

The judge called the pay package “unfathomable,” and said it was approved by “starry eyed” Tesla directors “swept up by the rhetoric” that, at the time, made Tesla a “superstar.” She also noted the “extensive ties” Musk had with Tesla directors that appeared to improperly influence their decision.

Not in Tesla’s best interests

“Put simply, neither the Compensation Committee nor the Board acted in the best interests of the Company when negotiating Musk’s compensation plan,” McCormick wrote.

The ruling could create serious financial problem for Musk as he copes with the downturn at X, the former Twitter.

The deal was based on 12 tranches, each setting targets for such things as Tesla sales and earnings. But, shareholders challenged the plan while also questioning whether the carmaker’s board was really as “independent” as claimed.

“A number of key milestones in the compensation plan that Musk and the board described in proxy disclosures as very difficult to achieve were, in fact, expected based on Tesla’s confidential projections shared with banks and rating agencies,” said a statement hailing the court’s Tuesday ruling released by Bernstein Litowitz Berger & Grossmann, the law firm that handled the case for dissident shareholders.

A “starry eyed” board

Tesla’s board of directors has frequently come under fire as being far less independent than claimed. Among others, it includes Musk’s brother Kimbal – who, like Elon Musk himself – did recuse themselves from voting on the pay package.

But other members of the board had strong ties to the South African-born CEO, including Antonio Gracias. He was one of five out of the six directors on the Tesla compensation committee whom the judge said “were beholden to Musk or had compromising conflicts.”

McCormick also noted the influence on the decision to approve the pay package by Todd Maron, Tesla’s general counsel. Before he was appointed to that position, Maron was Musk’s divorce attorney.

More Tesla News

- Latest recall adds to Tesla’s very, very, very bad week

- Tesla sets sales record but misses targets

- Tesla recalls 2 mil vehicles for Autopilot defects

A big hit to Musk’s wealth

The court’s ruling, if upheld after the almost certain appeal, would sharply reduce Musk’s wealth, possibly knocking him off his perch as the richest man in the world. The pay deal was the single largest ever approved by a U.S. corporation.

The court’s ruling, if upheld after the almost certain appeal, would sharply reduce Musk’s wealth, possibly knocking him off his perch as the richest man in the world. The pay deal was the single largest ever approved by a U.S. corporation.

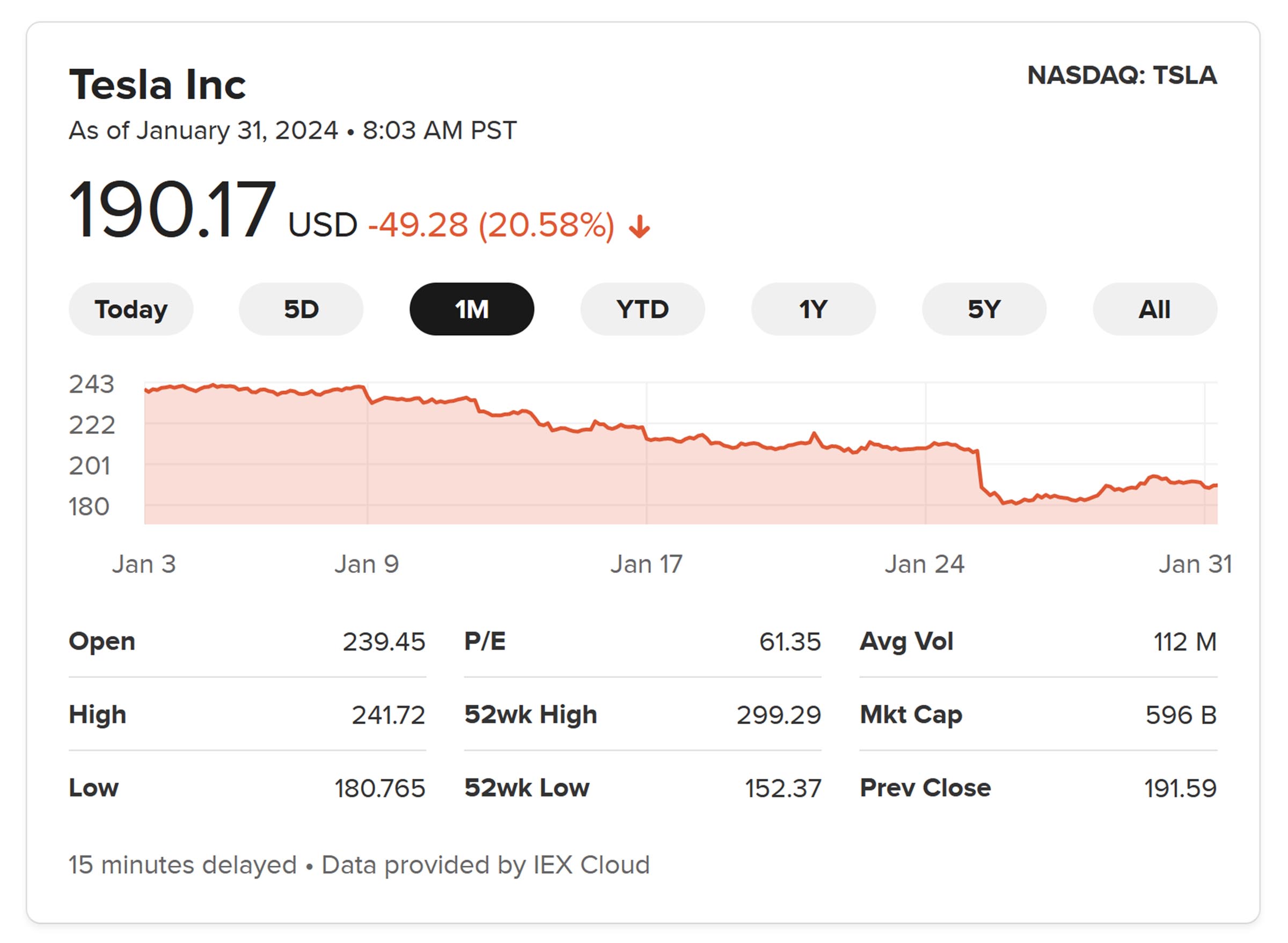

In November 2023, both Forbes and Bloomberg estimated Musk’s wealth at somewhere between $198 billion and $220 billion. The precise figure has also been hit by the sharp decline in the price of Tesla stock – on which much of the CEO’s wealth is based. In January alone, TSLA tumbled about $56, opening Tuesday at $187.00 a share. It is, however, up from a 52-week low of $152.37.)

More trouble ahead

The court’s ruling could create a serious issue for Musk as he struggles to address the declining value of X. Musk sold off billions of dollars in stock in 2022 to help fund the purchase of the social media site formerly known as Twitter.

At the time, it was valued at $44 billion but that has plunged since the takeover was completed in October 2022, largely due to the collapse of X’s advertising base. Major advertisers, such as IBM, Disney and Apple, have fled the site as criticism grows of anti-semitic and racist posts, as well as Musk’s own turn to the extreme right.

With the value of X estimated by various analysts now down below a third of its pre-takeover worth, and with its annual revenues down by billions, Musk faces potentially serious problems. He backed many of the loans he arranged to back the Twitter purchase with Tesla stock. Not only is that stock now far less valuable, but Musk could lose a large chunk of his holdings if Judge McCormick’s ruling stands.

Musk’s latest demands

Even as the Delaware court was preparing to issue its ruling, Musk laid out another major demand. He told the Tesla board that he expected them to grant him 25% control of the EV maker. Alternatively, he warned, he would refuse to give the company access to the artificial intelligence and robotics technologies he has been working on.

That would be about double the value of his current stake in Tesla – which would further decline as a result of the new ruling on his 2018 pay package.

The latest demand has generated significant pushback, even from some normally friendly investors. There’s never been a more delusional CEO that I’ve ever invested with,” said Ross Gerber, whose firm, Gerber Kawasaki owns about 400,000 Tesla shares. “Elon’s pay package is worth $50 billion which, you would think, would incentivize any human on earth,” Gerber said during an appearance on Fox Business last week.

Tesla’s slump

Gerber is one of a growing number of investors questioning Musk’s behavior, as well as his stewardship of Tesla.

“None of his actions are to benefit Tesla,” the investor said. “He thinks in some weird world that what he says matters, but what he’s really doing is destroying everything he built.”

Tesla’s shares were hammered last week when Musk revealed the company’s fourth-quarter and full-year financial data. While sales were up, they missed earlier forecasts, as did revenues and margins were down sharply, especially during the final months of the year. Musk predicted more trouble ahead as growth of the overall EV market slows, sending shares into a one-day tailspin costing 15% of their value.

0 Comments

Trackbacks/Pingbacks