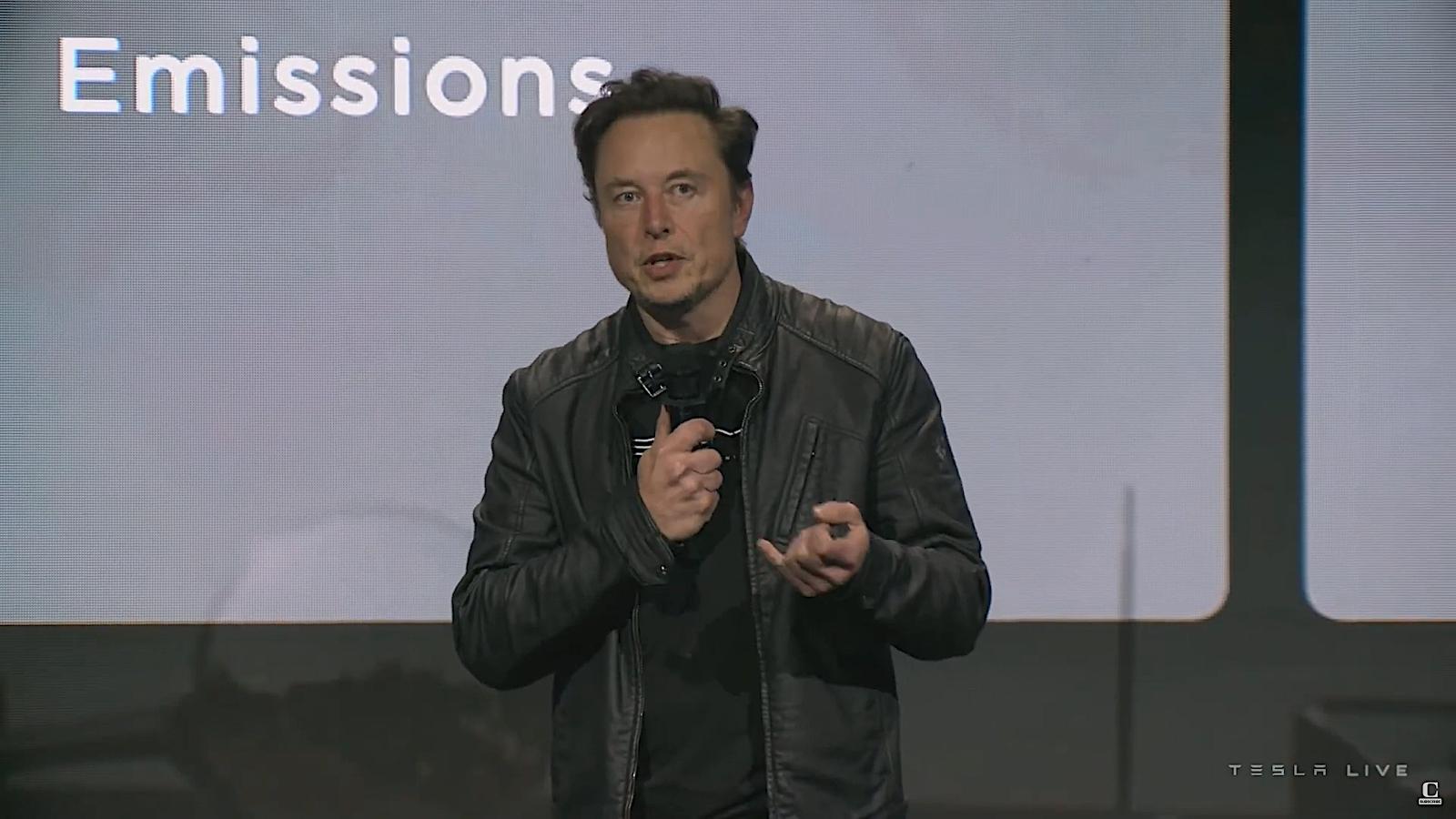

Elon Musk created a fair share of controversy several years ago when he appeared to smoke a joint during an appearance with podcaster Joe Rogan. A new report is kicking up even more dust, the Wall Street Journal alleging money and drugs have improperly tied the Tesla CEO to the same board of directors that previously approved a $55 billion pay package for Musk.

The court’s ruling on Musk’s pay package cited a too-cozy relationship between Musk and Tesla’s board.

When Delaware Chancery Court Judge Kathaleen McCormick last week struck down the $55.8 billion pay package awarded to CEO Elon Musk by the Tesla board of directors, she called the deal “unfathomable.” But she went a step further, directly taking aim at the board which, McCormick said, had “extensive ties: to Musk. In particular, she took aim at the compensation committee that negotiated the deal, saying it’s members “were beholden to Musk or had compromising conflicts.”

Just how compromising were those conflicts? A new report by the Wall Street Journal makes some serious allegations, raising concerns not only about extensive financial links but also the use of drugs within that tight-knit community.

The report has escalated growing concerns about both Musk and Tesla, the EV maker’s shares tumbling by as much $15, or about 6%, in Monday morning trading. That’s on top of a broader slide that began last December. Since the beginning of 2024, meanwhile, Tesla stock has lost about a quarter of its value, wiping out hundreds of billions in market capitalization.

“Deep personal and financial ties”

The WSJ report asserts that “the connections (between Musk and Tesla directors) are an extreme blurring of friendship and fortune and raise questions among some shareholders about the independence of the board members charged with overseeing the chief executive. Such conflicts could run afoul of the loose rules governing what qualifies as independence at publicly traded companies.”

It outlines some of the ties supposedly independent board members have had over the years with Musk, including Oracle founder and former director Larry Ellison who not only had tens of millions invested in Tesla but also in another of Musk’s major company, X, the former Twitter. Current independent board member James Murdoch, son of the Fox empire’s Rupert Murdoch, has money in both Tesla and SpaceX. Another independent director, Ira Ehrenpreis, has investments in Tesla, SpaceX, Neuralink and The Boring Co.

Drying out

The Journal alleges some board members used illegal drugs, at time sharing them with the CEO, according citing sources both inside and associated with Tesla who had knowledge of the incidents. Musk, in particular, reportedly has used not just marijuana — which now is legal in many parts of the country — but cocaine, LSD, ecstasy and hallucinogenic mushrooms. The report claims Musk used some of those substances at “drug-fueled events,” including parties in Mexico and the Burning Man Festival.

Oracle founder and former Tesla director Larry Ellison reportedly offered to help Musk “dry out,” according to the WSJ report.

The problem got bad enough, the publication reported over the weekend, that “The former Tesla director (Ellison) invited Musk to Hawaii to dry out from drugs.” It also noted that the Oracle founder described himself as “very close friends” with the Tesla CEO.”

Separately, Musk went to bat for another former director, Steve Jurvetson, after he became embroiled in a sex-and-drugs scandal stemming out of his work on Wall Street.

Other Tesla News

- Judge strikes down Musk’s “unfathomable” $55.8 billion pay package

- Another Tesla recall – even as feds upgrade probe of allegedly defective steering

- Tesla sets sales record but misses targets

The payoff

Musk is no stranger to controversy, actively courting it since purchasing Twitter and renaming it X.

Landing a board position with a major corporation provides prestige and cash. The General Motors proxy statement shows that some of its directors have received more than $300,000 in salaries and other compensation in recent years.

The Journal noted that Tesla board members are paid solely in stock options. But most of the current directors “have amassed shares worth hundreds of millions of dollars from their seats over the years, significantly more than what board members at other companies make for their service.”

Some of them have agreed to return some of their compensation as part of a shareholder lawsuit’s settlement. The court has yet to approve the deal.”

Ongoing concerns

This is the latest report alleging drug issues at Tesla, Musk in particular. It raises numerous concerns, not only about the impact on the CEO’s judgement but on other legal ramifications.

It could threaten not only his personal relationship with the federal government but security clearances involving SpaceX which is involved in numerous secret programs.

Last month, Musk’s attorney Alex Spiro told the WSJ the CEO is “regularly and randomly drug tested at SpaceX and has never failed a test.” He and Musk have so far failed to respond to new questions from the Journal. An e-mail query from Headlight.News has not been responded to. Tesla no longer maintains a public relations department.

Board in the bullseye

Over the last several years there have been calls by some major Tesla shareholders to remove the CEO.

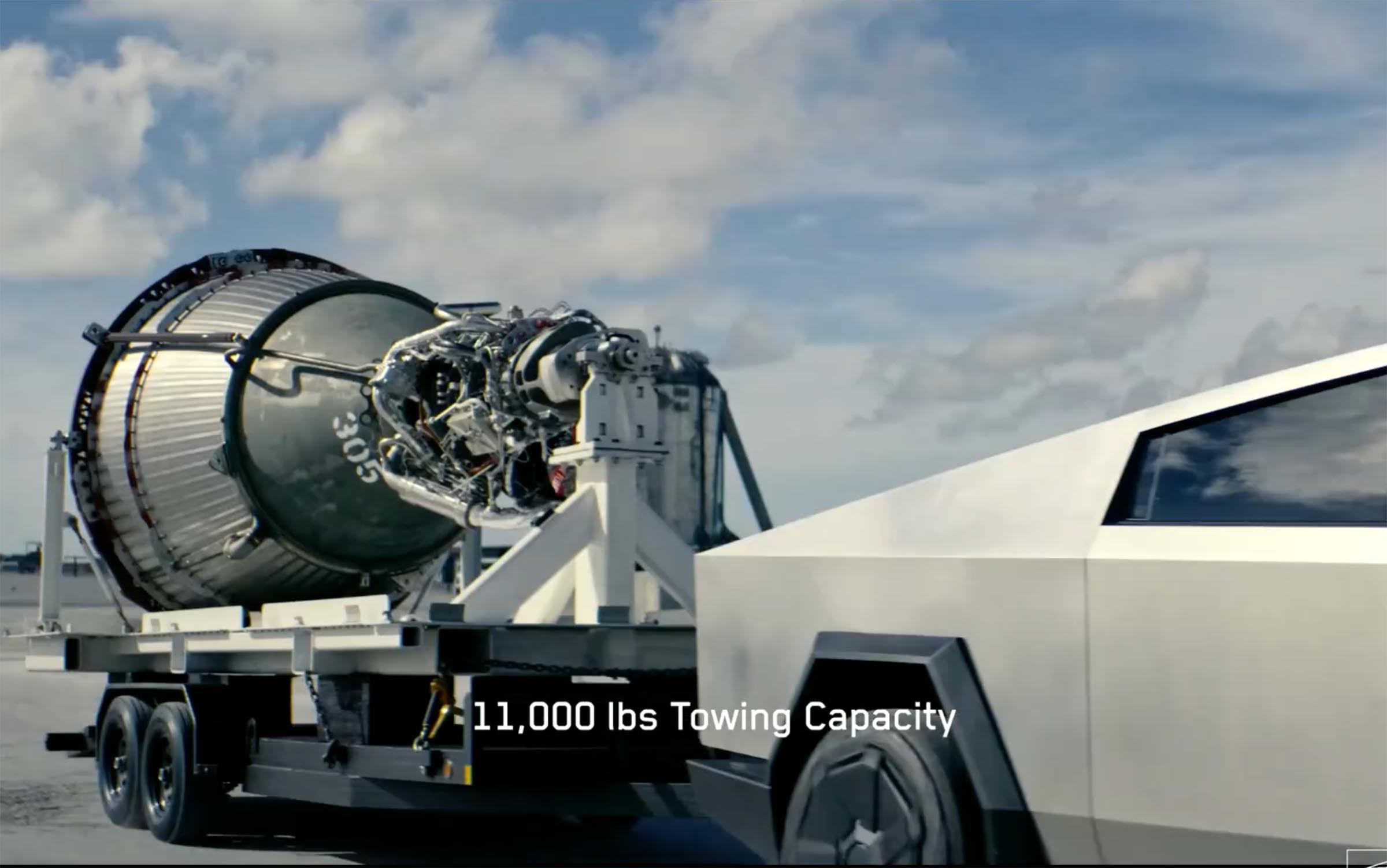

The report could create headaches for SpaceX which is required to be a drug-free company due to federal contracts. (A Tesla Cybertruck is shown here towing a SpaceX rocket motor.)

But Tesla directors now could come under more intense scrutiny. Rules at the Nasdaq, where Tesla shares are listed, call for the majority of board members to be independent, which rules out not only Elon Musk’s brother Kimbal but those who are employees or who have otherwise close relationships that “would interfere with the exercise of independent judgment.”

The current members have already come under fire, with Amalgamated Bank – which has roughly $180 million in Tesla holdings – last year calling for the board to step up its “meager oversight” of the CEO.

What next for Musk?

Over the years, Musk has not only survived a stream of controversies but seemingly encouraged them, even at the occasional detriment to companies he owns or dominates.

Several analysts have told Headlight.News that the CEO’s ongoing swing towards extreme right-wing politics has contributed to slowing growth in Tesla sales. Comments last autumn perceived as being anti-Semitic cost X potentially billions in revenue as major advertisers such as IBM and NBC fled.

It’s unclear whether the new report might make more difficult the anticipated appeal of the Delaware court’s rejection of Musk’s $55.8 billion pay package. It could also fuel already strong opposition to Musk’s demand to receive 25% voting control of Tesla.

While Musk and Tesla have faced some modest scrutiny from federal securities regulators — paying millions in fines on several occasions — critics say the CEO continues to flout the rules. The question now is whether the new allegations could force not only the SEC to step in but other regulators overseeing Musk’s various corporate ventures.

0 Comments