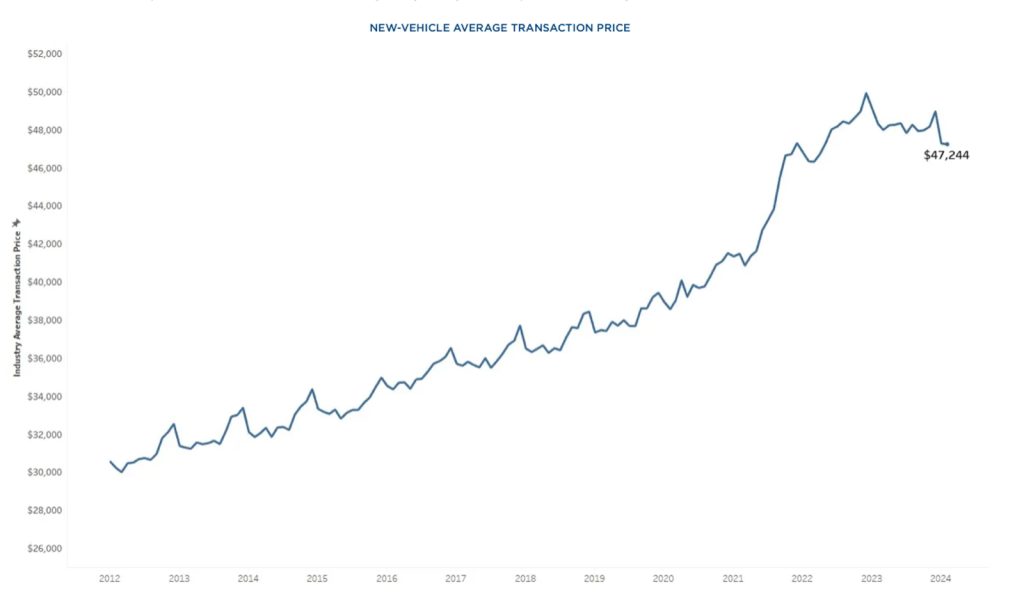

The average transaction price, or ATP, for new vehicles dropped again in February, falling a little less than 1% compared to January prices. Rising inventories and increased incentives keep pushing the prices paid for new vehicles down.

U.S. consumers paid an average of $47,244 for a new vehicle, which is 2.2% lower than February 2023. It’s also 5.4% lower than the high-water mark achieved in December 2022, according to Cox Automotive.

However, if it still feels like you’re paying more than you should, well, that’s because the market hasn’t recovered from the big run up on prices during the COVID pandemic. Prices are 14% higher than in February 2021, which is still a significant jump.

“While everyone may applaud that prices are coming down, even marginally for the moment, affordability is still challenging the market,” said Erin Keating, executive analyst for Cox Automotive.

“Most shoppers have not seen their incomes increase as quickly as vehicle prices, so affording a new vehicle remains difficult. We should also note that despite rising inventory, which is good for consumers, the levels are muted, not alarming.”

Competing elements

While there is a backlog of new vehicle buyers who delayed their purchase due to a lack of inventory in the wake of the pandemic. Some remain out of the market because of the rise in interest rates.

However, automakers are attempting to lure more shoppers back with bigger incentives. Cox analysts noted incentives comprised 5.9% of the transaction price in February, which is up slightly from the 5.7% in January. That’s significantly higher than the nadir of September 2021 when incentives made up just 2.1% of the ATP.

Despite the rise in incentives, finding an inexpensive new vehicle is tougher than ever. Of the 270-plus models available to U.S. buyers, just nine vehicles featured an ATP of less than $25,000. Of those, only the Kia Rio and Mitsubishi Mirage could be had for less than $20,000.

While vehicle price increases have slowed in the past year, the industry’s vehicle mix and shift toward luxury has tilted the U.S. auto market away from affordability. In February 2021 — three years ago — there were 29 vehicles with transaction prices routinely below $25,000, including eight different models transacting below $20,000, Cox noted.

More sales stories

- Ford, Volvo Report Double-Digit Sales Jumps in February

- Sales of Hybrids Help Automakers Boost February Deliveries

- Healthy January Sales Get Car Business Off to Good Start in 2024

Most money on the hood

Shoppers looking for the biggest incentives should head to the luxury dealer lots, where they accounted for 6.1% of the ATP, which is twice as high as the year-ago period. The average price paid for a luxury vehicle was $61,424, which is up marginally from January.

Non-luxury vehicle ATPs last month were $44,052, generally unchanged from January, when prices were estimated at $44,062.

The average price paid for an electric vehicle in February was $52,314, down from a revised $54,863 in January, according to Cox Automotive and Kelley Blue Book estimates. EV transaction prices in February were lower year over year by 12.8%, an accelerating decline compared to January when prices were lower year over year by 11.6%.

The market’s general EV price decline has been led in part by the two most popular EVs in the U.S. – the Tesla Model 3 and Model Y. Transaction prices for the Model Y last month, estimated at $49,363, were the lowest on record and were lower versus February 2023 by 16.2%.

Model 3 transaction prices last month, at $43,614, were lower year over year by 12% and near the lowest level on record. High incentives and discounts on most models also continue to play a major role in lower EV prices.

0 Comments