Tesla made good on previously announced plans to raise prices on its bestselling Model Y by $1,000 in the U.S. The move was revealed a few weeks ago, and now it’s been put in place. The price increase comes as new study suggests CEO Elon Musk is putting off potential buyers.

The base Model Y now costs $44,990, while the long range and performance versions come in at $49,990 and $53,490 — all $1,000 increases.

The base Model Y now costs $44,990, while the long range and performance versions come in at $49,990 and $53,490, according to the Tesla website. Musk announced the planned increase in mid-March.

Musk, who not only runs the world’s largest EV maker but also social media outlet X, formerly known as Twitter, is a big personality. Some view him as an eccentric genius while others are much less kind.

Concerns about his ever more mercurial personality have cause some shareholders and observers to wonder if his support of the more extreme elements of the Republican Party in the U.S. and his perceived support of anti-Semitic comments — he has repeatedly denied he is anti-Semitic — will negatively impact the EV company.

We have a problem

A new study by research firm Caliber suggests the CEO and his opinions which are broadcast rapid fire on X, are now costing the publicly traded electric vehicle company potential new vehicle sales.

Tesla CEO Elon Musk may be negatively impacting his EV company by closely aligning with extreme parts of the Republican Party, a new study suggests.

Caliber creates a “consideration score,” and did so for Tesla. The company’s consideration score is now 31%, according to Reuters, which was given exclusive access to it. Tesla’s consideration score at 70% in November 2021. The score is a tracking tool for consumer interest in a brand.

The company’s “Trust & Like” score fell from the low 80% range to the mid- to high-50% range during the same period.

In the short term, Tesla’s consideration score is also falling, dropping 8 percentage points from January. The slide comes as Caliber’s scores for Mercedes, BMW and Audi, which produce gas as well as EV models, moved upward during the same period, reaching 44%-47%.

Inextricably linked

“It’s very likely that Musk himself is contributing to the reputational downfall,” Caliber CEO Shahar Silbershatz told Reuters. He noted his company’s survey shows 83% of Americans connect Musk with Tesla.

In short, the further away from the mainstream Musk appears to be, the more difficult he makes it to sell his vehicles, which already suffer from perception problems about quality. Musk has repeatedly dismissed the issue.

“Whether you hate me, like me or are indifferent, do you want the best car, or do you not want the best car?” Musk said at an event in November, according to Reuters.

That’s another problem he’s facing: there are an increasing number of options. The internet is chock full of stories and shorts of people shifting from their Teslas to offerings from Kia, Hyundai, Ford and others.

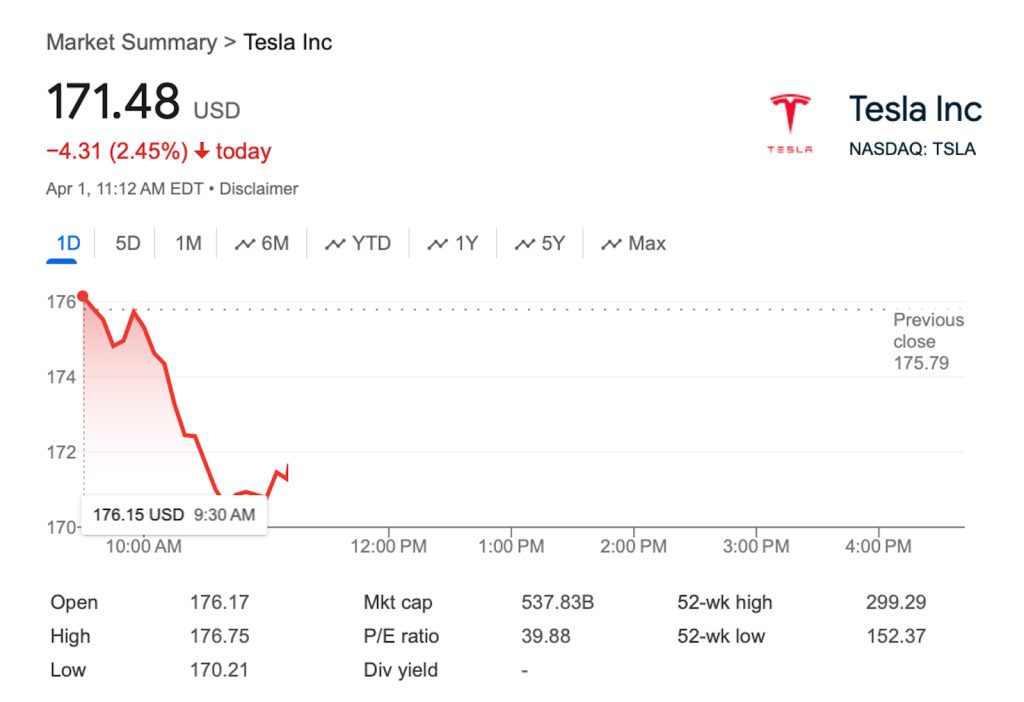

The bad news of the price increase as well as the increasing negative perception about the company has the stock down more than $4.20 a share to $171 range in morning trading. The stock is down from $250 a share at the beginning of 2024.

More Tesla Stories

- Better Move Fast if You Want a Tesla Model Y — Prices are Going Up

- Money, Drugs, Elon Musk and the Tesla Board of Directors

- Tesla Stock in Freefall: How Low Will it Go?

Tougher numbers coming

While EV sales are expected to rise 15% during the first quarter, according to Cox Automotive Inc., Tesla’s only expected to see a small gain of about 3% — a far cry from the massive double- and triple-digit hikes investors and observers are accustomed to and far below the long-term predictions made by Musk in the past.

Like many other automakers, Tesla is expected to report its first-quarter sales numbers this week. Wall Street consensus expects first-quarter deliveries of 457,000 units, according to FactSet. However, actual predictions are expected by many to be closer Tesla’s 422,875 number from Q1 2023, reports Investor’s Business Daily. Tesla t hit a record 484,507 deliveries in Q4 2023, which means some fall off is likely.

Tesla announced Friday it had had produced six million cars, which led some observers to increase Q1 production estimates.

Earnings roller coaster

Many aren’t optimistic about the company’s Q1 earnings results either as the analyst consensus now has 2024 Tesla earnings well below 2023’s results. This suggests another year of earnings declines for this growth stock. The “street” expects Tesla earnings per share to come in at just $2.87 in 2024: an 8% decline vs. last year’s $3.12.

Wall Street’s 2024 EPS consensus estimates for Tesla have now come down nearly 25% since the end of 2023, IBD reproted. Some analysts believe earnings could drop even further, potentially around 2021 EPS of $2.26.

There is good news on the horizon for the company and its shareholders as business is expected to increase in the second quarter due to strong Model 3 and Cybertruck sales.

Wall Street currently forecasts Q2 deliveries of 510,000 units, according to FactSet. Troy Teslike, who closely follows delivery trends for the EV maker, estimates have second-quarter deliveries totaling 460,000, which would be slightly below Q2 2023.

However, Teslike does have Cybertruck deliveries doubling from slightly more than 4,000 in Q1 to 8,160 in Q2 in the U.S. Teslike also has Model 3 sales in the U.S. growing 70% in the second quarter compared to Q1, as production improves.

0 Comments