With sales falling sharply, the first quarter of 2024 was an “unmitigated disaster,” according to one of Tesla’s big boosters. Now, one of the automaker’s big critics is warning the company could “go bust.”

There’s no question things didn’t go very well for Tesla during the first three months of this year. The automaker reported delivering just 386,810 of its battery-electric vehicles worldwide. Industry analysts were forecasting figures ranging from 449,080 to 454,200 EVs, making this the biggest shortfall for Tesla in years.

Tesla has a history of extreme ups-and-downs, as anyone who has invested in its stock needs to be well aware of. But the latest delivery numbers – coming at a time when the growth in the global EV market has slowed sharply – seems to be making even the company’s traditional bulls increasingly nervous. Dan Ives, at Wedbush Securities, called the Q1 results an “unmitigated disaster.”

He sounds like an optimist compared to Per Lekander, a managing partner at the investment management firm Clean Energy Transition. During an appearance on CNBC’s “Squawk Box Europe,” Lekander warned that, “I actually think the company could go bust.”

“End of the Tesla bubble”

Over the past five years, a chart of Tesla’s share price resembles some of the scariest roller-coasters in the country. Investors certainly have been taken on a wild ride. The numbers peaked at $407.36 a share on November 15, 2021. They have largely lost momentum since October 2022 when CEO Elon Musk finished his controversial acquisition of Twitter – now renamed “X.” Since Wall Street reopened on January 2, 2024, Over the past five years, a chart of Tesla’s share price resembles some of the scariest roller-coasters in the country. Investors certainly have been taken on a wild ride. The numbers peaked at $407.36 a share on November 15, 2021. They have largely lost momentum since October 2022 when CEO Elon Musk finished his controversial acquisition of Twitter – now renamed “X.” Since Wall Street reopened on January 2, 2024, shares have fallen about 30%, closing on Wednesday, April 3 at an even $170.00 – though they were up slightly on Thursday morning.

Where things will go now is a matter of hot debate. Wedbush analyst Ives still sees the opportunity for a solid rebound, holding to his target of $300 a share. A search through the list of analysts covered by Zacks and other tracking services shows an increasingly broad range of estimates. Lekander is clearly an outlier. But he’s garnering far more attention than he might have just a few months ago, the hedge fund manager warning that Tesla could plunge to a low of $14 a share.

“This was really the beginning of the end of the Tesla bubble, which probably, arguably was the biggest stock market bubble in modern history,” Lekander said, warning that if Tesla shares really go that low, “It’s going to go bust.

New math

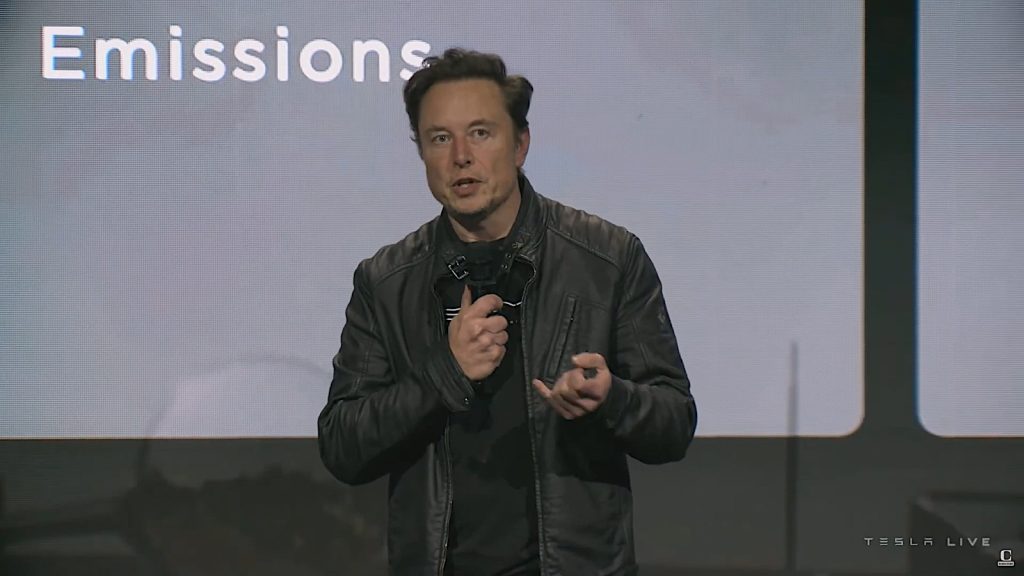

Elon Musk is facing growing criticism for his posts on X, and that could be turning off potential buyers, according to Caliber research.

From the time Tesla shares started trading on the Nasdaq market in June 2010 Wall Street has used a very different set of metrics to determine its worth.

It’s been trading at nearly 60 times its projected earnings. That’s substantially more than what investors value “legacy” automakers like General Motors, Toyota Motor Corp. and Volkswagen AG at, and more in line with the brightest tech stocks such as Apple or Microsoft.

Lekander’s $14-a-share forecast would come closer to the metrics used for traditional auto companies and is about 10 times the $1.40-a-share earnings he expects from Tesla in 2024.

More Tesla News

- Tesla Raises Prices – Even as Musk’s Reputation Plunges

- Better Move Fast if You Want a Tesla Model Y — Prices are Going Up

- Money, Drugs, Elon Musk and the Tesla Board of Directors

The bulls could start running with the bears

While Lekander remains an outlier, even some of the biggest bulls are starting to question whether the Tesla bubble could burst.

“Let’s call this as it is: While we were anticipating a bad 1Q, this was an unmitigated disaster 1Q that is hard to explain away,” Ives said in a note to investors on Tuesday. “We view this as a seminal moment in the Tesla story for Musk to either turn this around and reverse the black eye 1Q performance.”

But others are more upbeat. During an appearance on the Asian version of “Squawk Box,” RBC Capital Markets analyst Tom Narayan, insisted Tesla’s weak quarter was “one-time in nature.”

Tesla’s spin

For its part, the automaker insisted that was closer to the case, blaming a variety of factors, such as supplier disruptions, for its weak performance.

While supplier issues can be addressed, there are other challenges that could prove harder to address. Competition is growing at a rapid rate, underscored by the rapid and increasingly global expansion of China’s BYD. Korean brands are a growing threat, as well, even as EV sales growth slowed. Kia, for example, saw U.S. demand for its EVs rise 151% in March. It could gain even more momentum after its new 3-row electric SUV, the EV9, was named World Car of the Year during a ceremony at the New York International Auto Show last week.

Add growing concerns about CEO Musk. Research firm Caliber found that Tesla’s “Consideration Score,” which indicates whether potential buyers are looking seriously at the brand, has fallen from 70% in November 2021 to just 31% now. The company’s “Trust & Like” score fell from the low 80% range to the mid- to high-50% range during the same period, Reuters reported this week.

Requests for comment by Tesla have not been responded to. The company no longer maintains a media relations department.

An upside?

Tesla could face more challenges in the near-term, driven in part by a lack of new products. It recently updated the aging Model 3 but it was more of a modest, midcycle refresh than a serious makeover. The new Cybertruck, meanwhile, has generated far more controversy than sales.

It will be at least a year until anything significant comes out of the Tesla pipeline, based on Musk’s revelation that the automaker is working up a new entry offering – a possible Model 2 – that could come in as low as $25,000. One concern is that Tesla could be later to market than expected, as was the case, again, with Cybertruck. And that low an MSRP would make it harder to deliver the double-digit margins Tesla was celebrated for.

There are opportunities to boost revenues and earnings. Tesla could drive up demand for its Full Self-Driving technology which commands a $199-a-month subscription fee. On the flip side, it still hasn’t met the goal of full hands-free driving the name promises and is coming under increasing scrutiny from both consumer and safety advocates. Separately, Tesla is pushing to expand its business in other green tech sectors, including energy storage and solar cells.

The automaker’s bulls are convinced that this year’s poor start will soon be forgotten. Ark Invest, one of the biggest Tesla backers, has helped slow the stock’s decline with another large share purchase. But the bears are clearly gaining traction, making investors nervous. Musk and company will have to move soon to prove Tesla remains a safe bet.

0 Comments