If you’ve bought a new car recently you’re well aware of how much vehicle prices have risen over the last decade. In many cases, that’s pricing many potential buyers out of the market. But others are simply taking a deep breath and signing up for hefty loans. The problem is that they may find they’re “underwater” when they next go to trade in – owing more than the vehicle is worth.

Between Hurricanes Helene and Milton there’ll likely be tens, even hundreds of thousands of flooded vehicles that need to be replaced. But owners in the Southeast hit by those storms won’t be the only ones worried about being “underwater.”

The price of a typical new vehicle has risen by nearly 50% over the past decade, well beyond the pace of income growth for the typical American. As a result, many potential buyers have been priced out of the new car market. For those who don’t want to go with a previously owned model the challenge is finding a way to absorb rising sticker prices. On the whole, buyers haven’t substantially increased their downpayments. And that means they’re taking bigger loans, according to several recent studies.

In turn, to handle the bigger monthly payments, they’re stretching out their loan terms. Nearly one in five now are paying off their vehicles over 84 months. But, because of the way financing works, that means many will find themselves owing more on their loans than the vehicle is worth when it comes time to trade in – a situation professionals refer to as being “underwater.”

Outpacing inflation

The typical new vehicle now costs more than $48,000 by the time a customer drives off the dealer lot.

On average, inflation has increased the price of consumer goods by about 35% since 2014. But the situation is far worse – at least from a buyer perspective – when it comes to automobiles.

The average transaction price – which factors in a vehicle’s MSRP, mark-ups, incentives and options – was $32,495 in 2024, according to industry data. This month it’s expected to come in at $47,936, according to Cox Automotive, a rise of nearly 50%.

While there are some buyers who can stroke a big check or whip out a fat wallet, the vast majority of American vehicle buyers have to finance their purchases. And that’s been complicated by the fact that interest rates have been running at levels not seen in several decades.

Loans get longer and longer and…

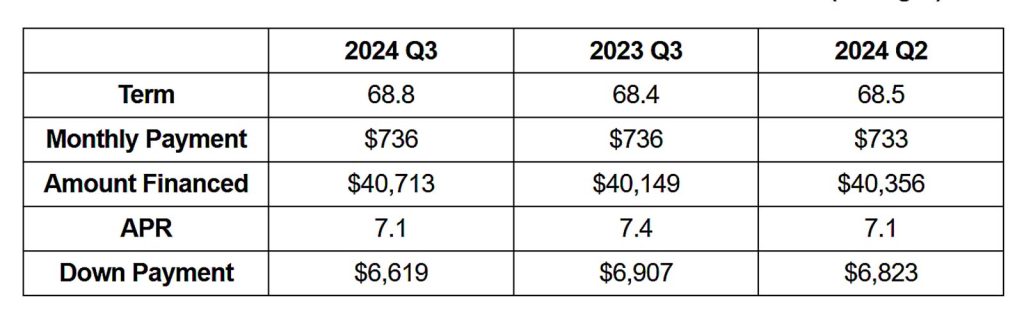

When Baby Boomers were buying their first cars, loans typically ran 24 to 36 months, with the occasional 48-month term for those willing to stretch for the car of their dreams. That has steadily increased over the decades and, by the turn of the millennium, many customers were signing 60-month notes. But that has become more the norm than the exception these days. By the middle of this year, the average auto loan term was 68.48 months, reported consumer tracking firm Experian.

When Baby Boomers were buying their first cars, loans typically ran 24 to 36 months, with the occasional 48-month term for those willing to stretch for the car of their dreams. That has steadily increased over the decades and, by the turn of the millennium, many customers were signing 60-month notes. But that has become more the norm than the exception these days. By the middle of this year, the average auto loan term was 68.48 months, reported consumer tracking firm Experian.

A new study by Edmunds shows that 69% of new vehicle buyers now sign loans of 60 months or longer. Meanwhile, 84-month terms accounted for 15.8% of new vehicle purchases during the first quarter of 2024 and are now running at 18.1%.

Even so, motorists are still having to come up with more cash every month. With new car prices currently just a hair below the record levels reached during the final months of 2022, Edmunds found that more than one in six new car buyers, about 17.4% to be more precise, are shelling out over $1,000 a month for their loans. That’s despite an average $6,619 downpayment, a near record, during the third quarter.

More Consumer Auto News

- EVs, Hybrids Salvage an Otherwise Weak September

- What’s Coming to this Year’s Paris Motor Show

- Traffic is Getting Back to Normal – But Some Cities are Just Better to Drive In

Winding up underwater

How do you wind up underwater on a car loan?

First, it helps to understand that your new vehicle loses value the moment you drive off the dealer lot. And its value, if typical, will drop by 20% during the first year. At the same time, you’re initially paying off mostly interest on your loan. So, that $50,000 SUV might only be worth $40,000 at the first anniversary of your purchase. But you might owe the bank as much – or more – than the original purchase price. With an 84-month loan you may not break even until you’re into the fifth year.

Trade in before then and you’ll owe the bank money – on top of what you might pay for your new vehicle.

“Longer loan terms might make monthly payments more palatable for consumers, but the harsh reality is that most Americans don’t want to keep their vehicle for seven years,” said Ivan Drury, Edmunds’ director of insights. “Simply put, longer loan terms put car owners at greater risk of rolling negative equity into their next auto loan.”

Some relief may be on the way

The news isn’t entirely bleak. New car prices have actually settled back a bit from late 2022 when they set an all-time high ATP of $48,681, according to Kelley Blue Book. And while prices are still going up on some models the increases so far appear to be more modest on 2025 models, several analysts told Headlight.News.

On top of that, after having saddled many buyers with mark-ups on popular products during the COVID pandemic, automakers and their retailers seem more willing to bargain these days. As inventories rise, meanwhile, incentives are becoming more common again. And the Federal Reserve Board is lending a hand. It just lowered its interest rate by a half point, with another cut expected at its next meeting.

“The Fed’s decision to cut rates was a welcome update at the end of the quarter but, on its own, is unlikely to dramatically change the financial landscape for car buyers,” said Jessica Caldwell, Edmunds’ head of insights.

I’m sure a lot of the blame is with the banks that give loans that aren’t justified based on income and expenses.