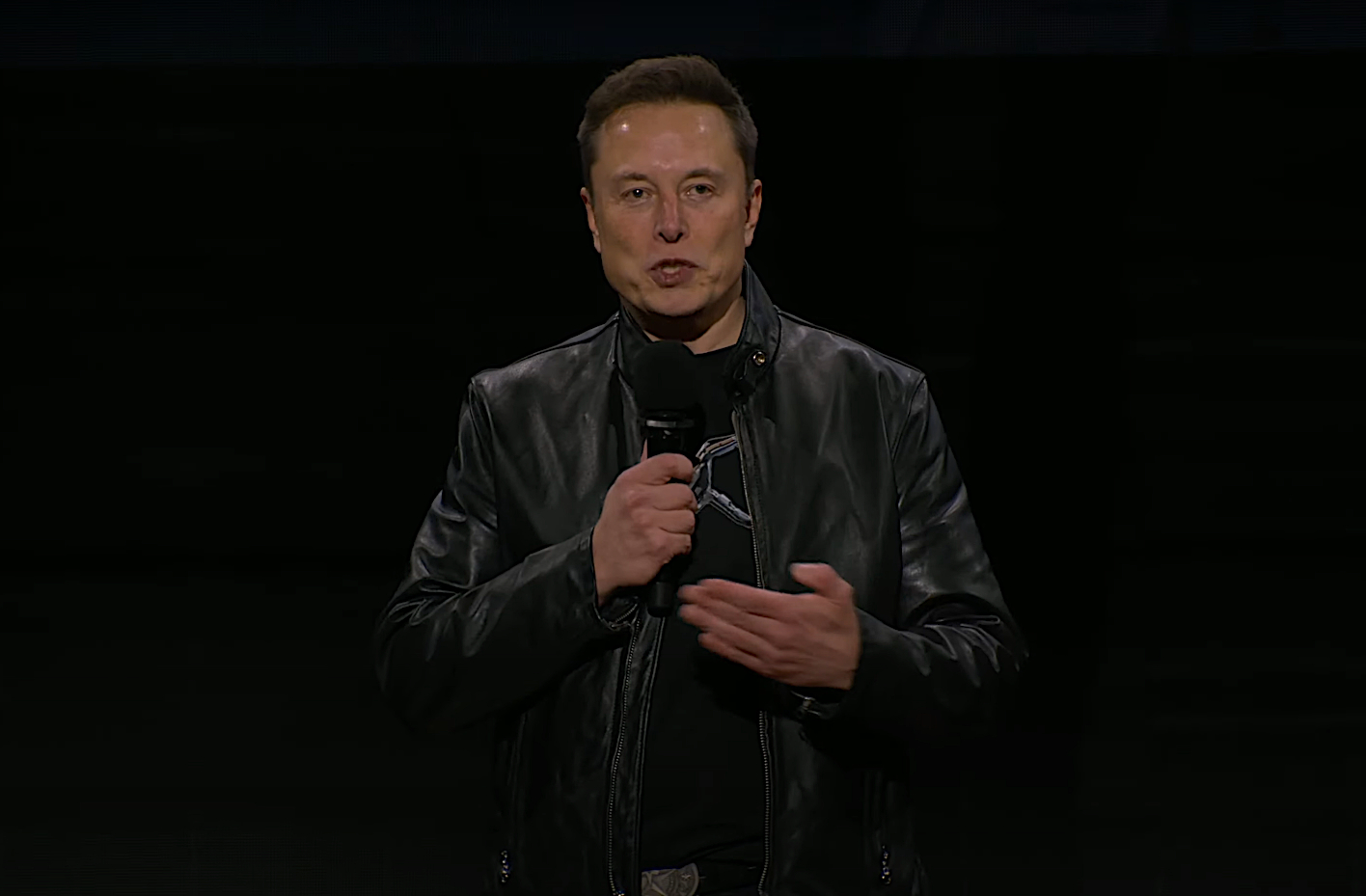

A Delaware judge has again rejected the $56 billion payout for Tesla CEO Elon Musk, even after shareholders voted to reinstate the package earlier this year. But even if the ruling is upheld, the South African-born entrepreneur and confident to President-elect Donald Trump is expected to remain the world’s richest man.

Tesla CEO Elon Musk handed over the keys to the first dozen Cybertrucks during a ceremony at the company’s Austin, Texas Gigafactory in November 2023.

Tesla CEO Elon Musk could wind up about $56 billion poorer than he might have expected just a few days ago, now that a Delaware judge has again rejected the pay package stockholders approved earlier this year.

It marks the second time Chancery Judge Kathaleen McCormick backed opponents of the record-setting payout, She declared that her original ruling, issued last January, still stands and that Musk and his supporters on the Tesla board weren’t entitled to hit “reset,” even if that involved a vote by shareholders.

“Were the court to condone the practice of allowing defeated parties to create new facts for the purpose of revising judgments, lawsuits would become interminable,” she said in her ruling – which Musk and Tesla have indicated they now plan to appeal.

What’s at stake

Musk’s pay package was first approved by the Tesla Board of Directors in 2018 and was based on 12 tranches, each setting targets for such things as Tesla sales and earnings. If finalized, it was expected to become the largest pay package in history, according to reports by Bloomberg and Forbes.

But, the plan was controversial from the start. It immediately led to a lawsuit filed by Tesla shareholder Richard Tornetta. With other investors joining the case, the issue went to trial in Delaware Chancery Court in November 2022, Judge Kathaleen McCormick issued a scathing 201-page ruling 14 months later.

She called the pay package “unfathomable,” and said it was approved by “starry eyed” Tesla directors “swept up by the rhetoric” that, at the time, made Tesla a “superstar.” She also noted the “extensive ties” Musk had with Tesla directors that appeared to improperly influence their decision.

The shareholders vote

Tesla has had an up-and-down year, with weak sales and earnings during the first half of the year, with a modest rebound during the third quarter.

In a bid to get around that ruling, the Tesla board called for a shareholder vote. About the same time, Musk laid out additional demands, calling for an increased level of control. Otherwise, he warned, he would leave the automaker and take with him access to some key assets, such as the artificial technology under development.

In June, Tesla announced during its annual meeting in Austin, Texas that shareholders voted to approve the $56 billion payout for CEO Musk, effectively reinstating the compensation package that Judge McCormick overturned last January.

But the original plaintiffs in the case sought a new review, despite the vote.

More Musk News

- Court Rejects “Unfathomable” Musk Pay Package

- Tesla, Musk Strike Delicate Balance Between Business and Politics

- Quid Pro Quo: Musk Money Turns Trump into an EV Fan

No do-overs

Elon Musk is now when of the most influential figures working with Donald Trump as he prepares to return to the White House.

In this week’s ruling, Judge McCormick effectively declared there are no do-overs. She dismissed claims that the shareholder vote somehow nullified her original decision.

“The large and talented group of defense firms got creative with the ratification argument, but their unprecedented theories go against multiple strains of settled law,” McCormick wrote.

But while Tesla and Musk were handed a defeat, the judge took a shot at plaintiff attorneys, as well. They had asked for $5.6 billion in fees to cover their own costs, but,

“In a case about excessive compensation, that was a bold ask,” McCormick countered. She wound up awarding them $345 million. It will be paid by Tesla either in stock or cash – or a mix of both.

The case isn’t closed

Both Tesla and Musk spoke out in response to the latest setback. In a tweet on his social media service, X, the CEO said, “shareholders should control company votes, not judges.”

In its own statement, the automaker said, “The ruling is wrong, and we’re going to appeal.” The timing of an appeal has not yet been announced, however.

Responding to the latest ruling, plaintiffs’ law firm Bernstein, Litowitz, Berger & Grossmann issued a statement saying, “We hope that the Chancellor’s well-reasoned decision will end this matter for the shareholders of Tesla.”

However, in an advisory note to investors, Gary Black, the managing partner in the Future Fund wrote that, “I doubt this ruling will be resolved anytime soon, and it will likely be overturned by a more moderate court along the way.” The Future Fund is one of the larger Tesla shareholders and had supported Musk’s proposed payout.

“Iif defendants choose to further delay implementation of this judgment by appealing it, we look forward to the privilege of defending the Court’s thoughtful and well-grounded opinions on appeal to the Delaware Supreme Court,” countered the plaintiffs’ law firm in its statement.

Don’t cry for Musk

If left standing, Judge McCormick’s ruling would result in a substantial hit to Musk’s personal wealth. Nonetheless, Bloomberg reported that the South African-born executive will remain the world’s richest man. His net worth has skyrocketed over the past month as Tesla shares soared in the wake of the 2024 presidential election.

Musk became a key backer of then-candidate Donald Trump’s campaign and is now positioned as one of his closest advisors. Analysts believe this will allow him to influence future policies on not only EVs but on space flight, autonomous vehicles and artificial intelligence, issues that will impact other Musk companies, such as SpaceX.

0 Comments