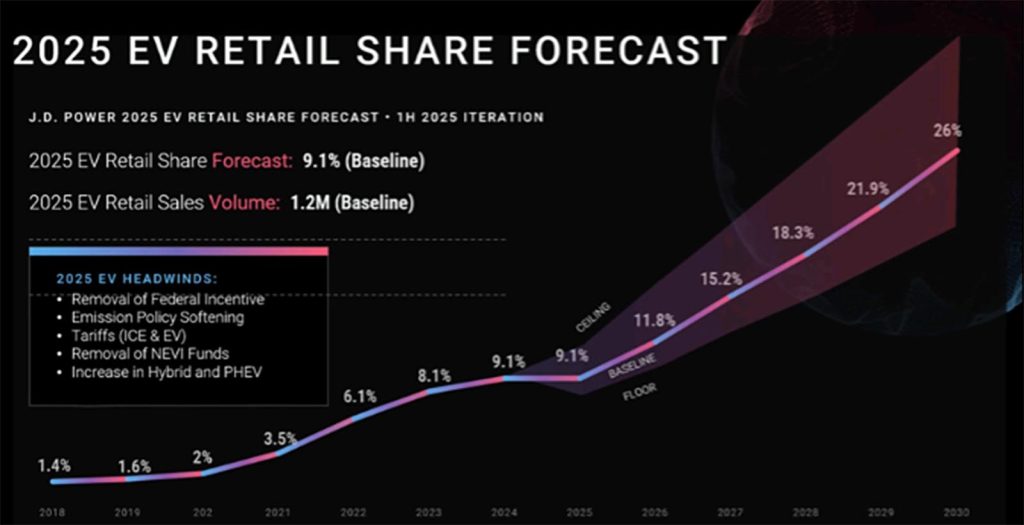

EV sales appear likely to stagnate in 2025 in 2025, largely due to new roadblocks the Trump administration and Congress are ready to throw in the way, according to a new J.D. Power forecast. That could cause major headaches for automakers investing billions to bring more of the vehicles to market. But the research firm still sees demand rebounding later in the decade to the point where electric vehicles will account for more than a quarter of new vehicle sales.

This will be a “reset year” for the U.S. EV market, according to a new forecast by J.D. Power, with sales of battery-electric vehicles to hold steady at around 9.1% of total U.S. market demand.

The California-based market research firm cites a “combination” of factors working against EVs, including “uncertainty about the future of federal EV incentives, possible tariffs on both EV and gasoline-powered vehicles and ongoing challenges with the public charging network.” Adding to the concerns, a group of Republican senators on Tuesday proposed a $1,000 tax, ostensibly to cover road repairs since EV owners don’t pay state or federal excise taxes on fuel.

But Power’s new study is optimistic about the long-term. While EV sales likely won’t hit the optimistic targets laid out by the Biden administration, they’re expected to reach 26% of the American market by 2030.

Slowing demand growth

EV sales surged roughly eight-fold between 2019 and 2023, to nearly 1.1 million. The growth curve, while still significant, dropped to just under 10% in 2024. As the year ended, all-electric vehicles accounted for 9.1% of the American new vehicle market.

Power expects that share to hold in 2025, with total demand reaching about 1.2 million vehicles.

“2025 will be a reset year for EV adoption, in which total retail share will hold at 9.1% as manufacturers and consumers adjust to new market dynamics,” Power said in a summary of its new research. But it also showed some optimism about the future, adding “Longer term, the forecast calls for the EV market to reach 26% retail share by 2030.”

New market dynamics

A variety of factors slowed sales last year, most experts agree, starting with the high cost of the typical battery-electric vehicle. The average transaction price jumped to $55,544, reported Kelley Blue Book, or roughly $6,000 more than the typical gas model – though EVs tended to be in higher price segments and come with more equipment. (The EV figure doesn’t include federal and state incentives, however, the tax credits often making EVs less expensive.)

The lack of a robust public charging network has been seen as another major factor, research has shown.

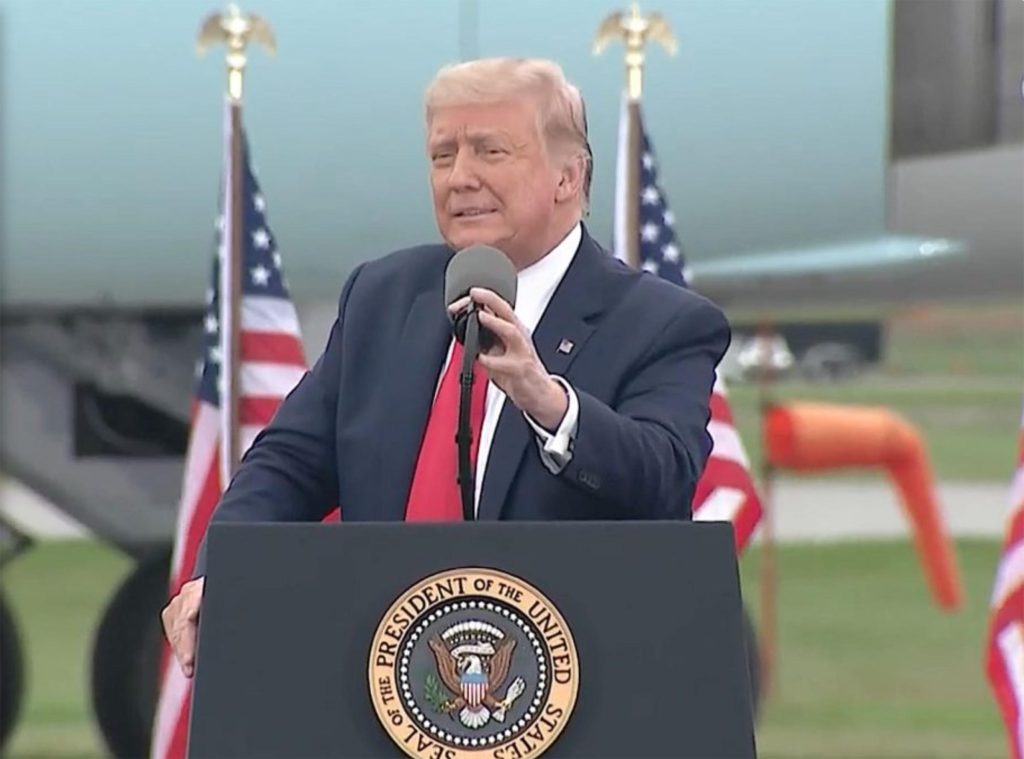

While Biden had hoped to address both challenges, the Trump administration wants to raise those hurdles. The new president has indicated plans to eliminate tax credits of up to $7,500 for EV buyers. The White House last week also put a freeze on the NEVI program, part of the federal infrastructure act providing $5 billion to help create a nationwide network of 500,000 public chargers. Trump also wants to strip away California’s ability to set emissions standards tougher than federal guidelines, rules that would effectively serve as EV sales mandates. More than a dozen other states have adopted those rules.

More EV News

- Forget Incentives, Republicans Want $1,000 Tax on Electric Vehicles

- Trump Vows to Reverse Biden EV Policies

- Trump Steel, Aluminum Tariffs Will Raise Vehicle Prices

New federal EV tax proposed

While a number of states provide incentives for those purchasing a battery-electric vehicle, EV buyers in some other states wind up paying more to register their vehicles than owners of gas- and diesel-powered models. The fees are ostensibly intended to help recover lost gas taxes typically used for road maintenance and repairs. They run anywhere from $50 in Hawaii to $213.70 in Alabama.

Now, a group of Senate Republicans proposes a $1,000 surcharge to make up for lost federal gas excise taxes.

“EVs can weigh up to three times as much as gas-powered cars, creating more wear and tear on our roads and bridges. It’s only fair that they pay into the Highway Trust Fund just like other cars do,” Nebraska Senator Deb Fischer, the lead sponsor, said,

Critics have already attacked the proposal, saying EVs, while usually heavier, typically carry nowhere near that much excess mass. Meanwhile, the average gas vehicle now on the road normally contributes $100 or less in federal excise fees.

All cars could grow more expensive under Trump

There’s growing fear within the automotive industry that all vehicle sales could slide in the coming year, at least if the new president continues to initiate trade wars with allies and other nations providing crucial materials.

Last week, Trump announced new tariffs on imported steel and aluminum, two metals critical to automotive manufacturing. He has put a temporary hold on broader tariffs targeting neighbors Canada and Mexico, traditionally two of America’s largest trade partners, but went ahead with 10% tariffs on China.

The Beijing government responded with new duties of its own on American goods – including some imported vehicles. And the Chinese said they will now limit access to some critical minerals, including metals needed for EV powertrains.

Bucking the trend

While EV sales could stagnate overall, the new Power report anticipates electric vehicles will continue to see growth in at least some states, notably Colorado, Florida, Michigan, New York and Texas. California has traditionally seen the biggest growth rate and EVs there now account for nearly a quarter of the overall new vehicle market.

While EV sales could stagnate overall, the new Power report anticipates electric vehicles will continue to see growth in at least some states, notably Colorado, Florida, Michigan, New York and Texas. California has traditionally seen the biggest growth rate and EVs there now account for nearly a quarter of the overall new vehicle market.

Sales in the Golden State flattened out last year, actually dipping 0.3% in 2024. But “All of the decrease in the state market last year was attributable to Tesla, which had an 11.6 percent decline,” the California New Car Dealers Association said in a statement. “Registrations for all other brands increased 1.4 percent.”

How much of Trump’s anti-EV agenda will be put in place is uncertain. The courts rejected his bid to limit California’s unique status when it comes to setting emissions targets during his first term. And efforts to kill the NEVI program are facing lawsuits, opponents asserting that the current administration cannot claw back funds previously approved by Congress due to strictures set by Watergate-era legislation.

Looking further into the future, Power continues to see significant growth in EV sales, especially as automakers launch new lower-cost offerings, such as the upcoming Chevrolet Bolt EV expected to start under $30,000 – even without federal or state incentives.

“The forecast,” concluded Power, “calls for the EV market to reach 26% retail share by 2030, which is approximately half of the market share the Biden administration targeted in its climate agenda.”

Why should I pay for my neighbor’s EV or charging station?

Eliminating a subsidy IS NOT raising an obstacle.