Automakers and auto buyers could face new import tariffs, based on comments made by President Donald Trump. Such a move would drive up costs not only for foreign-made vehicles but likely also will impact many of those assembled in the U.S. as most of those rely on imported parts and components. With the average transaction price for new vehicles already near record levels, analysts warn, many buyers could be priced out of the market. And, with some trade partners already warning they would strike back with new tariffs of their own, U.S. auto exports may also take a big hit.

While Trump delayed the tariffs he originally planned to enact against Canada and Mexico in February, he has signaled he is getting ready to announce new levies on imported automobiles, parts and components next month.

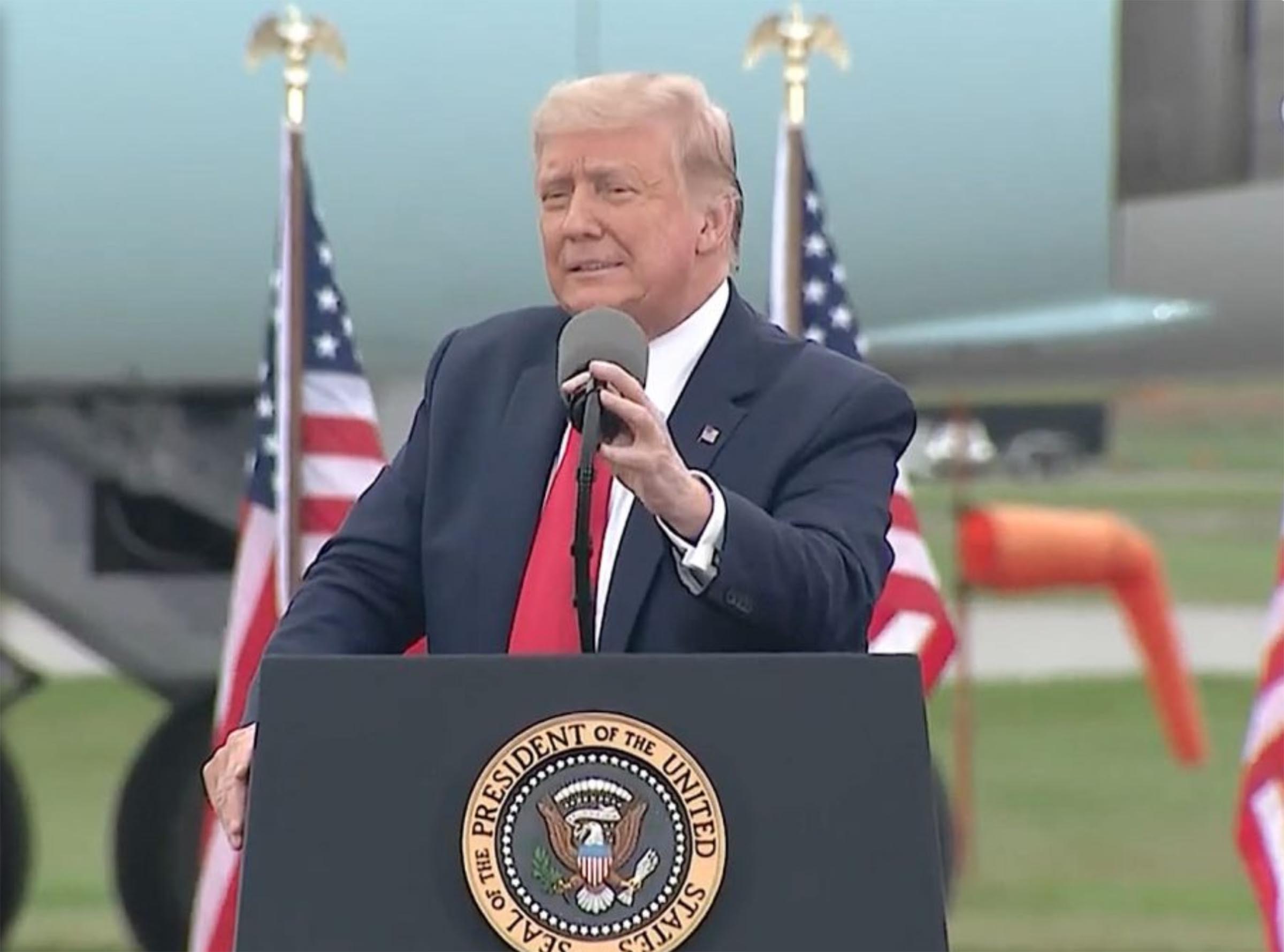

“We are going to do that on around April 2,” Trump told reporters as he signed another executive order in the Oval Office.

Such a move could have a broad impact on automakers and auto buyers alike, further raising vehicle prices that have already been at near-record levels. And, because most vehicles assembled domestically rely on at least some foreign-made parts and components, even those assembled in the U.S. would likely see price hikes as manufacturers pass on their own higher costs. The move could also have a big impact on exports from U.S. automotive factories.

Trump targets trade

Trump could cause “chaos,” some industry insiders fear, by tearing up the current trade agreement with Canada and Mexico where plants like this GM Silao facility are located.

Even before targeting office on January 20, the new president had signaled plans to remake America’s global trade policies. Immediately after his inauguration, Trump focused on the country’s three largest trading partners, Canada, Mexico and China. In 2024 the U.S. imported $81.2 billion in automotive goods from Mexico, for example, while auto exports totaled $31.8 billion, economic tracking service Statista reported.

For the moment, actions against Canada and Mexico are on hold, though Trump did move forward with new tariffs against China – on top of duties enacted during his first term in office, and those levied by former President Joe Biden.

What’s coming in April hasn’t been disclosed but Trump previously indicated he could launch tariffs against other trade partners, including Europe, Japan and South Korea.

Separately, he has now begun taking action in key trade sectors, with new 25% tariffs expected to go into place covering imported aluminum and steel.

Higher prices – fewer models

Some imports, especially base models such as the VW Taos, could disappear from showrooms, some analysts warn.

Automakers have been pleading with the new administration to back down on tariffs covering Canada and Mexico. Even before the North American Free Trade Agreement was enacted three decades ago the auto industry had developed a web of manufacturing operations in all three countries. With NAFTA, manufacturers operated almost as if there were no borders. And it’s today common for some automotive goods to cross back-and-forth between the trade partners as parts are fitted into components and components into fully assembled automobiles.

“Our economies are inextricably linked by manufacturing and many other critical industries,” Glenn Stevens Jr. the executive director of trade group MichAuto said in a statement.

Currently, about 90% of the steel, and most of the aluminum used by Ford Motor Co. comes from U.S. sources, CFO Sherry House said during a Wolfe Research conference earlier in February. But even the modest amount sourced abroad will translate into higher production costs and, ultimately, higher sticker prices, analysts warn.

They also fear that new tariffs could result in fewer products available for American motorists. Roughly two dozen vehicles sold in the States come from Mexico, for example. That includes four of the five best-selling models sold by Volkswagen Group. That includes its most affordable offering, the little Taos crossover. Observers fear that many entry level models, like the Taos, simply can’t be produced affordably in the U.S. If they are saddled with new tariffs it simply may not make economic sense to offer them any more.

More Automotive News

- Tk

- Tk

- Tk

Chaos coming

Trump claims his tariff push will encourage foreign manufacturers to set up new plants in the U.S. For now, however, all he is seeing is “a lot of cost and a lot of chaos,” Ford CEO Jim Farley said during the Wolfe conference.

While manufacturers may feel pressure to rethink their sourcing strategies, added Stevens, “You can’t change supply chains very quickly and you certainly can’t change manufacturing locations very quickly.”

Erecting a new assembly plant can take anywhere up to three years or more and even smaller parts plants take substantial time. So, if Trump follows through, the impact of new automotive tariffs could stay in place for some time.

And that could have unintended consequences. The average transaction price of vehicles sold in the U.S. topped $48,000 last month, according to Cox Automotive, near the record high set during COVID when the industry was facing numerous shortages that drove up production costs. Analysts like Abuelsamid have been concerned the U.S. market is nearing “peak sales,” with more and more motorists forced to move from new to used vehicles. That would be particularly true if automakers abandon cheap imports like the VW Taos.

Trade war

BMW’s Spartanburg plant could be hard hit as it depends on European components while exporting a large share of its vehicle production.

The other big concern is that trade partners will respond in kind with their own tariffs and other trade restrictions. Along with import duties on some American-made vehicles, China has responded by limiting U.S. access to key minerals needed for such things as EV batteries.

About 1.7 million U.S.-made vehicles were exported to trade partners around the world, from Canada to China, in 2024, according to Statista.

BMW has been the largest auto exporter for the past decade. On average, its been shipping more than 200,000 vehicles a year – including models like the X5 and X6 — from its plant in Spartanburg, South Carolina. On background, several BMW officials have told Headlight.News they are worried that a tit-for-tat trade war could seriously impact production at the facility which currently employs about 11,000 U.S. workers.

While Spartanburg is the only global source for many BMW SUVs, many other American assembly and parts plants could also feel the heat if Trump’s tariffs kick off a global trade war.

0 Comments