Tesla stock wracked up its sixth straight loss on Thursday, reaching its lowest point since the automaker’s shares surged in the wake of the 2024 presidential election and CEO Elon Musk’s close ties to Donald Trump. Musk’s role in the new Trump administration has been a key factor in the downturn, but analysts warn of other issues that could make it difficult for Tesla to bounce back.

How low can it go? That’s one of the questions that analysts and investors have been asking this week as Tesla shares continue sinking. They bottomed out at $281.95 when Wall Street’s closing bell sounded on Thursday. That’s down from a December peak of $488.54 and marked the stock’s sixth straight loss — and its 14th during the 19 trading days in February so far.

How low can it go? That’s one of the questions that analysts and investors have been asking this week as Tesla shares continue sinking. They bottomed out at $281.95 when Wall Street’s closing bell sounded on Thursday. That’s down from a December peak of $488.54 and marked the stock’s sixth straight loss — and its 14th during the 19 trading days in February so far.

More significantly, it means that Tesla has largely given up the massive gains it made after Donald Trump’s election victory in November, a surge that saw the automaker joined the Trillion Dollar Club, alongside companies like Apple and NVIDIA whose market capitalizations now top 10 figures.

The other question being asked: can Tesla bounce back? It’s become a mantra among stock traders never to bet against Tesla. Ask hedge fund managers who have lost billions doing so over the years, finding out the hard way as they did when Tesla experienced a similar plunge in December 2022. But many observers question whether things are different this time around, warning that the wild card that always seemed to help Tesla in the past – CEO Elon Musk’s almost mystical ability to win over skeptics – could be having exactly the opposite impact this time.

Musk isn’t the only problem for Tesla. The new Trump administration is taking steps that could short-circuit EV growth, even as the Texas-based automaker faces a flood of new competition. Add it all up and one major shareholder lamented, Tesla stock is now sinking “faster than a Cybertruck in quicksand.”

The Musk Effect

Musk was called out by media around the world for appearing to give something resembling the Nazi salute during the ceremonies following Trump’s second inauguration.

That certainly seems to be the case with buyers. Over the years, Elon Musk’s image had grown to almost mythical proportion. He was seen as the David ready to bring down the established auto industry, while also launching a number of other breakthrough companies, such as SpaceX. But his reputation began to tarnish in the months leading up to the controversial acquisition of social media giant Twitter and the site’s subsequent hard right political turn. While Musk said it was all in the name of “free speech,” his own posts grew increasingly conservative – critics would say “radical.”

Then came his tie-up with candidate Donald Trump during the final months of the 2024 election campaign, Musk putting up close to $300 million for the Republican presidential candidate and others in his orbit. Post-inauguration, Musk has been leading Trump’s push to radically scale back the federal government as the head of the newly created Department of Government Efficiency, or DOGE. Musk has become the darling of Internet memes. “Please share five things you did for Tesla shareholders this week,” celebrity photographer Jerry Avenaim said on a Wednesday post, referencing DOGE’s demand that federal workers list five things they’ve done or risk being fired. “Or are you working remotely? Asking for all of us.”

With his high-profile and highly controversial role heading DOGE, Musk is alienating many of the traditionally left-leaning motorists who make up the vast majority of EV buyers.

Tesla’s sales collapse

Tesla’s sales collapse

For the first full year since the launch of the original Model S, Tesla sales took a tumble in 2024, falling 1.1% worldwide. The automaker doesn’t break out numbers by region but by tracking registration data Cox Automotive estimated the slump was more than 6% in the U.S. And the California Auto Dealers Association noted that in the traditionally liberal state Tesla’s slump was enough to drag the entire EV segment into the red. It otherwise would have shown growth closer to the national average of around 10% in 2024, the trade group indicated.

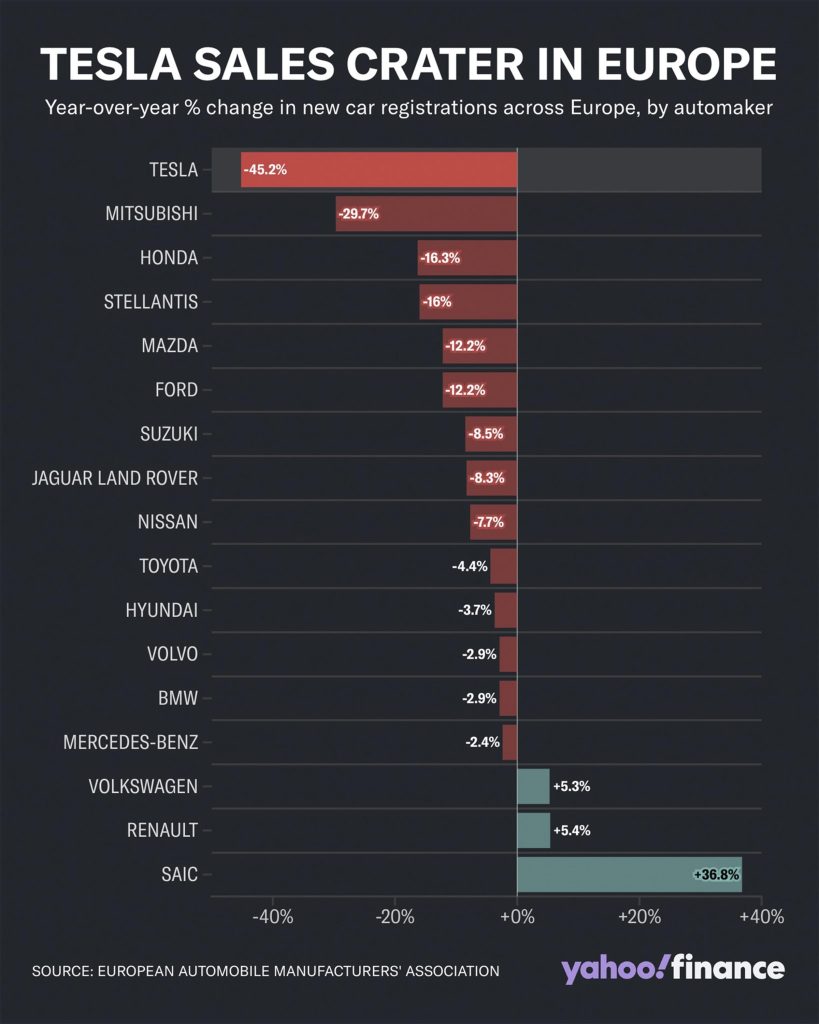

As Musk’s role in the Trump administration has grown, the negative impact on Tesla has become even more pronounced. In Europe, the automaker’s sales were off roughly 50% during January, with Germany and some other markets down by as much as 75%.

Preliminary data suggest the downward trend has been accelerating in February. And some liberal and progressive groups are determined to make that happen. Following what appeared to be Musk twice making what appeared to be Nazi salutes, some critics have begun referring to Tesla products as “Swasticars.” The UK group “Everyone Hates Elon” has launched an anti-Tesla poster and online campaign with the catchphrase “Goes from 0 to 1939 in 3 seconds.”

More Tesla News

- Has Elon Musk Jumped the Shark?

- Tesla Stock in Freefall

- Judge Again Rejects Musk’s Massive Pay Package

More headaches coming

The Kia EV2 will slot into an entry-EV segment where Tesla has long delayed the launch of its own Model 2.

Earlier this week, South Korea’s Kia revealed three new battery-electric vehicles, including the EV4 crossover, PV5 van. They join a growing line-up including the current EV6 and EV9 models. But the little EV2 that was also revealed this week could pose a particularly big headache for Tesla. It targets the entry-level EV product that Musk has long promised to develop in but has yet to bring to market.

Kia is, of course, just one of a growing array of competitors Tesla has to face off with. And they’ve begun gobbling away at the one-time EV king’s market share. In the U.S., Tesla dropped below 50% in 2024 and is widely expected to slide below 40% in 2025. In Europe, it’s losing ground more rapidly. A year ago, it was Britain’s number two EV brand. It’s now seventh. It’s sliding even faster down the charts in Germany, the EU’s largest automotive market.

Ironically, many of the policies now Pres. Donald Trump is putting into place could make matters worse by driving up costs for raw materials – from lithium and cobalt for batteries to steel and aluminum for vehicle bodies – for example. The new administration is pulling back on plans for a nationwide EV charging network and is expected to end tax credits of up to $7,500 for EV buyers.

On the plus side, at least for Tesla, planned tariffs on imported vehicles could cripple competitors like Kia, Volkswagen and even General Motors. For now, all Tesla EVs sold in the U.S. roll off its assembly lines in California and Texas.

Investors growing weary

Buyers aren’t the only ones growing concerned about Tesla, in general, and Musk, in particular.

Several major European shareholders have bailed out on Tesla in recent months; last month the continent’s second-largest pension fund ABP selling off 2.8 million shares. Ironically, it sold off its stake at almost precisely the right time, just before the plunge in value accelerated.

Pressure is growing on other major shareholders to exit their holdings. The 1.8 million member American Federation of Teachers has now demanded a review by the six largest institutional investors in Tesla, many representing AFT pension funds. The ongoing downturn “should raise alarms,” AFT President Randi Weinstein wrote, adding that Tesla shares are sinking “faster than a Cybertruck in quicksand.”

“Tesla faces significant risks in 2025, including declining sales in Europe and China, and potential U.S. market challenges due to policy changes,” warned stock tracker Value Portfolio.

Musk has become the darling of Internet memes. “Please share five things you did for Tesla shareholders this week,” celebrity photographer Jerry Avenaim said on a Wednesday post, referencing DOGE’s demand that federal workers list five things they’ve done or risk being fired. “Or are you working remotely? Asking for all of us.”

Is a rebound coming?

A big test for Tesla and Musk will come with the promised launch of the self-driving CyberCab scheduled for 2026.

“Never bet against Tesla,” goes a mandate among many investors. And many a hedge fund manager has found that out by losing billions when Tesla staged one of its many comebacks – as happened in late 2022, ending its worst slump to date. While some observers think things are different this time, there are others still willing to bet on the brand.

They point to the new update of Tesla’s best-selling product line, the Model Y, which just debuted in China and will soon follow in the U.S. There’s also a lot of optimism about the Cybercab autonomous taxi Musk intends to deliver in 2026, among other promises he’s lately made.

If anything, long-time Tesla bull Dan Ives, of Wedbush Securities, isn’t ready to rethink his “outperform” rating, backed by a $550 price target. “Tesla’s innovation pipeline, including next-generation EVs and enhanced Full Self-Driving (FSD) capabilities, will likely drive revenue growth and market expansion over the next 12 to 24 months,” Ives said in a recent note to shareholders.

Indeed, some investors appear to be betting shares traded under the ticker TSLA may be ready to bottom out. As of late morning Friday, Tesla shares were trading just over $290, a roughly 3% increase over their Thursday close. But whether the potential rally can hold is far from certain.

And there seems little likelihood that Musk’s image will regain its former luster. Increasingly, Tesla will have to be judged by its products and performance, several analysts stressed, more like the rest of the auto industry.

Excellent summation of Tesla & Musk. People who don’t like dictators should vote with their feet. No wonder the stock is dropping.