President Donald Trump, as expected, launched new tariffs targeting Canada and Mexico while also increasing prior tariffs on China. All three countries responded with their own trade sanctions. The tariff war will increase prices on everything from avocados to semiconductors but economists warn few consumer goods will feel the heat more than automobiles – some models set to see price hikes of $12,000 or more. At a time when sticker shock is already impacting sales, analysts fear the U.S. auto industry could see sales and profits tumble – while job cuts also could be in the offing.

After a month’s delay, Pres. Donald Trump enacted new, 25% tariffs against Canada and Mexico early Tuesday morning, while previously enacted tariffs were increased against China. The three largest trade partners immediately responded with new trade barriers of their own, with more threatened to follow – Canadian Prime Minister Justin Trudeau warnings that his country might restrict American access to critical raw minerals.

The president’s controversial move is expected to have a significant impact on all sectors of the economy, driving up prices for many popular grocery items and, by some estimates adding $200 or more to the price of an Apple iPhone. But in terms of the dollar impact, automobile buyers could be hardest hit, a study by Anderson Economic Group estimating prices will rise at least $4,000 for a typical SUV or CUV. On some products, such as a well-equipped, Mexican-made Chevrolet Silverado, the tariff penalty could top $12,000.

Even vehicles assembled in U.S. plants are expected to feel the heat due to the heavy reliance on imported parts and components. Industry analysts warn that this is highly likely to impact sales which were already feeling the pinch of sticker shock. That could translate into lower sales, a slump in industry earnings and the possibility of job cuts in the coming months.

Sticker shock

New vehicle prices hit an all-time high during the COVID pandemic, in part due to shortages of critical components, such as semiconductors and foam and rubber parts. In turn, U.S. dealers frequently saddled buyers with mark-ups on popular products, such as the Kia Telluride and Honda CR-V crossovers and the Chevrolet Corvette sports car.

New vehicle prices hit an all-time high during the COVID pandemic, in part due to shortages of critical components, such as semiconductors and foam and rubber parts. In turn, U.S. dealers frequently saddled buyers with mark-ups on popular products, such as the Kia Telluride and Honda CR-V crossovers and the Chevrolet Corvette sports car.

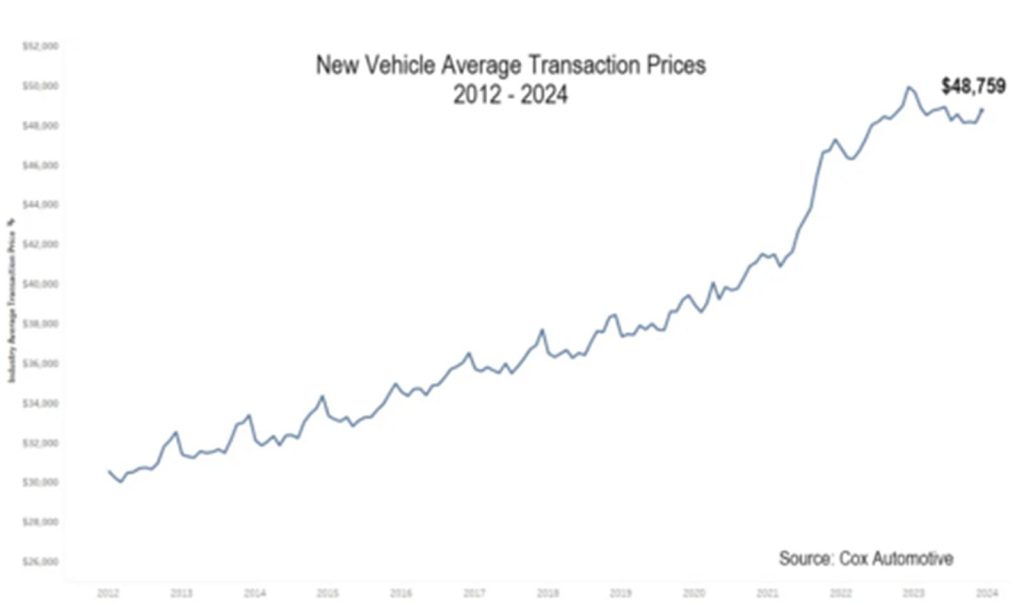

In late 2022 and into 2023 average transaction prices broke into the low $50,000 range before settling back last year as shortages were resolved and automakers built back diminished inventories. Even so, ATPs hit $48,641 in January, according to Cox Automotive and February numbers were expected to not stray far when final calculations are complete.

But the Trump tariffs are all but certain to push prices into never- before-seen territory, according to an analysis by the Anderson Economic Group and others. The typical crossover should see an increase of around $4,000 it forecast. And some models will see increases more than triple that amount.

“Auto prices aren’t as reactive as grocery prices, dealers’ inventories could temporarily cushion consumers for another two months before possible price hikes, so buying sooner could be a good idea,” said David Greene, an analyst with Cars.com, in a statement sent to Headlight.News.

Made in North America

The impact of the tariffs will be broad, according to the most recent Industry Insights Report from Cars.com. Consider that in January:

- 23% of new vehicle inventory was built in Canada and Mexico;

- 51% of inventory imported from Canada and Mexico has a Detroit-based badge on the hood;

- 36% of inventory from Japanese brands was imported from Canada and Mexico;

Then there’s the potential impact of the tariff increase on Chinese vehicles. About 1.4% of the new-vehicle inventory available at U.S. dealerships in January came from China, noted Greene. These include the Buick Envision and Lincoln Nautilus, which he said will be the “most impacted comprising 93% of dealer inventory imported from China.”

But Volvo’s EX30 is also imported from China.

More Trump Auto News

- Trump Has Auto Industry in His Sights

- Trump Tariffs: Protectionism or Ploy?

- Tesla Stock Continues Nosedive as CEO Musk Takes Lead Role for Trump

Which models will be impacted?

General Motors could be hit hard by a 25% tariff since it imports more than 350,000 vehicles annually from Mexico.

Dozens of vehicles available in the U.S. are assembled in Canada and Mexico. They include domestic products, like the Chrysler Pacifica minivan built in Ontario and the Chevrolet Silverado pickup that is produced in both Canadian and Mexican assembly plants. The Silverado was the second best-selling vehicle in the U.S. in 2024 and the tariffs will impact the third and fourth best-sellers, as well, the Toyota RAV4 and Honda CR-V, respectively, both coming from Canada.

Mexico is today one of the largest producers of motor vehicles in the world, providing the U.S. with models such as the Chevy Equinox and Audi Q5. Benefiting from cheap Mexican labor, a number of low-end models are assembled south of the border, such as the Volkswagen Taos, Honda HR-V, Hyundai Accent and Nissan Versa.

Analysts like Sam Abuelsamid, of Telemetry Research, warn that the tariffs could price such entry models out of reach for many buyers on a budget, leading some manufacturers to question whether it will be worth continuing to offer them in the U.S.

Even products assembled in the U.S. will be hit, noted Abuelsamid, as most vehicles today produced anywhere in North America use parts, components and raw materials sourced from all three countries.

An interconnected manufacturing web

Even if the vehicle sitting in your garage was assembled in the U.S., odds are it has plenty of imported parts and components. Virtually all use wiring harnesses produced south of the border because of the amount of labor needed. And the list of parts and components – never mind raw materials – sourced from Mexico and Canada is huge, everything from anti-lock brakes to suspensions.

The situation gets all the more complicated because of the way the industry has adapted to life under NAFTA and the subsequent USMCA trade agreements. Automakers have created an interconnected web of manufacturing operations operating as if borders were only minor inconveniences. It’s quite common, in fact, for goods to crisscross borders repeatedly as minerals are refined into parts, then assembled into larger components before being used in completed vehicles. Simply tracking and then determining how to calculate tariffs is a logistical nightmare, according to industry representatives.

In some instances, automakers have begun rethinking their manufacturing strategies. Honda, for one, has plans to move some Civic production from Mexico to the U.S. But there’s no guarantee that automakers will respond as Trump intends, moving operations to the U.S. While Volvo is now assembling the EX90 battery-electric vehicle in South Carolina, the automaker plans to shift sourcing for the smaller EX30 from China to Belgium.

Unintended consequences

Even if automakers do begin thinking about moving more operations back to the U.S., Such moves often can take “years,” cautioned Stephanie Brinley, principal auto analyst with S&P Global Mobility.

In the near to mid-term, higher prices could prove crippling for an industry already suffering from sticker shock. Despite a robust economy, American motorists purchased just 15.9 million new vehicles in 2024, a roughly 2% year-over-year increase. That fell well short of the industry record, the 17.5 million new vehicles sold in 2016.

This year got off to a good start, but there are growing concerns momentum is about to shift into reverse. “That kind of cost increase (expected from the new tariffs) will lead directly — and I expect almost immediately — to a decline in sales of the models that have the biggest trade impacts,” Patrick Anderson, chief executive officer of Anderson Economic Group, told Bloomberg.

One has to remember that even before the new tariffs went into effect, automakers were already paying more for imported aluminum and steel under a previous Trump tariff. Those tariffs alone are “trigger(ing) price hikes, production slowdowns, and job losses, ultimately placing more strain on consumers and businesses,” according to a new study by the Kaplan Group.

Where the pain will be felt

BMW’s Spartanburg plant could be hard hit as it depends on European components while exporting a large share of its vehicle production.

The new tariffs could “be a disaster” for the Michigan economy, said Gov. Gretchen Whitmer, as it particularly vulnerable to the ups-and-downs of the auto industry.

But it’s by no means the only state that could be in trouble. Over the past four decades foreign brands like BMW, Honda and Hyundai have established major production operations across the South. They, too, could wind up facing slower sales leading to production cuts and job losses.

A number of the newer plants, meanwhile, are focused on EV production, including the Hyundai Metaplant in Georgia, and a Toyota EV facility going into Texas. But those factories are facing hits from other moves by the Trump administration, such as the likely elimination of federal tax credits for EV buyers.

And there’s the strong possibility the president will follow up with still more trade restraints, including tariffs on European-made autos and auto parts. That could devastate the BMW plant in Spartanburg, South Carolina, for example. It’s BMW largest manufacturing complex in the world and the sole source for many of its X models, such as the X5 crossover. The complex, which currently employs 11,000, also holds title as America’s largest automotive exporter. Its future could be severely impacted by the trade policies Trump enacts going forward.

…but Trump said he would make things better and that tariffs are a big beautiful thing… Are you saying that he may have mislead people in an effort to get them to vote for him? I am shocked, simply shocked.