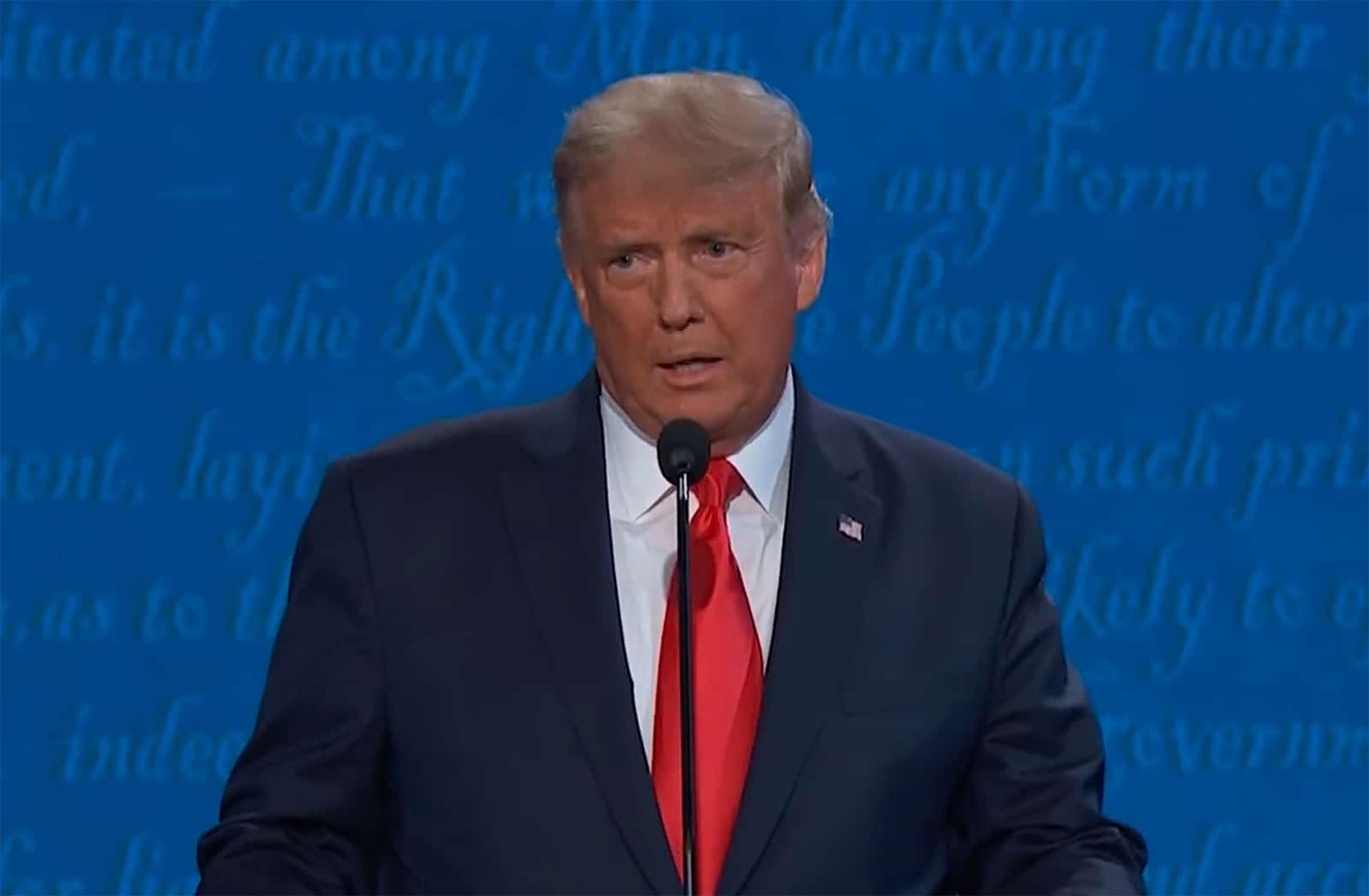

Little more than a day after announcing plans to enact 25% tariffs on goods imported from the Mexico and Canada, Pres. Donald Trump threw a temporary lifeline to the auto industry by granting a one-month reprieve on automotive parts and vehicles. But the threat remains that sanctions could still follow if the U.S. can’t reach resolution with its two neighbors and leading trade partners – something Ford CEO Jim Farley warned “would blow a hole in the U.S. industry.”

Prices on some products, such as the Chevrolet Silverado, could go up by $12,000 or more if tariffs eventually cover the auto industry.

Following a conference call with the CEOS of the three domestic automakers, General Motors, Ford and Stellantis, Pres. Donald Trump agreed to put in place a one-month reprieve on tariffs that could, by many estimates, cripple the U.S. auto industry.

On Tuesday morning, 25% duties went into effect covering a broad range of products imported from Canada and Mexico, while Trump also boosted previously enacted tariffs covering China. Together, they will raise the price American consumers pay on everything from avocados to smartphones – while counter sanctions the three trade partners have responded with are expected to quickly impact U.S. exports.

“We appreciate President Trump’s work to support our industry and exempt auto companies complying with USMCA,” the trade agreement binding the three countries, Ford said in a statement.

A bumpy ride ahead

The U.S. auto industry already is “in for a bumpy 2025,” Stephanie Brinley, principal auto analyst for S&P Global Mobility, said during a Tuesday webinar conducted by the Automotive Press Association.

The industry is feeling the impact of a variety of actions Trump has taken since returning to the White House on January 20. The president has moved to roll back environmental regulations, ordered a halt to federal funding meant to expand the country’s public EV charging network and has signaled he will end federal tax credits of up to $7,500 for EV buyers. He has already enacted new tariffs on China, which supplies a variety of raw materials, parts and components used by the American auto industry. And imported aluminum and steel have also been hit with new duties.

This creates what Brinley described as “one of most fluid situations the auto industry has ever seen.”

But things could get markedly worse if Trump moves ahead with tariffs on automotive goods a month from now.

Sticker shock

U.S. automotive sales reached an all-time peak of 17.5 million in 2016. Since then, prices have surged by nearly 40%, one reason experts believe it could be years – if ever – before the market returns to that level. In January 2025, the average transaction price for a new vehicle – factoring in sticker prices, options and incentives – came to $48,118, according to tracking firm Edmunds. That was just short of an all-time record. But that could change if sanctions go into effect.

Barring a sudden resolution to Trump’s trade war, a study by the Michigan-based Anderson Economic Group estimates prices will rise at least $4,000 for a typical SUV or CUV. On some products, such as a well-equipped Chevrolet Silverado, the tariff penalty could top $12,000.

Dozens of cars, trucks and crossovers currently come from Canadian and Mexican assembly plants, ranging from entry-level models like the Volkswagen Taos and Hyundai Accent to high-line products like the Audi Q5 and Chevrolet Silverado pickup. But even vehicles assembled in U.S. plants are expected to be impacted should tariffs go into effect.

More Automotive News

- Is the State Dept. Covering Up the Real Story Behind Plans to Buy $400 Million Worth of Tesla Cybertrucks?

- Trump Has Auto Industry in His Sights

- Trump Tariffs: Protectionism or Ploy?

Vanishing borders

That’s because the borders between the U.S., Canada and Mexico all but vanished – at least from the auto industry’s standpoint – with the 1994 enactment of the North American Free Trade Agreement. Modest changes were made to NAFTA during Trump’s first term in office, the treaty renamed the USMCA. But it did little to change the fact that the auto industry has built up an interwoven North American manufacturing network treating the borders between the three countries as minor inconveniences.

Whether wiring harnesses from Mexico or suspension components from Canada, parts freely flow from plant to plant, offering crossing borders repeatedly. Simply tracking such movements and figuring out how much duties to apply will be a nightmare, industry officials have warned.

But logistics aside, virtually every vehicle assembled in North America would see production costs rise with new tariffs. And most industry experts anticipate manufacturers would pass some, probably all, those costs onto consumers.

The potential impact

Trump originally planned to enact new Mexican and Canadian tariffs in February, delaying the move after indicating some of the issues under discussion between the three nations had been resolved. Automakers initially sighed in relief but then held their breath wondering whether sanctions would just be delayed.

For his part, Ford CEO Jim Farley warned last month that trade sanctions “would blow a hole in the U.S. industry.” This week, following the initial tariff announcement, Flavio Volpe, president of the Toronto-based Automotive Parts Manufacturers’ Association cautioned that the jobs of “hundreds of thousands of (North) American autoworkers” were at risk.

Automakers fear they will have to radically reshape the vast manufacturing network that has grown up across North America to meet Trump’s demands. In the meantime, rising prices would all but certainly translate into lower vehicle sales. Ironically, that would threaten to further weaken a U.S. economy that was already showing signs of trouble, countering Trump’s campaign promises to deliver more jobs and drive down the cost of consumer goods.

0 Comments