If you’re a Tesla shareholder you’re likely quite pleased to hear CEO Elon Musk promise to back away from his work in Washington to become “super-focused” on the automaker and his other companies. If you’re a buyer looking for an EV, however, that may not matter much, Tesla sales continuing to tumble in markets as diverse as Europe, China and the U.S. Headlight.News has more.

After losing more than half their value last month, Tesla shares have staged a sharp rally in recent days, Wall Street clearly buoyed by CEO Elon Musk’s pledge to pull back from his ties to the Trump administration in order to become “super-focused” on his businesses – which include not only Tesla but SpaceX, Neuralink and xAI.

Musk said he not only will be “spending 24/7” on the job but has suggested he will invest far less money into politics. He has spent billions to back not only Pres. Donald Trump’s reelection campaign but to support other conservative candidates.

While investors appear to be please, not everyone else is equally impressed. There’s no sign that Musk’s pullback from politics has eased the backlash he and Tesla have faced in recent months. That, according to many analysts, has resulted in a sharp downturn in sales of the automaker’s EVs. In Europe, Tesla delivered 49% fewer vehicles in April compared to a year earlier. As a result, it fell behind Chinese rival BYD for the first time.

“Did my best”

Tesla CEO Musk said he was stepping back from politics during a remote address to a recent business conference in Qatar.

Musk’s image began to tarnish following his takeover of social media giant Twitter in October 2022. His subsequent shift to the political far right didn’t help, nor the decision to let neo-Nazis and other extremist groups return to the newly renamed X. Things only got worse when Musk donated more than $270 million to back Trump ahead of the 2024 presidential vote, subsequently signing on as head of the new Department of Government Efficiency.

In a post on X over the Memorial Day weekend, Musk said he “did my best,” but the focus of DOGE on trimming or eliminating many social programs led to a full-scale backlash. Tesla dealerships and other facilities around the world continue to face protests. Sales have plunged and so many existing Tesla owners have moved to sell their vehicles that, Cox Automotive reports, trade-in values have shown the biggest slump of any product on the market this past year.

In the U.S., deliveries tumbled 13% during the first quarter of 2025, marking the biggest decline in the company’s history. Tesla only reports quarterly but trade groups and government registration data show that the automaker has continued losing ground in all key markets. In China, monthly sales have tumbled by as much as 26% this year. Meanwhile, newly released data released by the European Automobile Manufacturers’ Association shows demand dropped 49% in April.

Investors look past the numbers

Tesla CEO Elon Musk’s behavior – including what many saw as a Hitler salute – generated a major backlash to the automaker’s products.

The protests, along with the plunge in sales, have clearly worried investors. So has the rise of Chinese competitors, BYD in particular. Even some of Tesla’s biggest bulls, like Ross Gerber, of wealth management fund Gerber Kawasaki, started calling for Musk to either walk away from Washington or resign from Tesla.

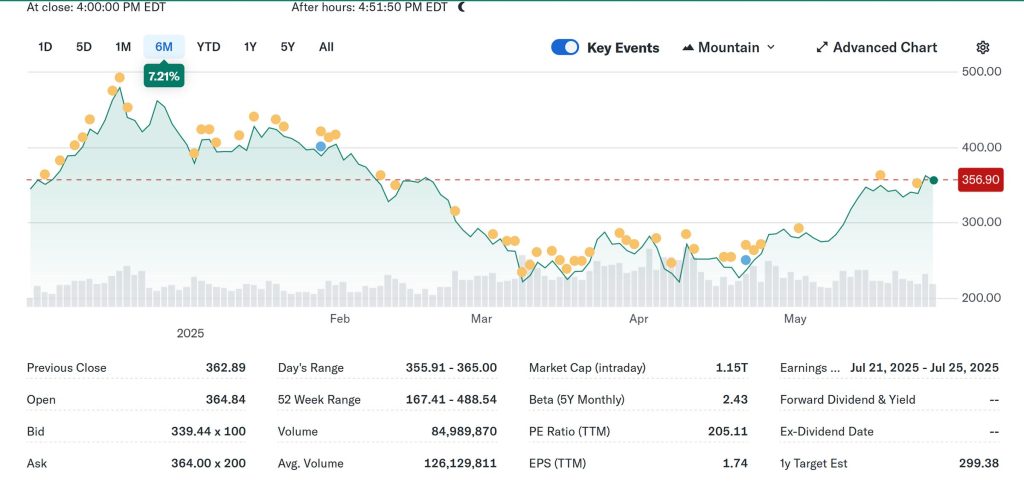

The mood is far less downbeat right now. After hitting a low of $221.86, Tesla shares have rebounded as high as $363.50 this week – though they settled back to close at $356.90 on Wednesday.

So, why the sudden rebound? Clearly, Musk’s decision to go “Back to spending 24/7 at work and sleeping in conference/server/factory rooms,” is buoying the market. Investors also have taken a positive stance on several key projects Tesla intends to bring to market in the coming months.

First, we should see the new CyberCab debut in the coming weeks. If Musk’s promise holds, there could soon be a million of these robocabs on the road challenging Alphabet’s own driverless cab subsidiary, Waymo. Musk also plans to get the Optimus Prime robot into production, forecasting widespread applications both in manufacturing and personal use.

More Tesla News

- Tesla CyberCab v Waymo: Get Set for the Battle of the Robocabs

- As Cybertruck Sales Collapse, Ford Lightning Takes the Lead in EV Pickup Segment

- The “Musk Effect”

Can he deliver?

The real question is whether either of those projects will deliver as promised. Musk’s track record hasn’t been all that good lately.

The Tesla Cybertruck has been a widely maligned failure, according to Sam Abuelsamid, lead data analyst for Telemetry Research. Despite Tesla’s claims to have logged over 1 million advance orders after the electric pickup’s November 2019 debut, sales continue to dwindle – from 12,900 during the fourth quarter of 2024 to just 6,406 during Q1 2025.

And updates of both the Model 3 sedan and Model Y SUV aren’t delivering the sort of kick-start Tesla had anticipated, especially in overseas markets like China and Europe. Meanwhile, the all-electric Tesla Semi has had a marginal rollout and the second-generation Roadster project is years behind schedule.

Investors want Musk to live up to his promise

Industry watchers are waiting to see if Tesla will deliver with CyberCab and Optimus, as well as the new, lower-priced EV due out later this year. Investors appear to be betting things will get better, especially with Musk back full-time.

But one group of investors wants to make sure Musk lives up to his word. That’s the goal of a letter signed by the SOC Investment Group and delivered to Tesla Board Chair Robyn Denholm on Wednesday. It calls for a guarantee that Musk will devote at least 40 hours a week to Tesla. The group is made up of labor funds and small investors, and controls less than 8 million Tesla shares – out of 3.22 billion outstanding. But the message could click with other, larger investors who want to be sure Musk really will put politics aside.

0 Comments