Iran is threatening to close the Strait of Hormuz, the critical Mideast waterway through which 20% of the world’s liquid petroleum passes through. That’s already led to a surge in gasoline prices in the U.S. and some analysts worry it could trigger the sort of global energy crisis not seen since the 1970s. Headlight.News has more.

Action – reaction. Just two days after Pres. Donald Trump ordered an attack on three nuclear sites in Iran that country’s parliament has approved a measure that could lead to the shutdown of the vital Strait of Hormuz, the shipping channel through which 20% of the world’s liquid petroleum supplies pass through.

That is the “key worry for the market,” said one leading commodities strategist, with other energy industry insiders warning that U.S. motorists could soon see a major spike in gas prices, even if the sort of Mideast petro-crisis seen back in the 1970s can be avoided.

“If (a shutdown) occurs, we would need to see governments tap into their strategic petroleum reserves,” Ewa Manthey, commodities strategist at ING Financial Service, told Fox News.

The latest news

On Monday Iran fired a volley of heavy ballistic missiles at the U.S. military base in Qatar, its largest facility in the Mideast. Qatar’s air defense system reportedly knocked down all the rockets, with no injuries reported.

For its part, nonetheless, Iranian State TV declared the attack “a mighty and successful response by the armed forces of Iran to America’s aggression.”

The question is whether Iran will use this either as a way to blow off steam and now ease tensions or as a prelude to further moves, including a shutdown of the Strait, observers cautioned.

Energy prices ride the rollercoaster

U.S. gas prices have held relatively steady since the Trump administration came into office – though at a significantly higher level than the $1.98 a gallon national average the president claimed back in April.

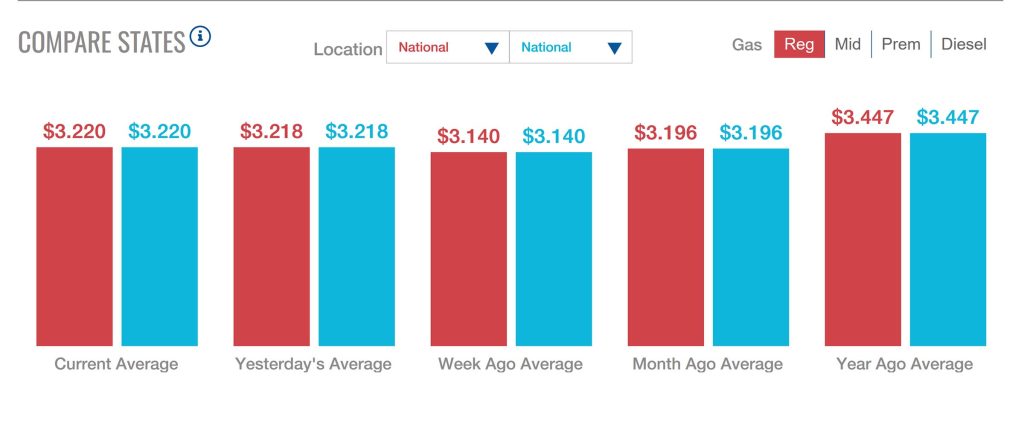

But the numbers began rising even before the Saturday bombing ride on Iran, reaching $3.220 on Monday, up $0.08 over the past week, reported AAA. For a vehicle holding 15 gallons of fuel that’s an added $1.20 per fill-up.

But the concern is what happens next, especially if Iran follows through on its threat to curb its own shipments or block the Strait. There is also the possibility the country could attack oil resources in other parts of the Mideast, some observers noted.

“There’s enough spare capacity in the system today to accommodate any Iranian oil that comes off the market,” Woods told Fox News’ Bret Baier, adding that “The bigger issue will be if infrastructure for exports or the shipping past the Strait of Hormuz is impacted.”

More Automotive News

- Tesla Rolls Out First Robotaxi

- Trump Tariffs Mean $2,000 Price Hike for Typical Vehicle

- Honda Joins Race to Orbit Reusable Rocket

Pain at the pump

Qatar’s air defense system “successfully intercepted a missile attack targeting the Al-Udeid Air Base,” the Ministry of Defense reported in a post on X.

That appeared to ease some worries, at least among energy traders, leading to a sharp drop in crude oil futures, which had surged to a global average of nearly $78 a barrel after the U.S. air attack on Iran. Late Monday trading saw the average dip to $68.745 a barrel, according to website TradingEconomics.com. That was still roughly 10% higher than a month ago. And observers warned that the downturn could be rapidly reversed should Iran continue to retaliate – especially if its missiles were to hit U.S. military bases or if other attacks were to take place.

How high up could oil go? Manthey suggested $120 a barrel would not be out of the question – and $150 would be possible if supply disruptions continued through the rest of the year. The latter number would translate into gas prices of around $4.50 a gallon. But it could also lead to supply disruptions, some have cautioned.

For his part, Patrick De Haan, the head of petroleum analysis at GasBuddy.com, downplayed the risk of a ‘70s-era oil shock, but he said there will be pain at the pump. “For now, motorists should anticipate a continued steady climb in prices.”

0 Comments