EV sales will “flatten considerably” once federal tax credits expire at the end of September, according to a new study. Even with more affordable models coming to market, EV market share will be nearly half what was previously expected before Congress voted to eliminate the incentives. Hoping to clear out inventory before then, automakers have launched a variety of deals that could put some buyers behind the wheel of an EV for less than $100 a month. More from Headlight.News.

Since taking office in January, Pres. Donald Trump has done a 180-degree turn from the preceding Biden administration’s pro-EV stance, rolling back a variety of federal mandates and restricting the use of money to set up a nationwide charging network. He also convinced Congress to end federal tax credits of up to $7,500 for EV buyers.

A new study finds price-sensitive buyers notably less likely to trade in for EVs once those incentives end, with battery-electric vehicles now likely to capture barely half the U.S. market share previously forecast for 2026 and beyond.

Worried by sales that have already down, as well as the prospect of an even bigger slump to come after incentives are gone, automakers have begun rolling out hefty deals of their own. With monthly payment dropping below $100 on some models, that means many EVs are now significantly more affordable than comparable gas models.

EV credits set to end

As things now stand, EV buyers are potentially eligible for up to $7,500 in federal tax credits – though there are a variety of caveats. For one thing, there are restrictions on where those vehicles are built and where their batteries come from. Restrictions also apply when it comes to the price of the EV and the income of a buyers. There are, however, loopholes available to those who lease, rather than buy.

As things now stand, EV buyers are potentially eligible for up to $7,500 in federal tax credits – though there are a variety of caveats. For one thing, there are restrictions on where those vehicles are built and where their batteries come from. Restrictions also apply when it comes to the price of the EV and the income of a buyers. There are, however, loopholes available to those who lease, rather than buy.

But all that ends on September 30 due to the One Big Beautiful Act of 2025, the Trump-backed spending bill passed by Congress earlier this year.

For many potential EV buyers, it translates into an immediate, $7,500 price hike. That’s on top of the fact that the average transaction price for a battery-electric vehicle was around $58,000 in July, about $9,000 more than a comparable gas vehicle.

“Headed for a rough patch”

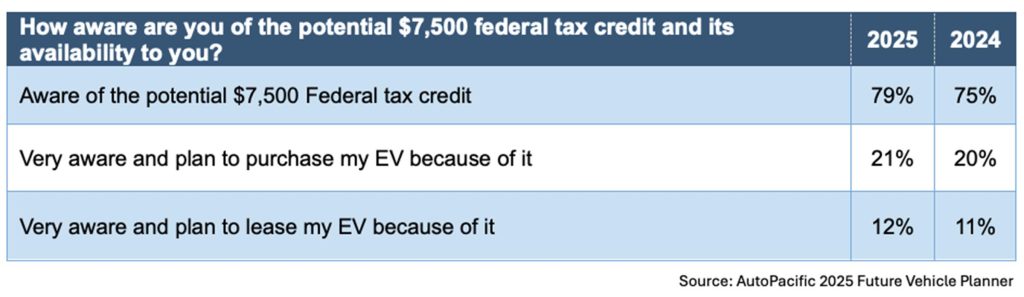

“The EV market in the U.S. is headed for a rough patch with market share growth stalled due to multiple factors related to lack of affordability, warned Ed Kim, president of research firm AutoPacific, Inc. “Consumer awareness of the Federal tax credit for EV purchases and leases as well as intent to buy an EV because of it have grown since 2024, but consumers interested in one will soon find them significantly less affordable.”

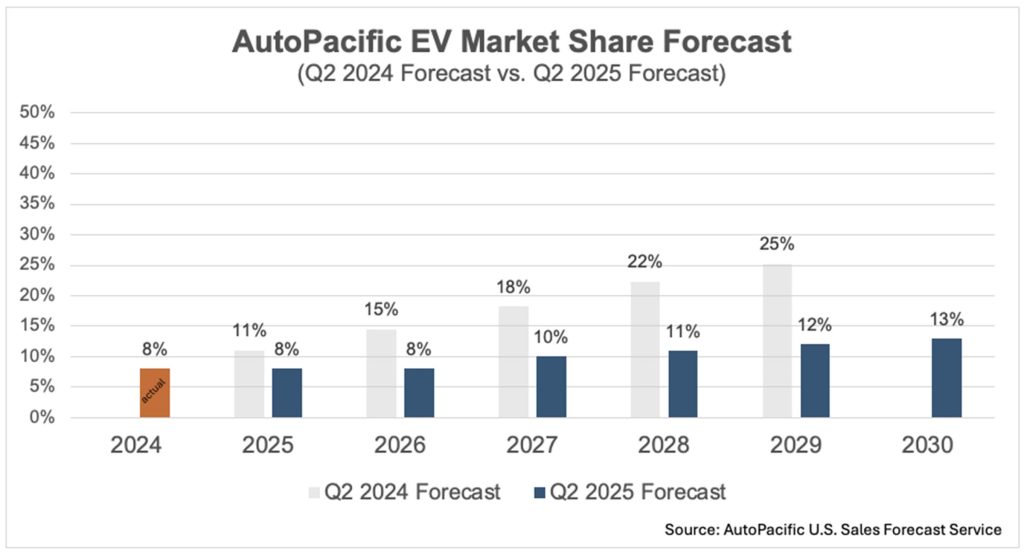

EV sales growth has slowed substantially over the last 18 months compared to the period between 2019 and 2023 when demand grew eightfold. AutoPacific previously expected battery-electric models to account for 11% of the U.S. new vehicle market for all of 2025. It now expects that to come in closer to 8% — the same as last year.

Over the next four years, the study projects, EV market share will drop to less than half what was forecast during the pro-EV Biden administration. AutoPacific now forecasts a share of 8% in 2026, dwn from the original 15% target. And for 2029, it forecasts a 12% share, compared to the earlier 25% target.

More EV News

- EV Buyers Find More Public Chargers, Face Fewer “Charge Failures”

- Trump Moves to Slow National EV Network Rollout

- EV Charging is About to Get a Lot Easier

Plenty of deals available

For those who do want an EV, automakers have begun rolling out aggressive incentives to bring buyers back into showrooms. In some cases, buyers may find dealers will willing to sign leases on low-end models, such as a Nissan Leaf, for less than $100 a month “in a bid to grab customers…before federal incentives expire,” reported the Bloomberg news service.

That’s especially the case for products that were already proving hard to sell, such as the Mercedes-Benz EQB. It carries a base list price of around $53,000 – but was being leased for as little as $352 a month, making it one of the five most affordable EVs in the U.S., noted Bloomberg.

As recently as April 2023, the average EV lease ran over $1,000 a month, according to tracking service Edmunds. It’s currently just over $600. Some of that reflects the arrival of more mainstream product lines, like the Chevrolet Equinox EV – base price $34,995. But the flood of special factory-backed deals has been an even more significant factor. Honda, for example, is offering the Prologue EV for as little as $200 a month for a 48-month lease, even though the MSRP starts just under $49,000.

Post-incentives

Many analysts expect to see even more deal-making take place come October 1. EV start-up Lucid has already indicated it will offer a $7,500 credit to cover the less of federal incentives.

The problem for automakers is that they have to find a way to keep EVs at least reasonably affordable, even at a time when their own manufacturing costs are set to skyrocket. Trump tariffs are adding significant increases on import models, such as that Mercedes EQB, the Genesis Electrified G80 and Toyota bZ4X. Even domestically assembled products are facing tariffs on imported steel and aluminum, along with foreign-made parts and components. Trump also signaled plans to add a 50% tariff on imported copper – covering about half of the metal used in the country. EVs require far more copper than conventional vehicles for motors, batteries and other components.

Automakers hope to overcome cost concerns with still more “affordable” EVs set to reach market. But it will take time to get there. Ford announced its new Universal EV line earlier this month, starting with a new pickup with a “target” price of around $30,000. But it won’t reach market until 2027.

0 Comments