Lexus and Subaru surged to the top of the charts in the latest American Customer Satisfaction Index, with Asian manufacturers, in general, scoring well ahead of their domestic American rivals. Stellantis brands, in particular, anchored the results of the annual study, reports Headlight.News.

Lexus is clearly connecting with its customers, at least if you look at the results of the latest American Customer Satisfaction Index. Toyota Motor Corp.’s high-line brand was the highest-ranked among luxury marques, leapfrogging last year’s leader, Mercedes-Benz.

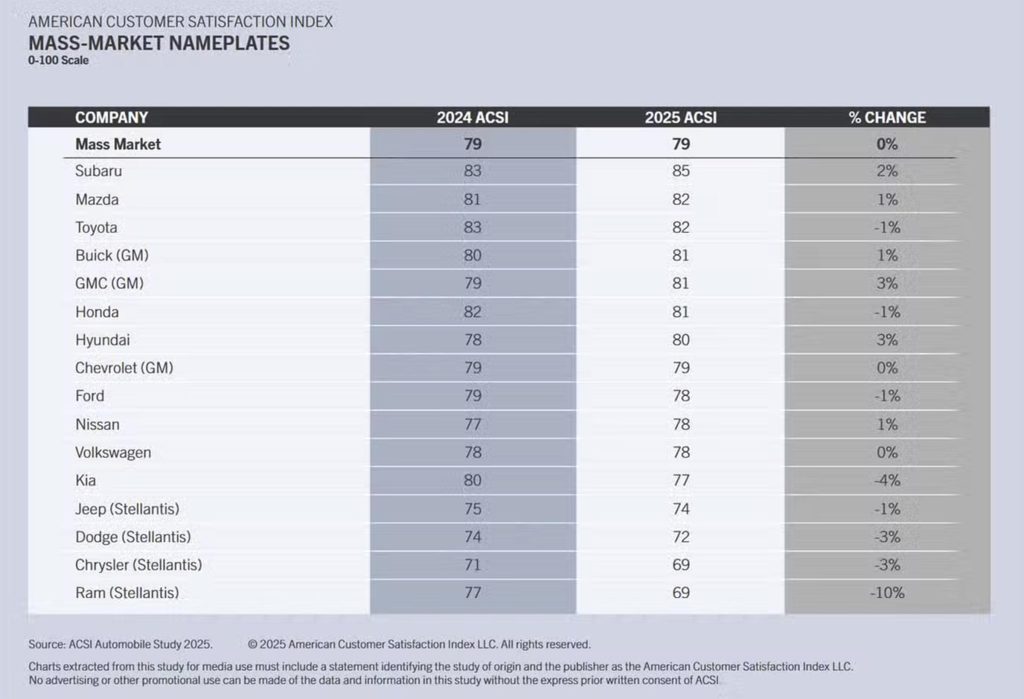

Subaru, meanwhile, pushed aside traditional chart-toppers Mazda and Toyota to come in as the top-ranked mainstream brand in the 2025 ACSI.

With the exception of General Motors’ Cadillac, Buick and GMC brands, Detroit’s Big Three didn’t fare particularly well this year. Four Stellantis brands anchored the yearly study, Ram coming in dead last.

What’s new

Asian brands dominated the 2025 American Customer Satisfaction Index, though there were a few surprises, with Subaru surging to the top of the mainstream chart, followed by Mazda and Toyota. The Japanese giant slid two spots compared to last year, but its Lexus brand jumped past Mercedes to not only win honors as the highest-ranked luxury brand, but the top marque overall, with a score of 87 compared to Mercedes’ 82.

The study found American brands largely struggling, though Cadillac was third among luxury brands and Buick and GMC were in the top five among mainstream marques. Ford and Chevrolet landed in the middle of that list, but Jeep, Dodge, Chrysler and Ram lagged at the bottom, in descending order.

Hybrid models scored just as well as conventional gas models among mainstream customers, even as they have become increasingly common, the ACSI results showed. All-electric models saw satisfaction scores drop by 5% in the latest study.

Pricing pressures

Industry data show that vehicle prices are now hovering at or near record levels, just below $50,000. Numerous studies have found mainstream consumers growing increasingly worried about this trend – all the more so with Trump tariffs expected to drive up the cost of even domestically produced vehicles in the months to come.

Industry data show that vehicle prices are now hovering at or near record levels, just below $50,000. Numerous studies have found mainstream consumers growing increasingly worried about this trend – all the more so with Trump tariffs expected to drive up the cost of even domestically produced vehicles in the months to come.

But the latest ACSI indicates that “luxury customers are becoming more price sensitive,” as well, according to a summary of the study – which was based on the results of surveys completed by 9,949 vehicle owners living in the U.S.

“Automakers are navigating a market where innovation and practicality collide,” said Forrest Morgeson, Associate Professor of Marketing at Michigan State University and Director of Research Emeritus at the ACSI. “Customers expect advanced technology and efficiency, but they’re also scrutinizing every dollar spent. The brands that thrive will be those that can deliver meaningful improvements without losing sight of what matters most to drivers right now.”

More Automotive News

- JD Power APEAL Study Finds Customers Happier With Their Vehicles than Ever

- Lexus, Nissan, GM Score Tops in New Initial Quality Study

- Satisfaction Rises Among EV Buyers

Why the winners led the pack

A deep dive showed that the top-ranked brands overcame the competition for several reasons.

Lexus not only is scoring well in studies like the ACSI but has been recording record sales this year. It’s increasing focus on hybrid vehicles paid off, according to the new study, with five of its gas-electric models among a list of the top hybrid products on the market.

Subaru, meanwhile, “continues its success by leaning into a reputation for safety and dependability. It has enjoyed strong sales growth in recent years, which could carry over into 2025 with offerings like a redesigned Forester, the availability of a more powerful Crosstrek engine, and new trim options for the Ascent and Outback,” the ACSI summary reported.

While luxury vehicles continued to maintain a customer satisfaction lead over mainstream products, th overall gap narrowed to just one point, the study found, noting that, “Going forward, both segments may be challenged by rising monthly payments and possible changes in quality expectations as loan lengths increase. For example, some customers may still be making new vehicle payments for cars that are six or more years old.”

Other recent studies have found that a record number of U.S. new vehicle buyers are both paying over $1,000 a month on their loans and stretching out financing to as long as eight years.

0 Comments